Wide Moat Research is a critical aspect of intelligent investing. It involves identifying companies with sustainable competitive advantages, allowing them to fend off competitors and maintain profitability for extended periods. This in-depth analysis goes beyond surface-level metrics and delves into the qualitative and quantitative factors that contribute to a company’s long-term success.

Understanding the Importance of Wide Moat Research

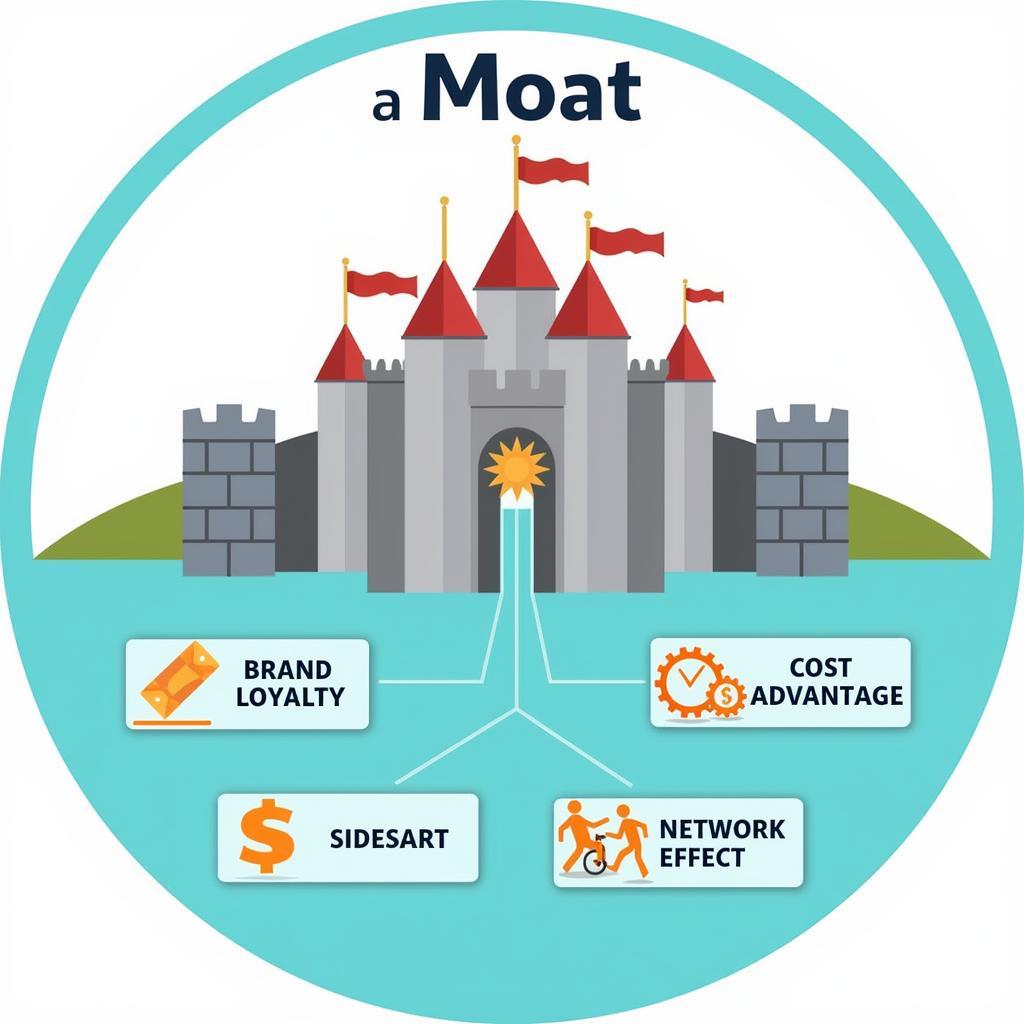

Why is wide moat research so crucial for investors? It provides a framework for identifying companies that are likely to generate superior returns over the long haul. These companies possess “moats,” or protective barriers, that make it difficult for rivals to encroach on their market share. This translates to sustained profitability and growth, making them attractive investment opportunities.  Wide Moat Research Visualization

Wide Moat Research Visualization

Key Elements of Wide Moat Research

Identifying Sustainable Competitive Advantages

A key aspect of wide moat research is identifying sustainable competitive advantages. These advantages can take various forms, including:

- Brand Loyalty: Strong brands command premium pricing and customer loyalty, making it difficult for competitors to gain traction.

- Cost Advantage: Companies with lower production costs can offer competitive pricing and maintain higher profit margins.

- Network Effect: The value of a product or service increases as more people use it, creating a barrier to entry for new competitors.

- Intangible Assets: Patents, trademarks, and copyrights provide legal protection and exclusivity, giving companies a competitive edge.

Analyzing Financial Performance

While qualitative factors are important, wide moat research also involves a thorough analysis of a company’s financial performance. This includes examining metrics such as:

- Return on Invested Capital (ROIC): A high ROIC indicates that a company is effectively using its capital to generate profits.

- Free Cash Flow (FCF): Strong FCF generation demonstrates a company’s ability to reinvest in its business and return value to shareholders.

- Debt Levels: Manageable debt levels are essential for long-term financial stability and resilience. goldman head of research ai bubble

What Questions Does Wide Moat Research Answer?

Wide moat research helps investors answer critical questions such as:

- Can this company maintain its competitive edge for the next 5-10 years?

- What are the potential threats to its moat?

- Is the current valuation justified by its long-term growth prospects?

Incorporating a Long-Term Perspective

Wide moat research requires a long-term perspective. It’s not about chasing short-term gains but rather identifying companies that can deliver sustainable value over time. This approach requires patience and discipline, but it can lead to significant rewards in the long run.

Conclusion

Wide moat research is a powerful tool for investors seeking long-term success. By identifying companies with sustainable competitive advantages, investors can position themselves to benefit from the power of compounding and achieve their financial goals. This meticulous research process allows investors to navigate the complexities of the market and identify companies poised for sustained growth and profitability. goldman head of research ai bubble

FAQ

- What is a “moat” in business?

- How do I identify a wide moat company?

- What are some examples of wide moat companies?

- Is wide moat investing suitable for all investors?

- How does wide moat research differ from traditional fundamental analysis?

- What are the limitations of wide moat research?

- How can I incorporate wide moat research into my investment strategy?

For further assistance, please contact us at Phone Number: 0904826292, Email: [email protected] or visit our office at No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam. We have a 24/7 customer support team.