A Tax Research Memo is a crucial document that analyzes tax laws and regulations to address specific client scenarios. This deep dive explores the purpose, structure, creation, and importance of a comprehensive tax research memo.

A well-crafted tax research memo serves as a cornerstone of informed decision-making in tax planning. It’s more than just a summary of tax laws; it’s a strategic tool that helps clients navigate the complexities of tax regulations. This article will provide valuable insights into creating and utilizing tax research memos effectively. Let’s delve into the intricacies of this essential document.

Understanding the Purpose of a Tax Research Memo

A tax research memo provides a clear and concise analysis of a specific tax issue. It’s designed to help tax professionals and their clients understand the potential tax implications of various actions or transactions. The memo identifies relevant tax laws, regulations, and judicial precedents, applying them to the client’s specific situation.

A key element of a tax research memo is its objectivity. It presents all sides of an issue, including potential risks and benefits. This allows clients to make informed decisions based on a thorough understanding of the tax implications involved. The memo also documents the research process, providing a valuable record for future reference.

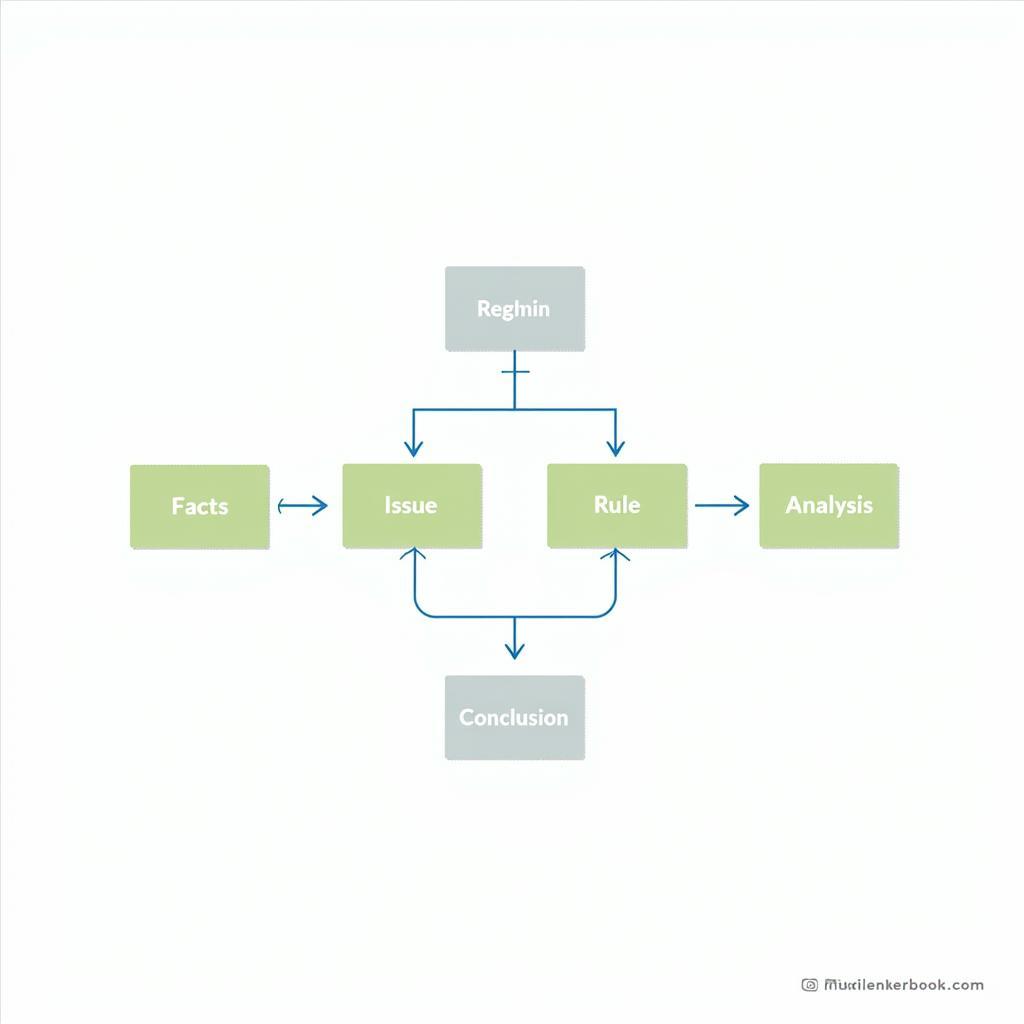

tax research memorandum example

Key Components of a Tax Research Memo

A standard tax research memo typically includes several key components:

- Facts: A clear and concise summary of the relevant facts of the client’s situation.

- Issue(s): A statement of the specific tax question(s) that need to be addressed.

- Rule(s): An explanation of the applicable tax laws, regulations, and judicial precedents.

- Analysis: Application of the rules to the client’s specific facts, including an analysis of different possible outcomes.

- Conclusion: A summary of the most likely tax consequences based on the analysis.

Key Components of a Tax Research Memo

Key Components of a Tax Research Memo

Crafting a Comprehensive Tax Research Memo

Creating a comprehensive tax research memo requires a systematic approach. Begin by gathering all relevant facts about the client’s situation. Next, identify the specific tax issues that need to be addressed. This involves formulating clear and concise questions that the memo will answer.

Once the issues are defined, thorough research is crucial. Consult relevant tax laws, regulations, and judicial precedents. Analyze how these rules apply to the client’s specific circumstances. Consider various interpretations and potential outcomes.

Ensuring Accuracy and Clarity

Accuracy and clarity are essential in a tax research memo. Ensure that all information is accurate and up-to-date. Use clear and concise language, avoiding technical jargon whenever possible. Organize the memo logically, making it easy for the reader to follow the analysis.

“A well-written tax research memo is a testament to thorough research and clear communication,” says Jane Doe, CPA and Tax Partner at XYZ Accounting Firm. “It empowers clients to make informed decisions based on a solid understanding of the tax implications.”

Ensuring Accuracy and Clarity in a Tax Research Memo

Ensuring Accuracy and Clarity in a Tax Research Memo

The Importance of a Tax Research Memo

A tax research memo plays a critical role in tax planning and compliance. It provides a framework for informed decision-making, helping clients minimize their tax liabilities while remaining compliant with applicable laws. The memo also serves as a valuable record of the research process, which can be useful in the event of an audit.

“A tax research memo provides a roadmap for navigating complex tax regulations,” says John Smith, Tax Attorney at ABC Law Firm. “It’s a crucial tool for both tax professionals and their clients.”

Navigating Complex Tax Regulations with a Tax Research Memo

A tax research memo is particularly helpful in navigating complex or ambiguous tax regulations. It provides a structured analysis of the relevant laws and their application to the client’s specific circumstances. This helps clients understand the potential risks and benefits of various courses of action, allowing them to make informed decisions.

the common rule applies to research that

Navigating Complex Tax Regulations with a Tax Research Memo

Navigating Complex Tax Regulations with a Tax Research Memo

Conclusion

A tax research memo is an essential tool for navigating the complexities of tax law. It provides a framework for informed decision-making, helping clients minimize their tax liabilities while ensuring compliance. By understanding the purpose, structure, and creation of a tax research memo, you can leverage its power for effective tax planning.

FAQ

- What is the main purpose of a tax research memo?

- What are the key components of a tax research memo?

- How can I ensure the accuracy and clarity of my tax research memo?

- Why is a tax research memo important for tax planning and compliance?

- How does a tax research memo help in navigating complex tax regulations?

- Where can I find an example of a tax research memo?

- What are some common mistakes to avoid when writing a tax research memo?

Need further assistance? Contact us at Phone Number: 0904826292, Email: research@gmail.com or visit our office at No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam. We have a 24/7 customer support team.