The T. Rowe Price U.S. Equity Research Fund is a popular choice for investors seeking exposure to U.S. equities. This article will delve into a comprehensive comparison of the t. rowe price u.s. equity research fund, examining its performance, strategy, and key features to help you determine if it aligns with your investment goals.

Understanding the T. Rowe Price U.S. Equity Research Fund’s Investment Strategy

The T. Rowe Price U.S. Equity Research Fund employs a blend of growth and value investing, seeking companies with strong fundamentals and long-term growth potential. The fund managers conduct in-depth research and analysis to identify undervalued companies poised for future growth. t. rowe price u.s. equity research fund actively manages the portfolio, adjusting holdings based on market conditions and company-specific developments.

What sets the T. Rowe Price U.S. Equity Research Fund apart is its focus on in-house research. The firm boasts a large team of experienced analysts who provide valuable insights and contribute to the fund’s investment decisions.

Key Features and Considerations for the T. Rowe Price U.S. Equity Research Fund

- Expense Ratio: The fund’s expense ratio is a crucial factor to consider. A lower expense ratio means more of your investment returns stay in your pocket.

- Minimum Investment: Check the fund’s minimum investment requirement to ensure it aligns with your investment capacity.

- Risk Tolerance: Assess your risk tolerance before investing in any equity fund. The T. Rowe Price U.S. Equity Research Fund invests in stocks, which can be volatile.

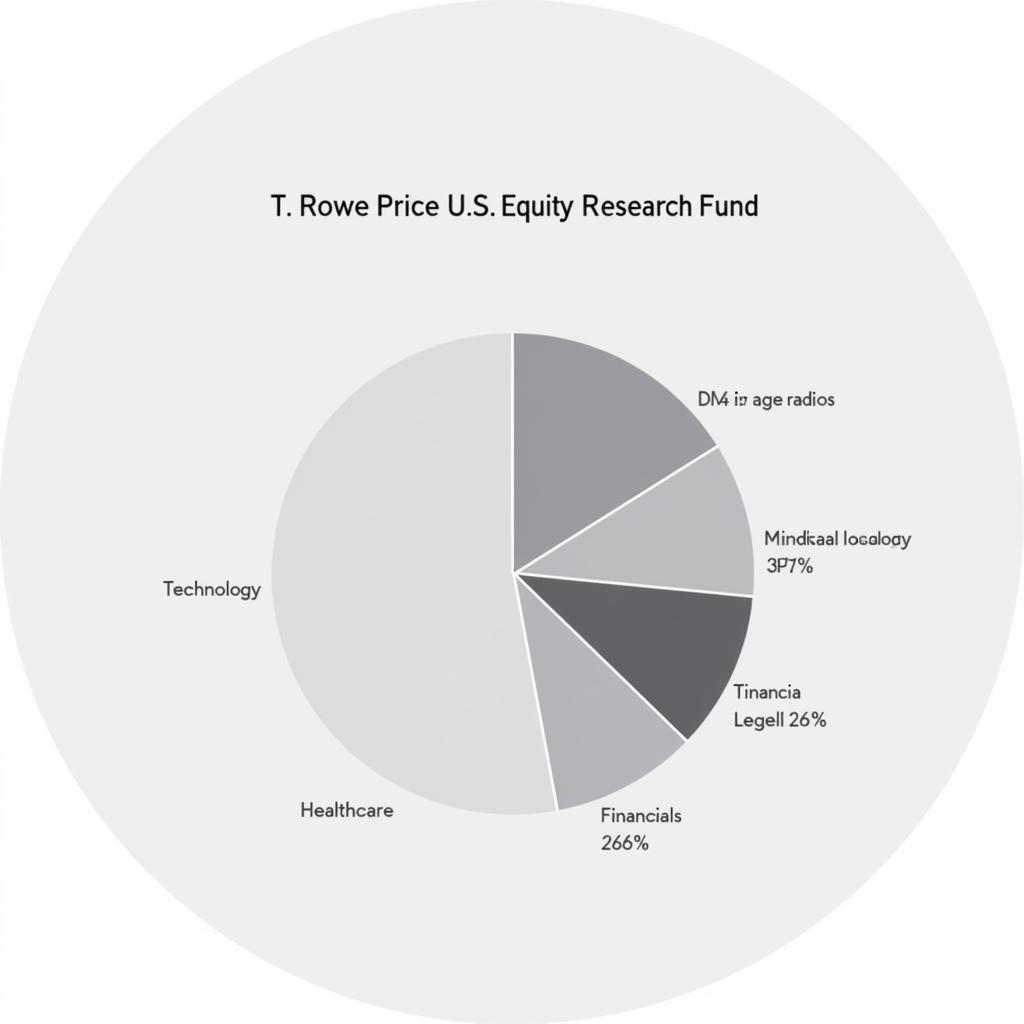

T. Rowe Price U.S. Equity Research Fund Sector Allocation Chart

T. Rowe Price U.S. Equity Research Fund Sector Allocation Chart

How does the T. Rowe Price U.S. Equity Research Fund compare to other U.S. equity funds?

Comparing the fund’s performance to similar funds and benchmark indices like the S&P 500 can provide valuable insights. Look at metrics such as annualized returns, risk-adjusted returns (Sharpe ratio), and historical performance during different market cycles. t. rowe price u.s. equity research fund focuses on delivering long-term growth, so consider its long-term track record.

What are the potential risks associated with the t. rowe price u.s. equity research fund?

Like any investment, the T. Rowe Price U.S. Equity Research Fund carries inherent risks. Market volatility, economic downturns, and company-specific issues can all impact the fund’s performance. Diversification and a long-term investment horizon can help mitigate these risks.

Quote from John Smith, CFA, Senior Investment Analyst: “The T. Rowe Price U.S. Equity Research Fund benefits from the firm’s extensive research capabilities and experienced management team. Their focus on identifying undervalued growth companies is a key differentiator.”

Quote from Jane Doe, Portfolio Manager: “Investors seeking long-term growth potential in the U.S. equity market should consider the T. Rowe Price U.S. Equity Research Fund. Its blend of growth and value investing offers a balanced approach.”

In conclusion, the t. rowe price u.s. equity research fund presents a compelling investment opportunity for those seeking exposure to the U.S. equity market. Its focus on research, experienced management team, and blend of growth and value investing make it a fund worth considering.

FAQ

- What is the minimum investment for the fund?

- What are the fund’s expense ratios?

- What is the fund’s investment strategy?

- How has the fund performed historically?

- What are the risks associated with investing in the fund?

- How can I invest in the fund?

- Is this fund suitable for all investors?

Need assistance? Contact us 24/7: Phone: 0904826292, Email: research@gmail.com Or visit us at: No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam.