Sell-side research plays a critical role in the financial markets, providing valuable insights and analysis to investors. From understanding market trends to evaluating investment opportunities, sell-side research helps investors make informed decisions. This in-depth article will explore the intricacies of sell-side research, its significance in the financial ecosystem, and its impact on investment strategies.

What is Sell-Side Research?

Sell-side research refers to the analysis and reports produced by financial institutions, typically investment banks and brokerage firms, for their clients. The primary objective of these reports is to provide insights and recommendations on various financial instruments, including stocks, bonds, and other investment products.

Sell-side analysts conduct thorough research, often employing sophisticated financial models and data analysis techniques to forecast market trends, assess company performance, and provide investment recommendations. These recommendations typically include ratings such as “buy,” “hold,” or “sell,” guiding investors on potential investment decisions.

Sell-side research process illustration

Sell-side research process illustration

The Importance of Sell-Side Research

Sell-side research plays a crucial role in the financial markets by bridging the information gap between companies and investors.

-

Informed Investment Decisions: Investors rely heavily on sell-side research to gather insights and make informed investment decisions. These reports provide valuable information on market trends, industry analysis, and company-specific data, aiding investors in assessing potential risks and rewards.

-

Market Efficiency: By disseminating research findings to a broad audience, sell-side analysts contribute to market efficiency. When investors have access to comprehensive and timely information, it helps ensure that securities are priced more accurately, reflecting their true value.

-

Capital Formation: Sell-side research assists companies in attracting capital by providing visibility and credibility to their businesses. Positive research coverage can enhance investor confidence and attract potential investors, facilitating capital raising efforts.

Key Components of Sell-Side Research Reports

Sell-side research reports typically encompass a range of sections, each providing valuable information to investors.

-

Executive Summary: This section provides a concise overview of the report’s key findings and recommendations, allowing readers to quickly grasp the essence of the analysis.

-

Industry Analysis: Analysts assess the overall industry landscape, including market size, growth drivers, competitive dynamics, and regulatory factors that may impact companies operating in that sector.

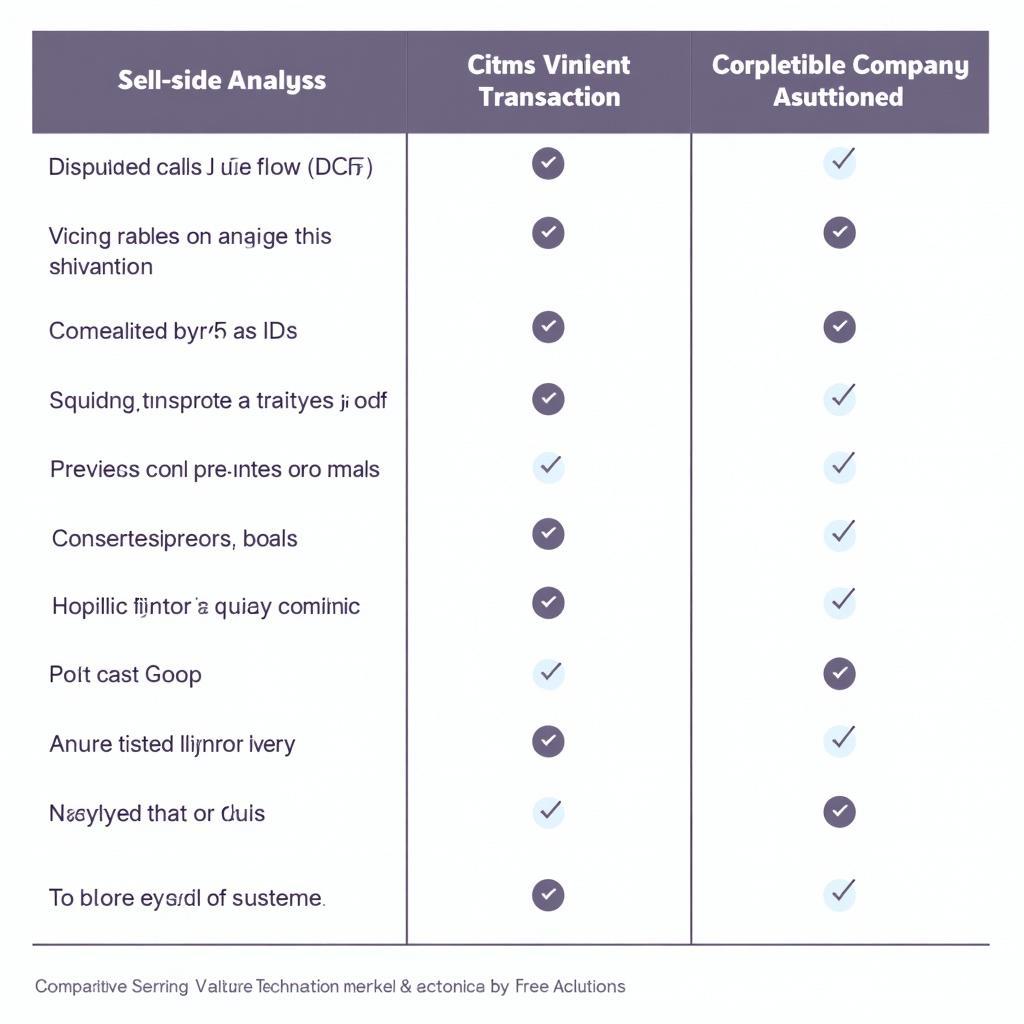

Chart comparing different company valuation methods used in sell-side research

Chart comparing different company valuation methods used in sell-side research

-

Company Profile: This section provides a detailed overview of the company under review, including its business model, products and services, management team, financial performance, and future prospects.

-

Valuation and Financial Analysis: Analysts employ various financial models and metrics to determine a company’s intrinsic value. This section often includes historical financial data, projected financial statements, and valuation multiples.

-

Investment Thesis and Recommendation: This is the heart of the report, where analysts articulate their investment thesis, outlining the rationale behind their buy, hold, or sell recommendations. They present the key factors supporting their view and potential risks to consider.

Challenges and Criticisms of Sell-Side Research

While sell-side research provides valuable insights, it also faces certain challenges and criticisms.

-

Potential Conflicts of Interest: Since investment banks often have relationships with the companies they cover, there is a potential for conflicts of interest to arise. Analysts may feel pressured to issue favorable recommendations to maintain or secure investment banking business.

-

Accuracy of Forecasts: Predicting future market movements and company performance is inherently complex, and sell-side analysts’ forecasts are not always accurate. Unforeseen events or changes in market sentiment can significantly impact actual results.

-

Information Overload: The sheer volume of sell-side research available can be overwhelming for investors. Sifting through numerous reports and differentiating between high-quality and less reliable research can be challenging.

Conclusion

Sell-side research remains an integral part of the financial landscape, providing investors with valuable insights to navigate the complexities of the markets. While it is crucial to be aware of the potential limitations and maintain a critical perspective, sell-side research, when used judiciously, can serve as a valuable tool in the investment decision-making process.