Researching credit unions is crucial for anyone seeking sound financial management. Understanding their structure, benefits, and potential drawbacks empowers you to make informed decisions about your financial future. This guide will delve into the essentials of Research Credit Unions, offering insights to help you navigate this important financial landscape.

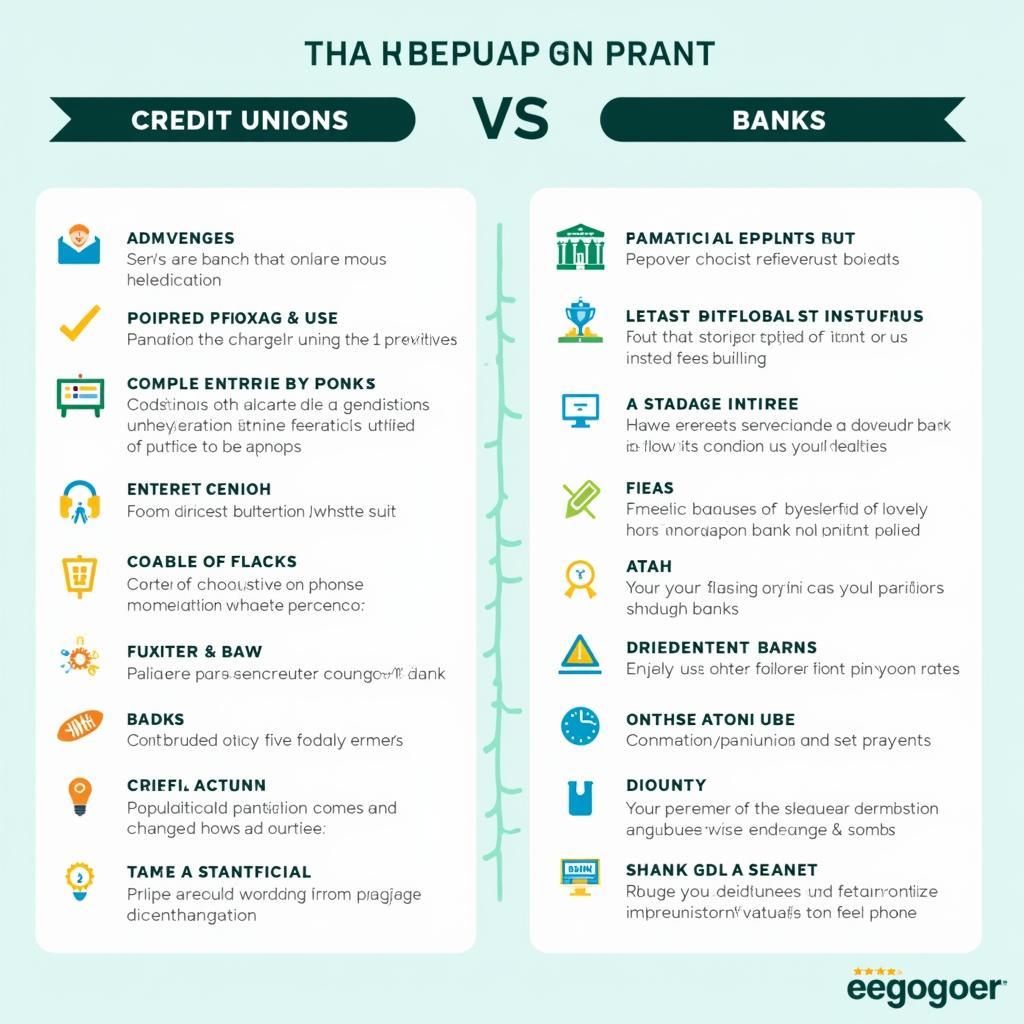

Choosing a financial institution is a significant decision. Unlike traditional banks, credit unions operate as non-profit cooperatives, prioritizing member service and offering potentially better rates and fewer fees. southwest research institute federal credit union. But how do you find the right one for you? This involves researching credit unions that align with your financial goals and values.

Understanding the Importance of Research Credit Union

Why should you research credit unions? This proactive approach allows you to compare offerings, understand membership requirements, and evaluate the overall financial health of the institution. A thorough research credit union process ensures you’re partnering with a trustworthy and beneficial financial partner.

What to Look for When Researching a Credit Union

Several key factors should be considered when researching credit unions. First, determine your eligibility for membership. Many credit unions are community-based or cater to specific professions. Next, compare interest rates on loans and savings accounts. Also, examine the fees charged for various services. Finally, consider the convenience of locations and online banking options.

Exploring Different Credit Union Options

Exploring Different Credit Union Options

Key Benefits of Credit Unions

Credit unions offer several advantages. They often provide higher interest rates on savings accounts and lower interest rates on loans compared to traditional banks. As member-owned institutions, they prioritize member well-being over profit maximization. They also tend to offer personalized service and a strong community focus. southwest research credit union.

How to Research Credit Union Options Online

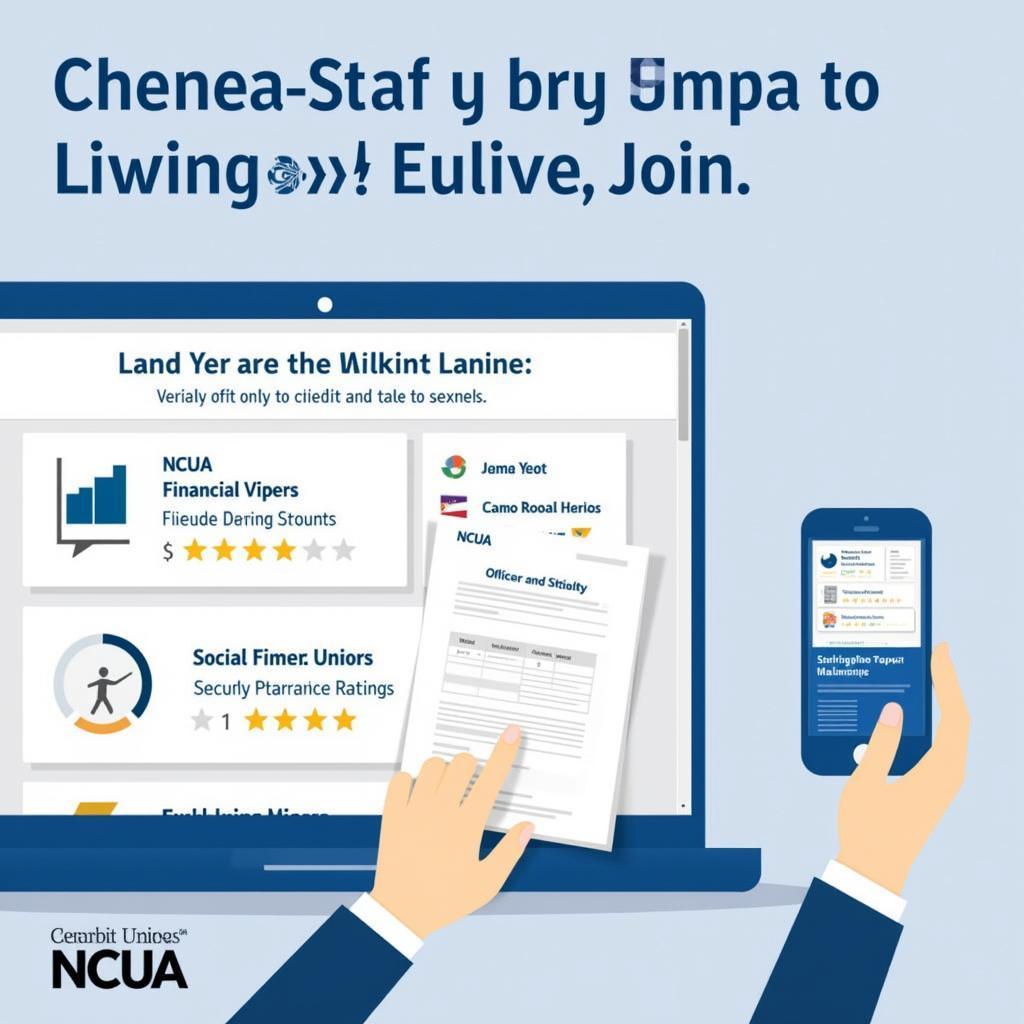

Online resources are invaluable for researching credit unions. Websites like the National Credit Union Administration (NCUA) provide tools to find and compare credit unions in your area. You can also access individual credit union websites to review their services, rates, and membership requirements.

Potential Drawbacks of Credit Unions

While credit unions offer numerous benefits, some potential drawbacks should be considered. Fewer branches and limited ATM access can be inconvenient for some. Some smaller credit unions may also have fewer technological resources compared to larger banks. southwest research institute credit union.

Comparison of Credit Union and Bank Services

Comparison of Credit Union and Bank Services

Navigating Membership Requirements

Understanding membership requirements is essential when researching credit unions. These requirements often relate to your employer, geographic location, or community affiliations. Be sure to verify your eligibility before proceeding with the application process.

Research Credit Union: Making Informed Decisions

Researching credit unions empowers you to make informed financial choices. By carefully considering the factors discussed in this guide, you can select a credit union that aligns with your financial needs and values. ncua research a credit union.

“Researching credit unions thoroughly is a crucial step towards achieving your financial goals,” advises financial expert, Amelia Grant, CFP. “It allows you to make an informed decision and select the best financial partner for your unique needs.”

Evaluating Credit Union Financial Health

Assessing a credit union’s financial health is another important aspect of research. The NCUA provides information on the financial stability of federally insured credit unions, giving you peace of mind about the safety of your deposits. southwest research center federal credit union.

Checking a Credit Union's Financial Health

Checking a Credit Union's Financial Health

In conclusion, researching credit unions is essential for anyone seeking a sound financial partner. By comparing offerings, understanding membership requirements, and evaluating financial health, you can confidently choose the right credit union for your financial journey. Remember to thoroughly research credit union options to secure your financial future.

FAQ

- What is a credit union?

- How do credit unions differ from banks?

- How can I find credit unions in my area?

- What are the benefits of joining a credit union?

- Are my deposits safe in a credit union?

- What are the membership requirements for credit unions?

- How do I research a credit union’s financial health?

Other questions that might arise:

- What are the current loan rates offered by credit unions?

- What types of savings accounts are available at credit unions?

- How do I switch from a bank to a credit union?

You can find more information on our website by exploring the following articles:

- Understanding Credit Union Membership

- Comparing Credit Union Loan Rates

- The Benefits of Credit Union Savings Accounts

When you need support, please contact Phone Number: 0904826292, Email: research@gmail.com Or visit us at: No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam. We have a 24/7 customer service team.