Mifid Ii Research Unbundling Rules, introduced in January 2018, have significantly reshaped the investment research landscape. These regulations aim to increase transparency and ensure investors receive value for their money by separating the cost of research from execution services. This guide will delve into the complexities of these rules, exploring their impact and providing practical insights for navigating this new era of investment research.

Understanding the Rationale Behind MiFID II Research Unbundling Rules

Before MiFID II, research costs were often bundled with execution fees, creating a lack of transparency and potential conflicts of interest. The unbundling rules address this issue by requiring asset managers to pay for research separately and directly, ensuring they are accountable for how investor money is spent. This fosters greater scrutiny of research quality and encourages a more efficient allocation of resources.

Key Provisions of MiFID II Research Unbundling

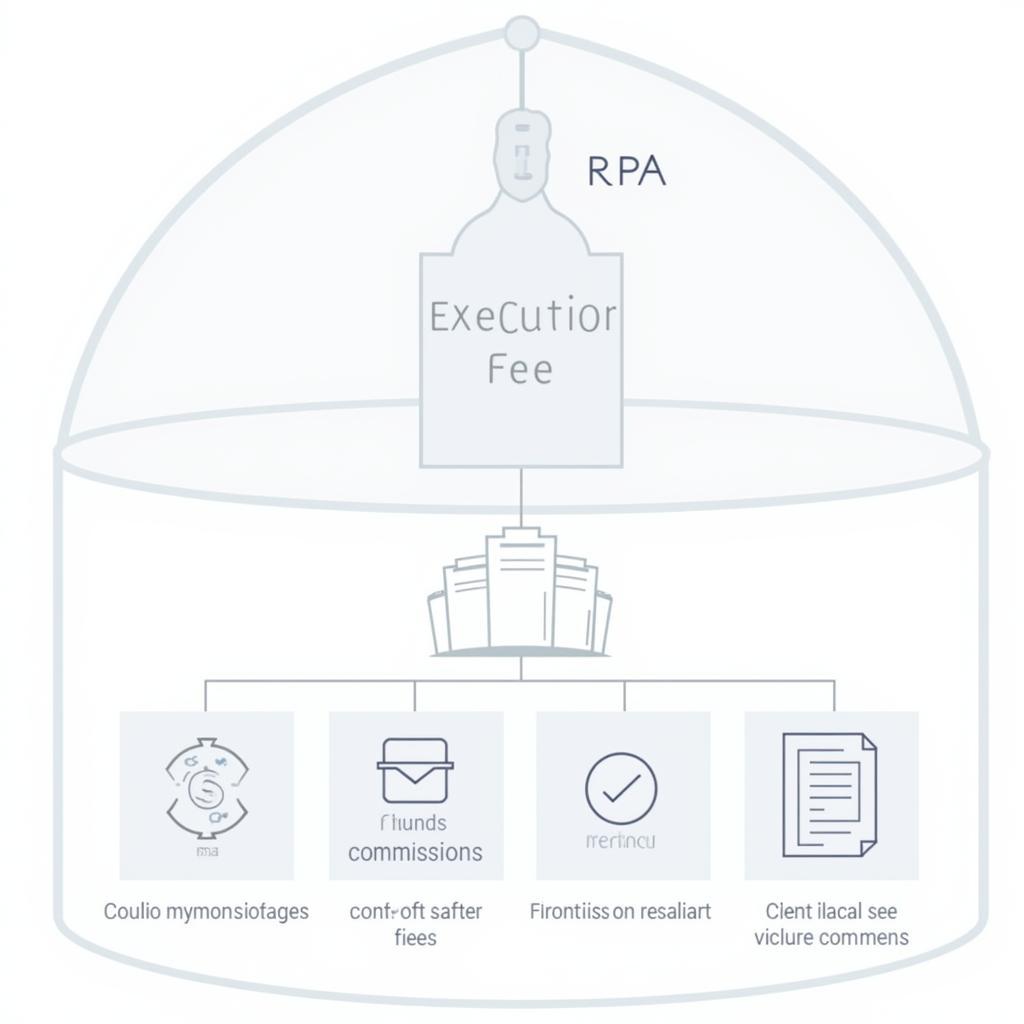

The core of MiFID II research unbundling revolves around establishing a clear separation between research payments and execution fees. Asset managers must either pay for research directly from their own Profit & Loss (P&L) or establish a Research Payment Account (RPA) funded by client commissions. The RPA approach allows research costs to be passed on to clients, but only with their explicit consent and subject to strict oversight. Crucially, the regulations also impose restrictions on the types of research that can be received for free, primarily limiting it to non-monetary benefits like corporate access.

Navigating the Challenges of RPA Implementation

Implementing an RPA has presented practical challenges for many asset managers. Determining a fair research budget, obtaining client consent, and managing the payment process can be complex and time-consuming. Furthermore, the rules require detailed record-keeping and reporting to demonstrate compliance.

MiFID II Research Payment Account Structure

MiFID II Research Payment Account Structure

Impact of MiFID II on the Research Landscape

MiFID II has had a profound impact on the research industry, leading to a significant reduction in the number of research providers and a greater focus on high-quality, differentiated research offerings. Smaller research firms have struggled to compete, while larger institutions have adapted by streamlining their operations and focusing on value-added services. This has also led to a shift in the types of research consumed, with greater emphasis on quantitative research, data analytics, and bespoke analysis.

The Rise of Independent Research Providers

One notable trend is the emergence of independent research providers who offer unconflicted and specialized expertise. These firms are attracting increasing attention from asset managers seeking differentiated insights and unbiased perspectives.

Independent Research Providers under MiFID II

Independent Research Providers under MiFID II

The Future of Investment Research under MiFID II

The MiFID II research unbundling rules continue to evolve, with ongoing discussions and potential refinements. Regulatory bodies are closely monitoring the implementation and impact of the rules, addressing concerns and providing further guidance. As the industry adapts to this new regulatory landscape, the focus on transparency, accountability, and value for money will continue to shape the future of investment research.

Addressing Common Concerns and Misinterpretations

One common misconception is that MiFID II prohibits all forms of free research. While the rules are strict, they do allow for certain types of non-monetary benefits, such as corporate access and conferences, provided they meet specific criteria. Understanding these nuances is crucial for compliance.

“MiFID II has undoubtedly raised the bar for research quality and transparency,” says Dr. Emily Carter, Senior Financial Analyst at Global Investment Strategies. “The focus on value-added insights is driving innovation and ultimately benefiting investors.”

MiFID II Compliance Checklist for Asset Managers

MiFID II Compliance Checklist for Asset Managers

Conclusion

MiFID II research unbundling rules have fundamentally changed the investment research landscape, demanding greater transparency and accountability. While the transition has presented challenges, it has ultimately led to a more efficient and transparent market for research. By understanding the key provisions and adapting their strategies, asset managers can effectively navigate this new era and continue to deliver value to their clients in the context of MiFID II research unbundling rules.

FAQ

- What is the main purpose of MiFID II research unbundling? To increase transparency and ensure investors receive value for their money by separating research costs from execution fees.

- How can asset managers pay for research under MiFID II? Directly from their P&L or through a client-funded RPA.

- What is an RPA? A Research Payment Account funded by client commissions, used to pay for research separately.

- What types of research are affected by MiFID II unbundling? Equity research, fixed income research, and other similar investment research.

- Are there any exceptions to the unbundling rules? Yes, certain non-monetary benefits like corporate access can be received under specific conditions.

- How has MiFID II impacted the research industry? Consolidation, focus on high-quality research, and the rise of independent providers.

- Where can I find more information on MiFID II compliance? Consult regulatory bodies like ESMA and your local financial regulator.

Scenarios

- Scenario 1: An asset manager wants to subscribe to a premium research service. They can use their P&L or set up an RPA to cover the cost.

- Scenario 2: A client questions the research charges on their statement. The asset manager must be able to demonstrate how the research adds value and justify the cost.

- Scenario 3: A research provider offers free access to a conference in exchange for order flow. This is likely a breach of MiFID II as it could be considered an inducement.

Further Reading

- MiFID II Research Unbundling: Best Practices for Asset Managers

- Understanding the Impact of MiFID II on Investment Research

- Navigating the Complexities of Research Payment Accounts

Need assistance with MiFID II research unbundling? Contact us: Phone: 0904826292, Email: research@gmail.com, Address: No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam. We offer 24/7 customer support.