The Jpm Global Research Enhanced Index Equity strategy aims to outperform traditional market-cap-weighted indices. It leverages fundamental research and quantitative analysis to identify and capitalize on potential investment opportunities. This approach moves beyond simply tracking an index, incorporating a dynamic element that seeks to enhance returns.

What is JPM Global Research Enhanced Index Equity?

JPM Global Research Enhanced Index Equity represents a sophisticated investment strategy. Unlike passively managed index funds, which mirror a specific market index, this approach actively selects stocks based on in-depth research. This research combines both quantitative and fundamental analysis to pinpoint stocks with strong growth potential that might be undervalued by the broader market. The goal is to provide investors with returns that exceed the benchmark index.

How Does the Strategy Work?

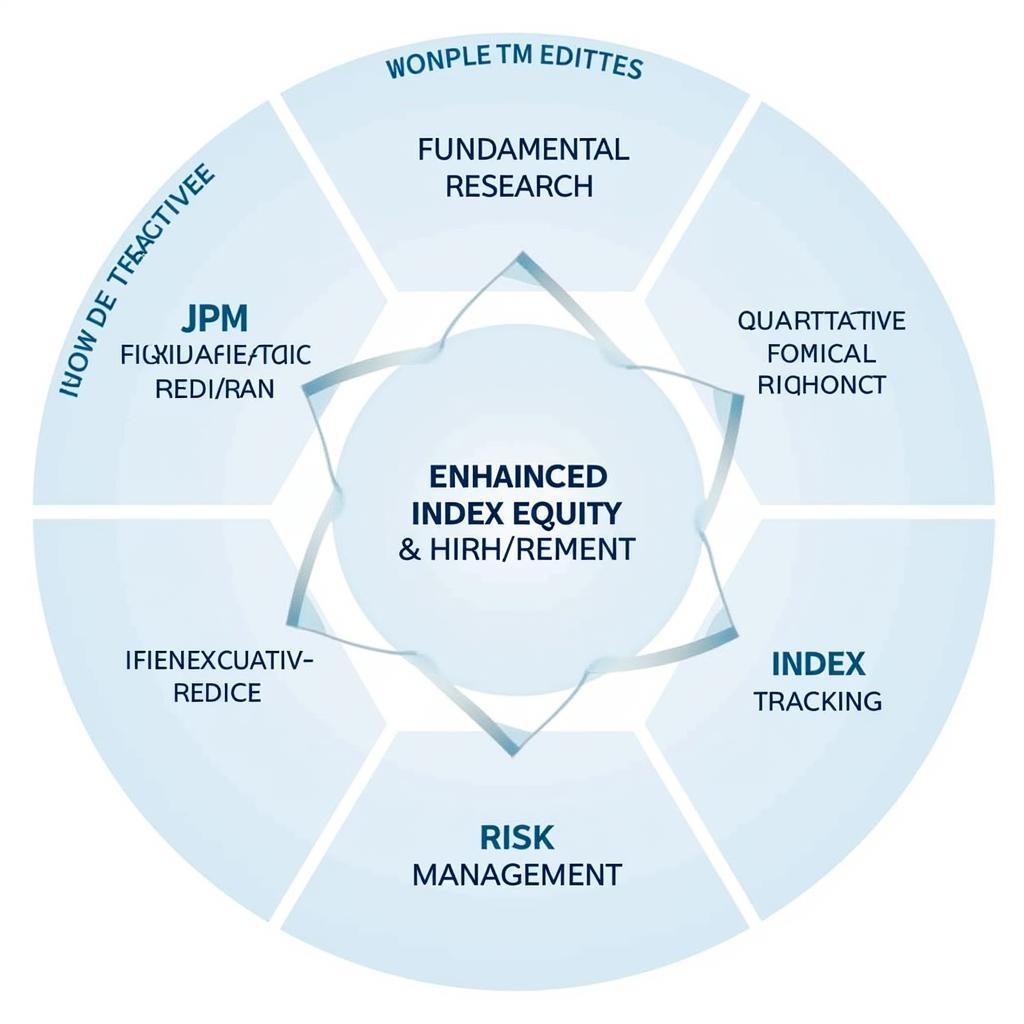

The JPM Global Research Enhanced Index Equity strategy employs a multi-faceted approach:

- Fundamental Research: Analysts delve into company financials, industry trends, and competitive landscapes to assess the intrinsic value of stocks.

- Quantitative Analysis: Statistical models are used to identify patterns and relationships in market data, providing additional insights into potential investment opportunities.

- Risk Management: The strategy incorporates risk management techniques to mitigate potential downsides and protect capital.

- Index Tracking: While actively managed, the portfolio still maintains a degree of correlation with the benchmark index to manage overall market risk.

JPM Global Research Enhanced Index Equity Strategy Overview

JPM Global Research Enhanced Index Equity Strategy Overview

Benefits of JPM Global Research Enhanced Index Equity

This investment strategy offers several potential advantages:

- Potential for Outperformance: The active management approach aims to generate returns that surpass the market benchmark.

- Diversification: The strategy invests across a diversified portfolio of stocks, reducing the impact of any single investment on overall performance.

- Professional Management: Experienced investment professionals manage the portfolio, leveraging their expertise to make informed investment decisions.

- Transparency: JPMorgan typically provides detailed information about the strategy’s holdings and performance, allowing investors to monitor their investments.

Is JPM Global Research Enhanced Index Equity Right for You?

Determining the suitability of this investment strategy depends on individual circumstances and risk tolerance. Factors to consider include:

- Investment Goals: Align the investment strategy with your long-term financial objectives.

- Risk Tolerance: Assess your comfort level with potential market fluctuations.

- Time Horizon: Consider your investment timeframe, as this strategy is generally more suitable for long-term investors.

- Investment Costs: Understand the associated fees and expenses.

“Enhanced index strategies aim to provide investors with the best of both worlds – the benefits of passive investing with the potential for alpha generation through active management,” says Dr. Amelia Carter, Senior Portfolio Manager at Global Investment Strategies. “However, it’s crucial to understand the underlying methodology and associated risks before investing.”

JPM Global Research Enhanced Index Equity vs. Traditional Index Funds

While both track a benchmark index, there are key differences:

- Management Style: Enhanced index strategies are actively managed, while traditional index funds are passively managed.

- Investment Approach: Enhanced index strategies use research to select stocks, while traditional index funds simply replicate the index composition.

- Potential Returns: Enhanced index strategies aim to outperform the benchmark, while traditional index funds aim to match it.

- Fees: Enhanced index strategies typically have higher fees than traditional index funds due to the active management component.

JPM Global Research Enhanced Index Equity Performance Comparison

JPM Global Research Enhanced Index Equity Performance Comparison

Conclusion

The JPM Global Research Enhanced Index Equity strategy offers a compelling approach to investing, combining the benefits of index tracking with the potential for enhanced returns through active management. However, understanding the intricacies of this strategy, including its methodology, potential risks, and associated fees, is essential for making informed investment decisions. Consider consulting with a financial advisor to determine if this strategy aligns with your individual investment goals and risk tolerance.

FAQ

- What is the main objective of JPM Global Research Enhanced Index Equity? To outperform the benchmark index through active stock selection.

- How does this strategy differ from traditional index funds? It utilizes active management and research-driven stock selection.

- What are the potential benefits of this strategy? Potential for outperformance, diversification, and professional management.

- What factors should I consider before investing? Investment goals, risk tolerance, time horizon, and investment costs.

- Where can I get more information about JPM Global Research Enhanced Index Equity? Consult with a financial advisor or visit the JPMorgan Asset Management website.

- What are the typical fees associated with this strategy? Fees vary but are typically higher than traditional index funds.

- Is this strategy suitable for short-term investors? Generally, it is more suitable for long-term investors.

Common Scenarios and Questions:

- Scenario: An investor seeking higher returns than a traditional index fund but with some level of market risk mitigation. Question: Is the JPM Global Research Enhanced Index Equity strategy a suitable option?

- Scenario: An investor with a long-term investment horizon and a moderate risk tolerance. Question: How can this strategy potentially benefit my portfolio?

- Scenario: An investor concerned about market volatility. Question: What risk management techniques are employed within the JPM Global Research Enhanced Index Equity strategy?

Further Exploration

You might also be interested in exploring related topics such as factor investing, smart beta strategies, and alternative investment approaches. Check out our other articles on these topics for a deeper understanding.

Need support? Contact us 24/7: Phone: 0904826292, Email: research@gmail.com. Visit our office: No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam.