The Investment Research Process is crucial for making informed decisions and maximizing returns. Whether you’re a seasoned investor or just starting out, understanding how to effectively research potential investments is key to success. This comprehensive guide will walk you through the essential steps of the investment research process, empowering you to make smarter investment choices.

Defining Your Investment Goals and Risk Tolerance

Before diving into the complexities of investment research, it’s crucial to define your investment goals and risk tolerance. Are you investing for retirement, a down payment on a house, or simply to grow your wealth? Understanding your objectives will shape your investment strategy and influence the types of investments you consider. Similarly, assessing your risk tolerance—your ability to withstand potential losses—is paramount. A higher risk tolerance might lead you towards more volatile investments like growth stocks, while a lower risk tolerance might steer you towards more stable options like bonds.

Fundamental Analysis: Unveiling the Intrinsic Value

Fundamental analysis involves delving into a company’s financial statements, evaluating its management team, and assessing its industry position to determine its intrinsic value. This involves analyzing key financial ratios, such as price-to-earnings (P/E) ratio, return on equity (ROE), and debt-to-equity ratio. By understanding a company’s financial health and growth prospects, you can make informed decisions about whether its stock is undervalued or overvalued. market research services

Analyzing Financial Statements: A Deeper Dive

A crucial aspect of fundamental analysis is scrutinizing a company’s financial statements, including the balance sheet, income statement, and cash flow statement. These documents provide valuable insights into a company’s assets, liabilities, revenues, expenses, and cash flow, allowing you to assess its financial stability and profitability.

“Thorough financial statement analysis is the bedrock of sound investment decisions,” says renowned financial analyst, Johnathan Davis. “It allows investors to separate the wheat from the chaff and identify companies with strong fundamentals.”

Technical Analysis: Deciphering Market Trends

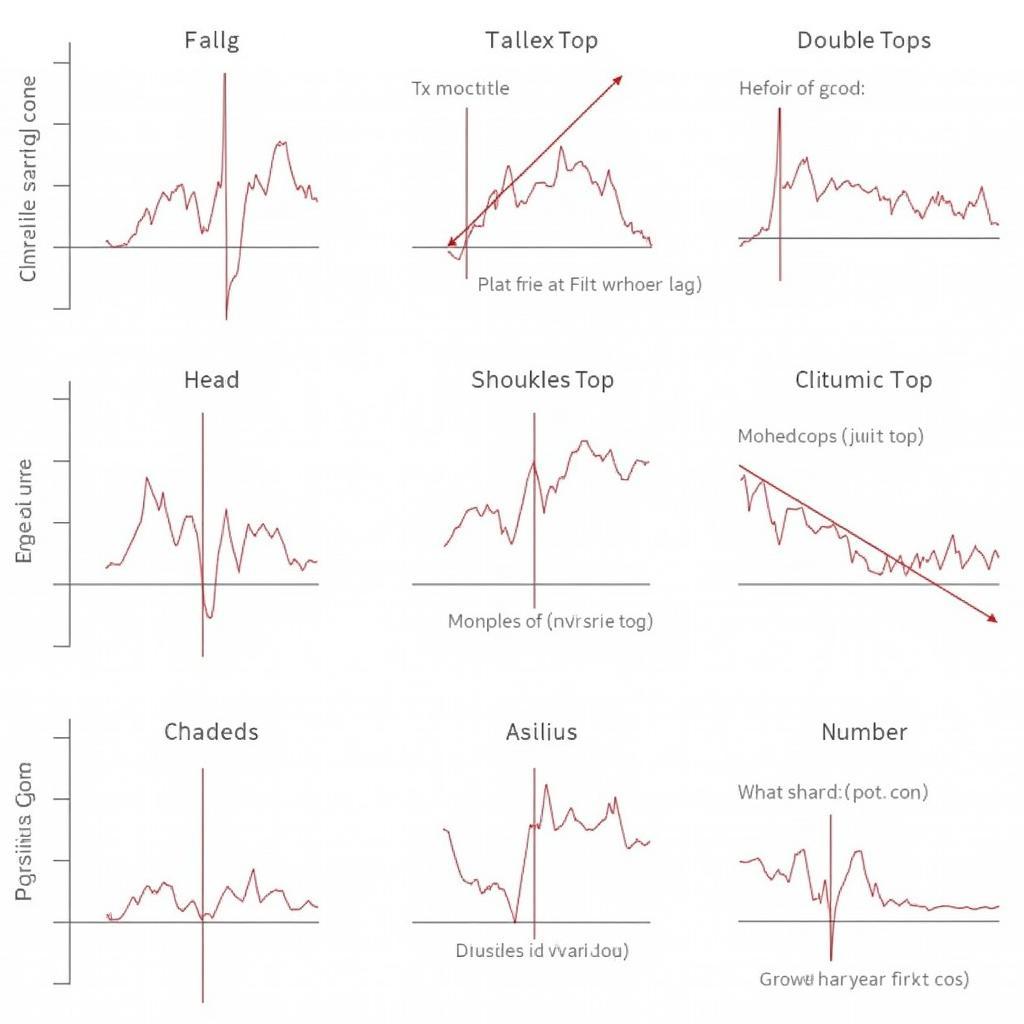

Technical analysis focuses on studying past market trends and price patterns to predict future price movements. This involves using charts and technical indicators to identify potential buying and selling opportunities. While some investors rely solely on fundamental analysis, others integrate technical analysis into their research process to gain a more comprehensive view of the market.  Technical Analysis Chart Patterns

Technical Analysis Chart Patterns

Using Technical Indicators: Identifying Buy and Sell Signals

Technical indicators, such as moving averages, relative strength index (RSI), and MACD, can provide valuable signals about potential price reversals or continuations. Understanding how to interpret these indicators can help you time your entry and exit points in the market. amp research bumper step

Evaluating the Competitive Landscape

No investment research process is complete without considering the competitive landscape. Understanding a company’s competitors, their market share, and their competitive advantages is crucial for assessing the company’s long-term prospects. Porter’s Five Forces analysis, a framework for analyzing industry competition, can be a valuable tool in this process. business license research package

“Understanding the competitive landscape is crucial for identifying companies that are well-positioned for long-term growth,” says Sarah Miller, a leading investment strategist. “Companies with sustainable competitive advantages are more likely to outperform their rivals over time.”

Staying Informed and Adapting Your Strategy

The investment landscape is constantly evolving, so staying informed about market trends, economic news, and industry developments is essential for success. Subscribing to financial publications, following reputable financial analysts, and attending industry conferences can help you stay ahead of the curve. Furthermore, be prepared to adapt your investment strategy as needed. Market conditions can change quickly, so flexibility is key to navigating the ever-changing investment world. science park and research campus in kips bay

Conclusion: The Investment Research Process is an Ongoing Journey

The investment research process is not a one-time event but an ongoing journey of learning and adaptation. By following a structured approach, staying informed, and continually refining your research skills, you can significantly improve your investment outcomes. Remember that investment research is about more than just picking stocks; it’s about understanding the underlying businesses, the market dynamics, and your own financial goals. investment research management software

FAQ

- What is the most important aspect of investment research?

- How can I improve my investment research skills?

- What are the best resources for investment research?

- How often should I review my investment portfolio?

- What role does risk management play in the investment research process?

- How can I balance fundamental and technical analysis in my research?

- How do I choose the right investment strategy for my goals?

For further assistance, contact us at Phone: 0904826292, Email: research@gmail.com or visit us at No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam. We have a 24/7 customer service team.