Income Research And Management are crucial for financial success, whether you’re an individual, a business, or an institution. Effectively researching and managing income streams allows for informed decision-making, optimized resource allocation, and ultimately, greater financial stability and growth. Understanding this dynamic process requires a deep dive into its core components and best practices.

Understanding Income Research

Income research involves analyzing potential and existing income sources to maximize profitability and minimize risks. This process encompasses several key areas, including market research, competitive analysis, and financial forecasting. For individuals, income research may involve exploring different career paths, investment research analyst salary, or side hustles. Businesses might focus on identifying new markets, developing innovative products, or optimizing pricing strategies. Institutional investors may conduct fixed income research to identify lucrative investment opportunities.

Key Aspects of Income Research

- Market Analysis: Understanding market trends, demographics, and consumer behavior is essential for identifying potential income streams.

- Competitive Analysis: Evaluating competitors’ strengths, weaknesses, and strategies can reveal opportunities for differentiation and market positioning.

- Financial Forecasting: Projecting future income based on historical data, market trends, and various economic factors helps in setting realistic financial goals.

Income Research Market Analysis Chart

Income Research Market Analysis Chart

Effective Income Management Strategies

Effective income management involves strategically allocating and controlling income to achieve specific financial objectives. This encompasses budgeting, saving, investing, and debt management. Effective income management empowers individuals, businesses, and institutions to make informed financial decisions, optimize resource utilization, and ultimately achieve financial security and growth.

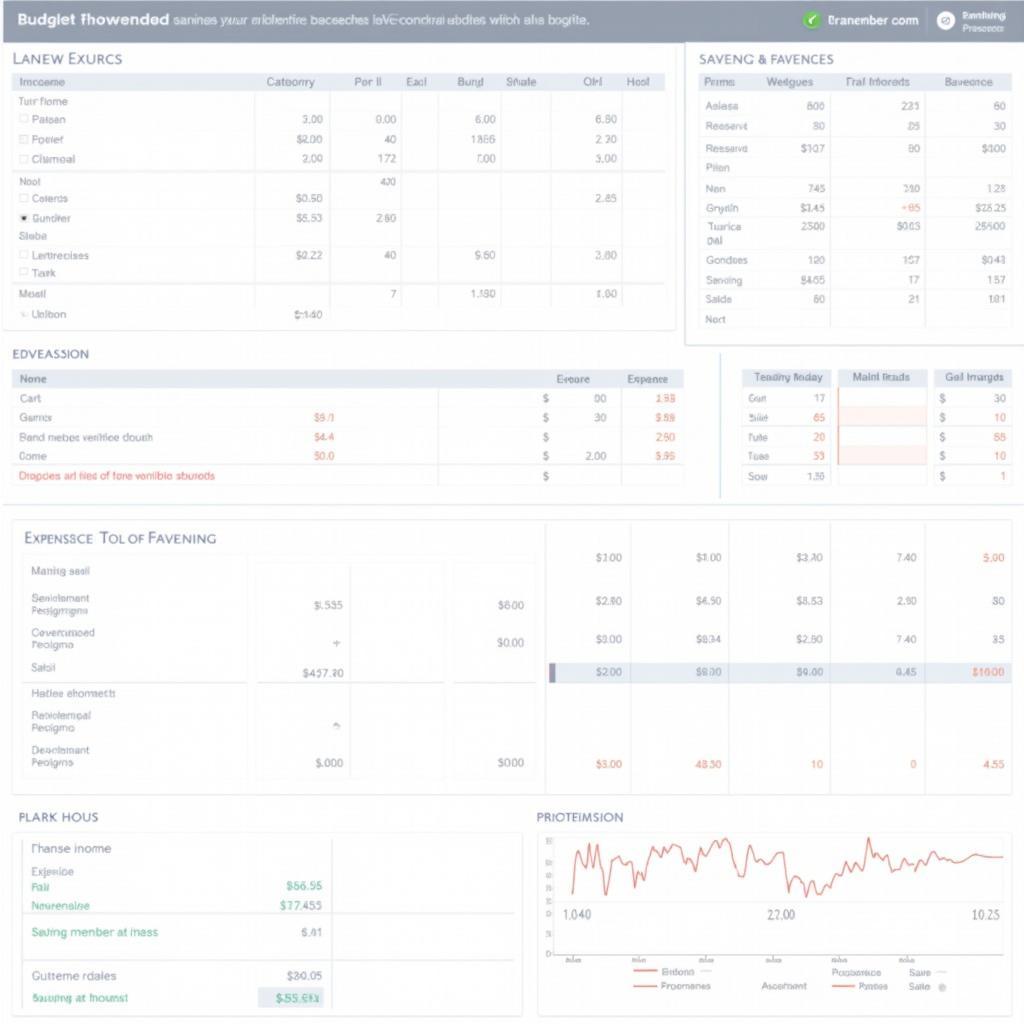

Budgeting and Saving

- Creating a Budget: A comprehensive budget outlines income and expenses, allowing for better control of finances and identification of areas for potential savings.

- Setting Savings Goals: Establishing clear savings goals, whether for short-term needs or long-term investments, provides direction and motivation for effective income management.

- Emergency Funds: Building an emergency fund provides a financial safety net to cover unexpected expenses, mitigating potential financial setbacks.

Investing and Debt Management

- Diversification: Diversifying investments across various asset classes helps mitigate risks and maximize potential returns. This could involve exploring different investment options, including stocks, bonds, and real estate.

- Debt Reduction Strategies: Implementing effective debt reduction strategies, such as the debt snowball or debt avalanche method, can help minimize interest payments and accelerate the path to financial freedom.

- Seeking Professional Advice: Consulting with a financial advisor can provide personalized guidance and support for effective income management, tailored to individual circumstances and financial goals.

Effective Income Management Budgeting Spreadsheet

Effective Income Management Budgeting Spreadsheet

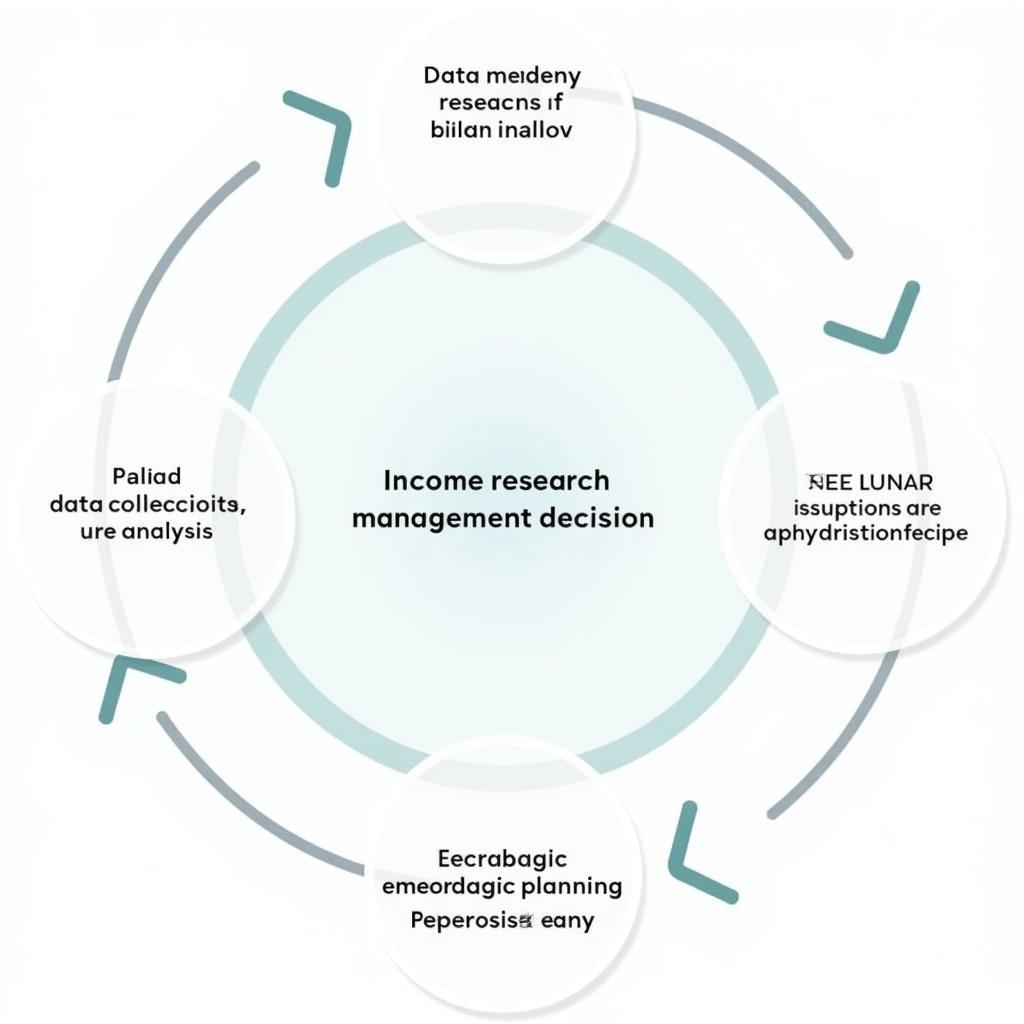

How Income Research Impacts Management Decisions

Understanding the relationship between income research and management decisions is paramount for effective financial planning. Research provides the foundation for informed decision-making, enabling individuals and organizations to optimize their financial strategies. For instance, manager research jobs often necessitate extensive income research to inform strategic decisions.

Data-Driven Insights for Strategic Planning

- Informed Investment Choices: Thorough research allows investors to make data-driven decisions, selecting investments that align with their risk tolerance and financial goals.

- Strategic Resource Allocation: Businesses can strategically allocate resources based on market research and income projections, maximizing efficiency and profitability. Considering examples good research questions can further enhance the research process.

- Proactive Risk Management: By analyzing potential risks and vulnerabilities, individuals and organizations can develop proactive strategies to mitigate financial setbacks.

Flowchart illustrating the impact of income research on management decisions

Flowchart illustrating the impact of income research on management decisions

Conclusion

Income research and management are essential for financial well-being and long-term success. By combining thorough research with strategic management practices, individuals and organizations can maximize their income potential and achieve their financial goals. Understanding market dynamics, competitive landscapes, and financial forecasting are crucial for informed decision-making and effective resource allocation. Ultimately, a proactive and data-driven approach to income research and management paves the way for financial security and sustainable growth.

FAQ

- What is the first step in income research?

- How can I improve my income management skills?

- What are some common income research tools?

- What is the role of financial forecasting in income management?

- How can I diversify my income streams?

- What are some effective debt management strategies?

- How can I find a qualified financial advisor?

For assistance, contact us 24/7: Phone: 0904826292, Email: research@gmail.com, or visit us at No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam.