Financial Research Associates play a crucial role in the world of finance. They are the investigative journalists of the investment world, digging deep into companies, industries, and markets to uncover hidden truths and potential opportunities. This article will explore the fascinating world of financial research associates, examining their responsibilities, required skills, career paths, and the evolving landscape of this demanding yet rewarding profession.

What Does a Financial Research Associate Actually Do?

Financial Research Associate at Work

Financial Research Associate at Work

Financial research associates are the backbone of investment firms, hedge funds, and asset management companies. Their primary responsibility is to conduct thorough research and analysis to support investment decisions. This involves analyzing financial statements, market trends, industry dynamics, and macroeconomic factors. They build financial models, write reports, and present their findings to portfolio managers and other investment professionals. They also monitor current investments and identify potential risks and opportunities. These associates are tasked with staying ahead of the curve, anticipating market shifts, and identifying emerging trends. They contribute significantly to the success of investment strategies and the overall performance of the firms they work for. Think of them as the Sherlock Holmes of finance, meticulously piecing together clues to solve the mystery of where to invest.

Essential Skills for a Financial Research Associate

Essential Skills for Financial Research

Essential Skills for Financial Research

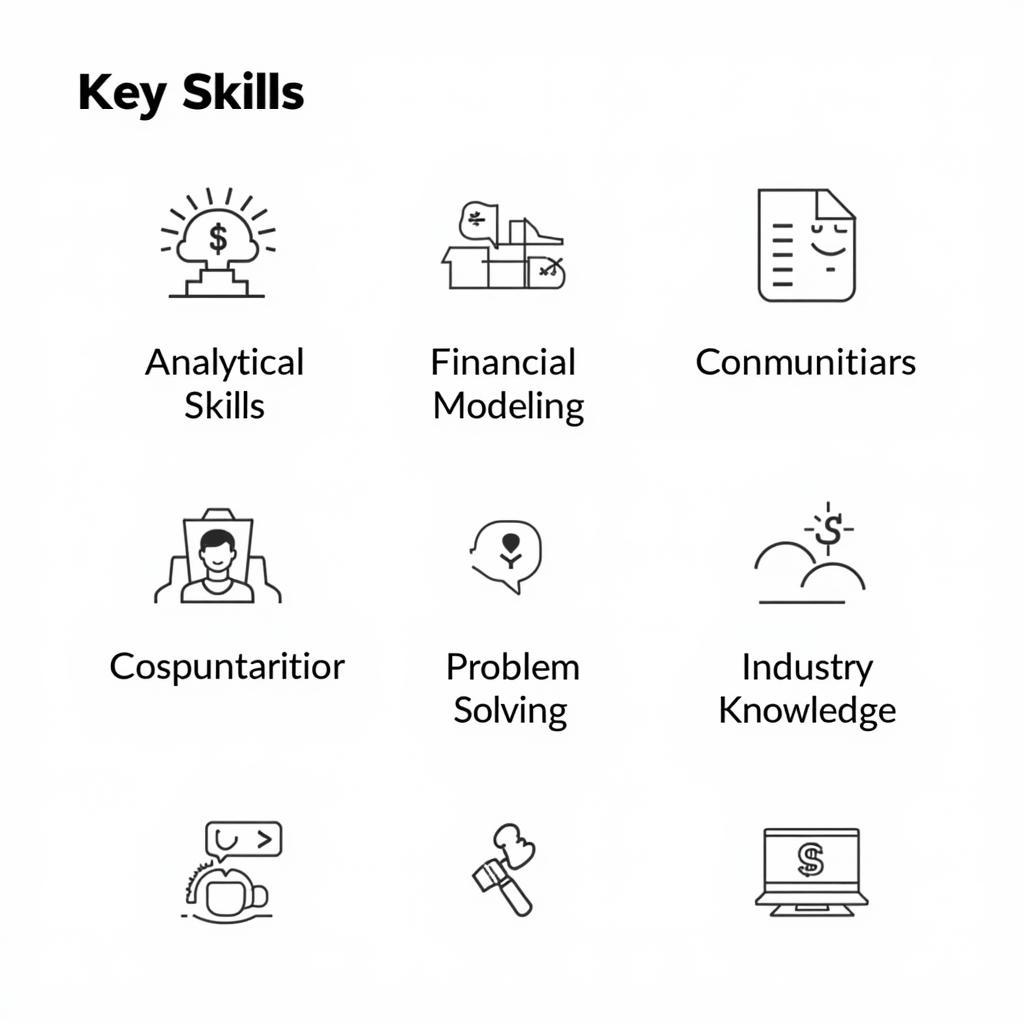

A successful financial research associate possesses a unique blend of analytical prowess, financial acumen, and communication skills. A strong foundation in finance, accounting, and economics is essential. Furthermore, proficiency in financial modeling, data analysis, and research methodologies is critical. Being able to clearly and concisely communicate complex financial information to both technical and non-technical audiences is paramount. This includes strong writing and presentation skills. Finally, a keen eye for detail, strong problem-solving abilities, and a genuine interest in the financial markets are key attributes for success in this field. Consider exploring equity research associate careers to delve deeper into this specific career path.

Navigating the Career Path of a Financial Research Associate

A career as a financial research associate can offer a dynamic and rewarding trajectory. Entry-level positions typically involve supporting senior analysts and portfolio managers. As associates gain experience, they can progress to senior analyst roles, taking on more responsibility and leading their own research projects. With further experience and proven success, they can move into portfolio management roles, making investment decisions based on their own research and analysis. Some may specialize in specific industries or asset classes, developing deep expertise in their chosen area. Others may transition into roles in investment banking, corporate finance, or other related fields. Are you interested in clinical research nurse salary? Although a different field, the research aspect may pique your interest.

The Changing Landscape of Financial Research

Financial Research and Technology

Financial Research and Technology

The financial research landscape is constantly evolving. The rise of big data, artificial intelligence, and machine learning is transforming how financial research is conducted. Financial research associates are increasingly leveraging these technologies to analyze vast amounts of data, identify patterns, and generate insights. This requires adapting to new tools and techniques, as well as developing a strong understanding of data science principles. The ability to combine traditional financial analysis with cutting-edge technology will be crucial for success in the future. For those interested in a slightly different research area, clinical research associate ii jobs might be a good option to explore. Alternatively, explore opportunities in corporate research associates.

Conclusion: A Rewarding Career in Financial Research

Financial research associates play a vital role in the financial ecosystem. Their rigorous research and analysis provide the foundation for sound investment decisions. This demanding yet rewarding career path offers opportunities for growth, specialization, and high earning potential. As the financial landscape continues to evolve, financial research associates who embrace new technologies and adapt to changing market dynamics will be well-positioned for continued success.

FAQ

- What is the typical starting salary for a financial research associate?

- What are the key skills needed to become a financial research associate?

- What is the career progression for a financial research associate?

- What are the educational requirements for this role?

- How has technology impacted the field of financial research?

- What are the different types of financial research roles?

- How can I gain experience in financial research?

Need further assistance? Contact us! Phone: 0904826292, Email: research@gmail.com or visit our office at No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam. We have a 24/7 customer service team ready to help.