Equity research is a demanding yet rewarding career path. This guide provides a comprehensive overview of Equity Research Career Progression, outlining the typical stages, skills required, and strategies for advancement. Understanding the trajectory of this profession can help aspiring and current analysts navigate their careers effectively.

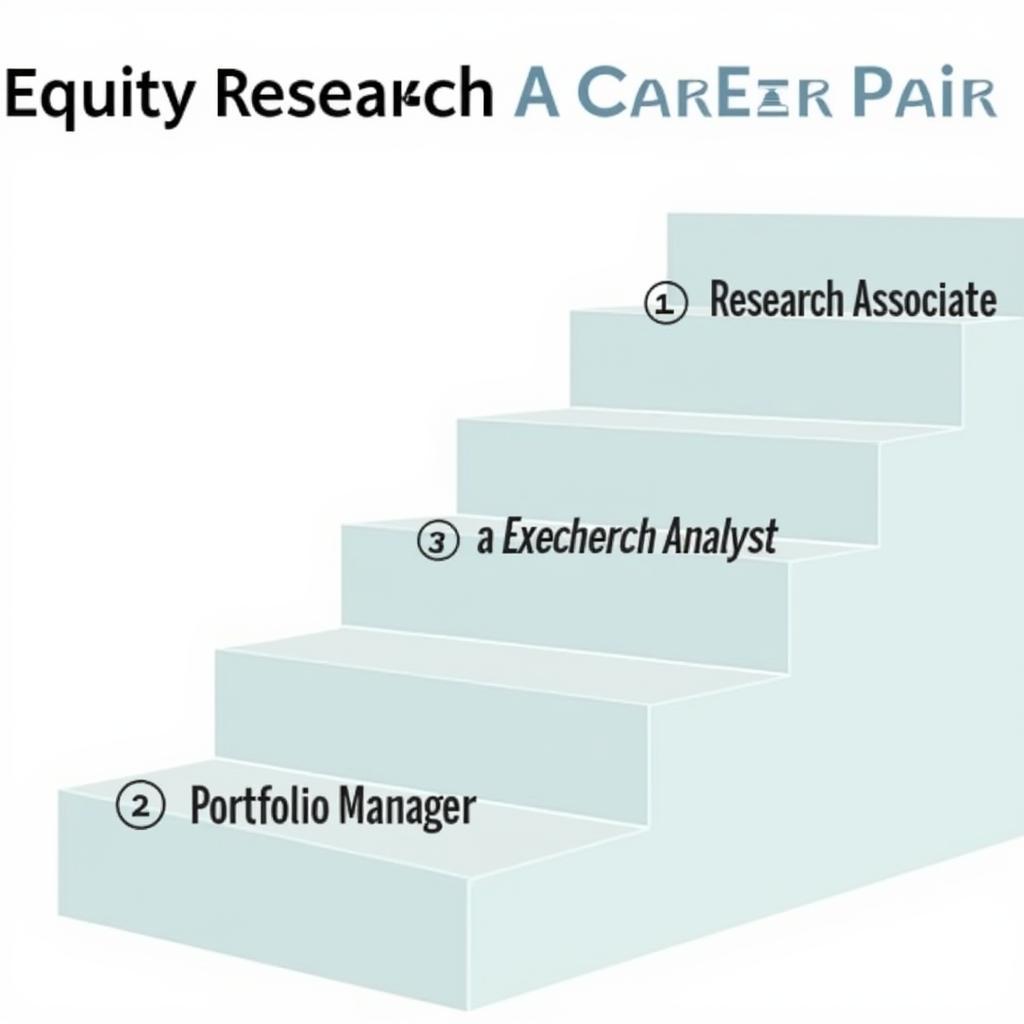

An equity research career typically begins with an entry-level position such as a Research Associate. From there, analysts can progress to Senior Research Analyst, and eventually to the coveted roles of Portfolio Manager or even Director of Research. This journey requires continuous learning, adaptability, and a deep understanding of financial markets. Want to learn more about investment research careers? Check out this helpful resource: investment research careers.

Climbing the Ladder: Stages in Equity Research Career Progression

Research Associate: The Foundation

The first rung on the ladder is often the Research Associate role. This position involves supporting senior analysts by gathering data, building financial models, and conducting industry research. It’s a crucial stage for developing fundamental analytical skills and understanding the intricacies of the profession.

Senior Research Analyst: Taking the Lead

After gaining experience as a Research Associate, the next step is typically becoming a Senior Research Analyst. This role requires more independent work, including developing investment recommendations, presenting to clients, and managing junior team members. A deep understanding of valuation techniques and industry dynamics is essential at this level. This is where your expertise as an senior research analyst truly shines.

Portfolio Manager: Managing Investments

For some, the ultimate goal is to become a Portfolio Manager. This role involves making investment decisions for clients, managing a portfolio of assets, and generating returns. Strong analytical skills, combined with a proven track record and excellent communication abilities, are essential for success.

Essential Skills for Equity Research Career Progression

Beyond technical expertise, certain soft skills are vital for upward mobility. Strong communication skills are necessary for effectively conveying investment ideas to clients and colleagues. Critical thinking and problem-solving abilities are crucial for analyzing complex financial data and making sound investment recommendations. Finally, teamwork and collaboration are essential for working effectively within a research team and interacting with other departments within a financial institution. For those interested in exploring different research roles, consider looking into research scientist pharmaceutical salary for a different perspective.

Visual representation of equity research career path stages, from research associate to portfolio manager

Visual representation of equity research career path stages, from research associate to portfolio manager

Strategies for Advancing Your Equity Research Career

Continuous Learning and Development

The financial world is constantly evolving, so continuous learning is essential for staying ahead of the curve. Pursuing professional certifications like the CFA can demonstrate a commitment to professional development and enhance your credibility.

Networking and Building Relationships

Building a strong network is crucial for any career, and equity research is no exception. Attending industry conferences, networking events, and connecting with professionals on LinkedIn can open doors to new opportunities.

Seeking Mentorship

Finding a mentor can provide invaluable guidance and support as you navigate your career. A mentor can offer insights into the industry, provide feedback on your work, and help you develop your skills.

Are you considering a career in equity research? An equity research job can be a challenging but rewarding path.

What is the typical salary progression in equity research?

Compensation in equity research varies depending on experience, location, and firm size. However, it generally increases significantly with each promotion. Understanding equity research analyst compensation is crucial for career planning.

Conclusion

Equity research career progression offers a challenging yet rewarding path for those with a passion for finance and investing. By developing the necessary skills, building a strong network, and continuously learning, aspiring and current analysts can successfully navigate this demanding yet fulfilling career. Understanding the steps involved in equity research career progression can help individuals plan their careers strategically and achieve their professional goals.

FAQ

- What is the starting salary for an equity research associate?

- What are the key skills required for a successful equity research career?

- How long does it typically take to become a portfolio manager?

- What are the best resources for learning about equity research?

- What are the typical working hours in equity research?

- How can I improve my networking skills in the finance industry?

- What are the biggest challenges faced by equity research analysts?

Need more information? Consider exploring these other related articles available on our website:

- Investment Strategies for Beginners

- Understanding Financial Markets

- Career Paths in Finance

Need assistance? Please contact us:

Phone: 0904826292

Email: research@gmail.com

Address: No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam. We have a 24/7 customer support team.