Equity Research Analyst Pay is a topic that frequently piques the interest of those considering a career in finance. It’s no surprise, as this role sits at the intersection of meticulous research, insightful analysis, and the dynamic world of investments. But what exactly does an equity research analyst do, and how lucrative can this profession be? Let’s delve into the intricacies of this demanding yet rewarding career path.

Decoding the Role: What Does an Equity Research Analyst Do?

Equity research analysts are the detectives of the financial world. They meticulously gather and analyze data to formulate investment recommendations on whether to buy, sell, or hold specific stocks. Their insights are highly valued by portfolio managers, fund managers, and individual investors seeking to make informed decisions in the stock market.

Here’s a glimpse into their daily grind:

- Financial Statement Scrutiny: Equity research analysts dissect a company’s financial statements – balance sheets, income statements, and cash flow statements – to assess its financial health and performance.

- Industry Analysis: They dive deep into specific industries, understanding market trends, competitive landscapes, and regulatory environments to identify potential investment opportunities or risks.

- Company Valuation: Using various valuation techniques, like discounted cash flow analysis and comparable company analysis, they determine a company’s intrinsic value and assess its attractiveness as an investment.

- Report Writing: Their findings are meticulously documented in research reports, which often include financial projections, investment recommendations, and risk assessments.

- Presentations and Communication: Equity research analysts present their findings to clients, portfolio managers, and other stakeholders, clearly articulating their investment thesis and rationale.

Factors Influencing Equity Research Analyst Pay

The earning potential of an equity research analyst can vary significantly based on a confluence of factors:

- Experience Level: As with most professions, experience commands higher compensation. Entry-level analysts earn considerably less than seasoned professionals with a proven track record.

- Location, Location, Location: Major financial hubs like New York, London, and Hong Kong tend to offer higher salaries due to the concentration of financial institutions and the competitive job market.

- Employer Type: Large investment banks and hedge funds, known for their deep pockets, typically offer more generous compensation packages compared to smaller boutique firms.

- Industry Specialization: Analysts covering high-growth or niche sectors might command higher salaries due to the specialized knowledge and expertise required.

- Performance and Stock-Picking Prowess: Ultimately, an analyst’s success in generating profitable investment ideas and outperforming the market can significantly impact their earning potential through bonuses and incentives.

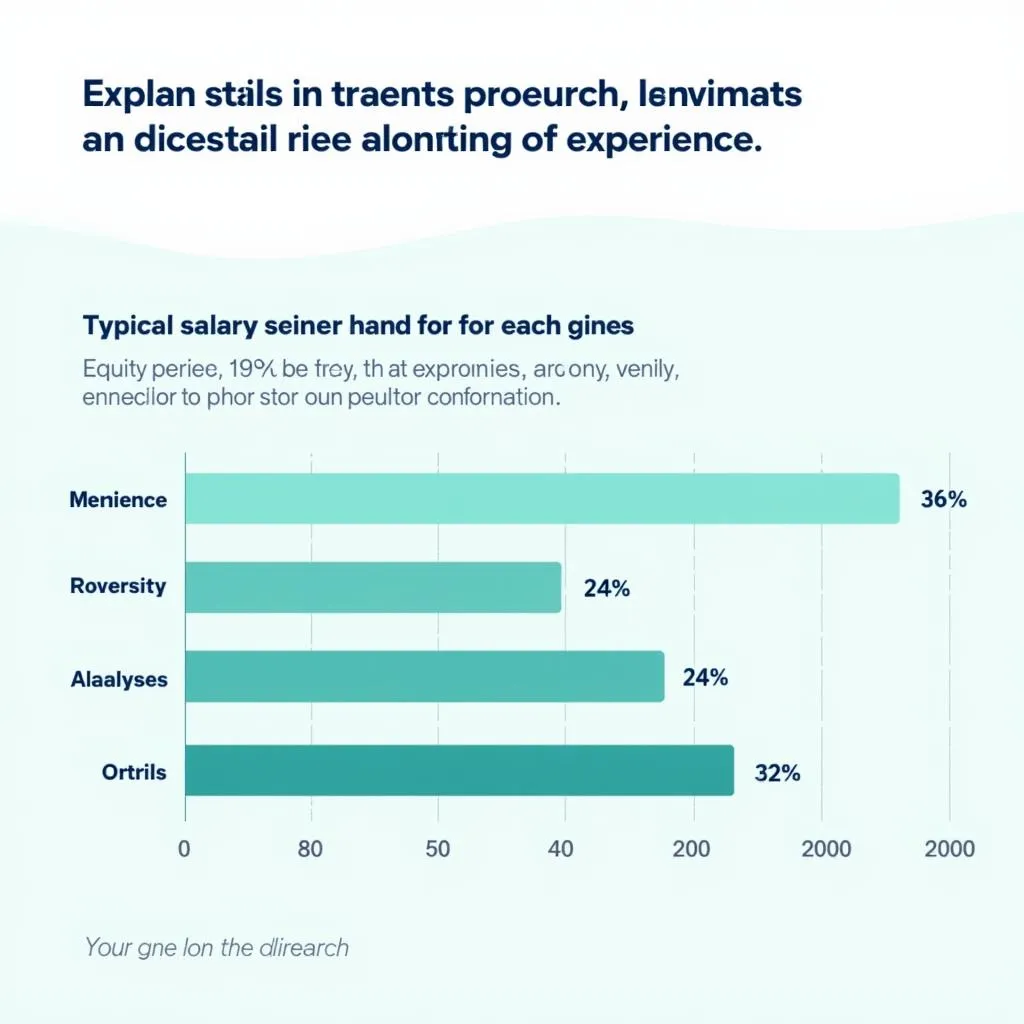

Equity research analyst salary range chart

Equity research analyst salary range chart

Navigating the Career Ladder: From Analyst to Portfolio Manager

The career trajectory for an equity research analyst often follows a well-defined path:

- Analyst: Entry-level position focused on data gathering, financial modeling, and supporting senior analysts.

- Senior Analyst: With a few years of experience, analysts take on more responsibility, conducting independent research, developing investment recommendations, and mentoring junior team members.

- Vice President: A leadership role involving managing a team of analysts, overseeing coverage of specific sectors or companies, and interacting directly with clients.

- Director/Managing Director: Senior management positions with significant decision-making authority, shaping the firm’s research agenda, and overseeing client relationships.

Some equity research analysts transition into portfolio management roles, leveraging their analytical expertise and stock-picking skills to directly manage investment portfolios for clients or institutions.

Essential Skills for Success in Equity Research

Thriving in the demanding world of equity research requires a unique blend of technical skills, analytical acumen, and strong communication abilities:

- Financial Acumen: A deep understanding of financial statements, accounting principles, and valuation methodologies is paramount.

- Analytical Prowess: Equity research analysts must be able to dissect complex data, identify patterns, and draw meaningful conclusions to support their investment recommendations.

- Communication Skills: Articulating complex financial concepts in a clear and concise manner, both verbally and in writing, is crucial for conveying insights to clients and stakeholders.

- Industry Knowledge: Developing expertise in specific industries is essential for understanding industry dynamics, competitive landscapes, and potential investment opportunities.

- Attention to Detail: Accuracy is paramount in equity research, as even minor errors in financial models or data analysis can have significant implications for investment decisions.

Image depicting the essential skills of an equity research analyst

Image depicting the essential skills of an equity research analyst

Is Equity Research the Right Path for You?

A career in equity research can be intellectually stimulating and financially rewarding, but it’s not for the faint of heart. It demands long hours, intense pressure to perform, and the ability to thrive in a fast-paced and constantly evolving environment.

If you have a passion for finance, a knack for numbers, and the ability to think critically and independently, then equity research might be the perfect career path for you.

Conclusion

Equity research analyst pay is commensurate with the demanding nature of the role and the potential to earn significant financial rewards. As you’ve seen, numerous factors influence compensation, including experience, location, employer, and performance. If you’re considering this challenging yet rewarding career path, kbw equity research offers valuable resources and insights to guide your journey.