Equity Research Analyst Compensation is a topic of much interest, particularly for those considering a career in finance. This guide will delve into the various factors influencing pay, including experience, location, and firm size, providing a comprehensive overview of what you can expect to earn in this demanding yet rewarding field.

Understanding equity research analyst compensation requires considering several key components. Base salary is just one piece of the puzzle; bonuses, often tied to individual and firm performance, can significantly impact total earnings. Additionally, benefits packages, including health insurance and retirement plans, contribute to overall compensation. Let’s explore these factors in more detail to gain a clearer picture of equity research analyst compensation. For those looking to break into the field, researching entry-level research analyst salary can be a good starting point. Also, understanding the typical equity research hours is crucial for anyone considering this career path.

Factors Influencing Equity Research Analyst Compensation

Experience and Performance

Entry-level analysts can expect a lower starting salary compared to their more experienced counterparts. As analysts gain expertise and demonstrate strong performance, their compensation typically increases. Performance-based bonuses are common and can significantly boost total earnings, especially for top performers.

For those considering a move from research to a different sector within finance, exploring options like equity research to private equity can be insightful in terms of potential compensation shifts.

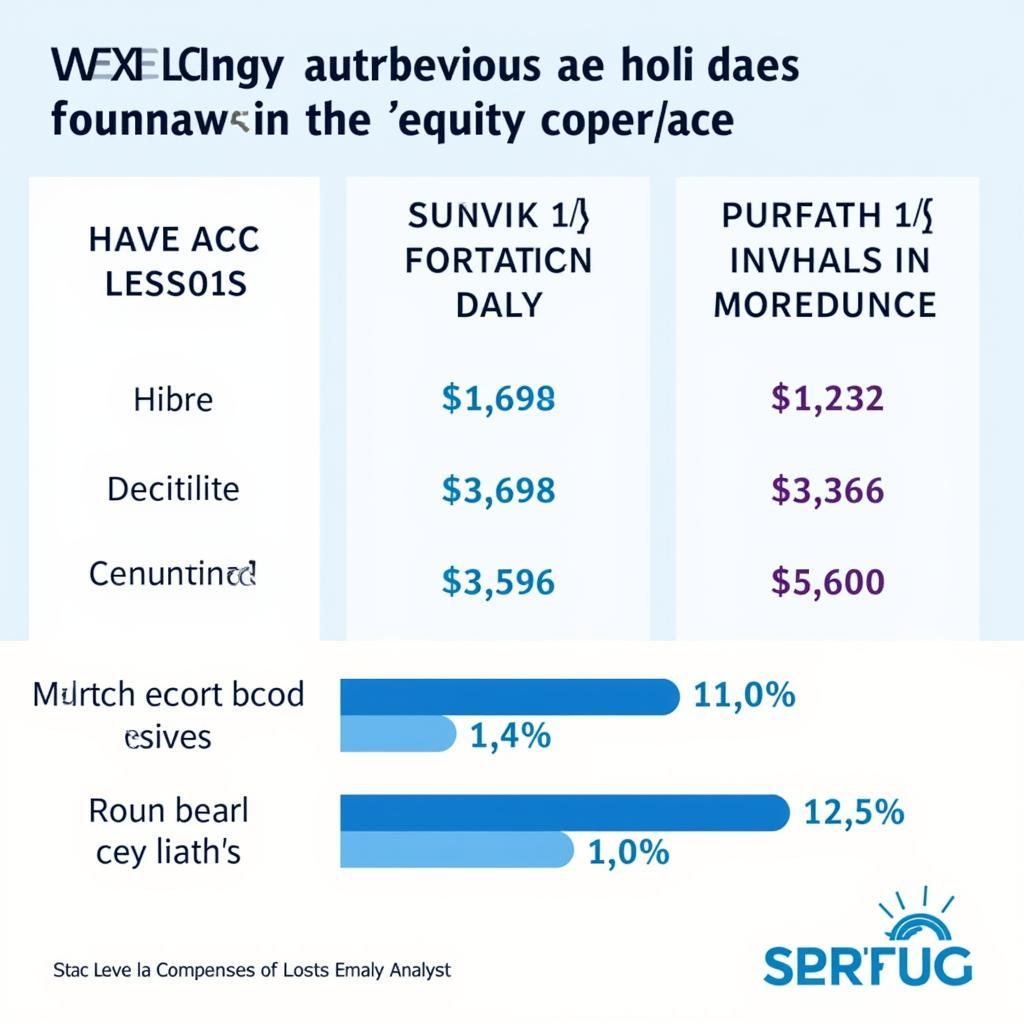

Equity Research Analyst Compensation by Experience

Equity Research Analyst Compensation by Experience

Location, Location, Location

Geographic location plays a significant role in compensation. Major financial hubs like New York City often command higher salaries due to the higher cost of living and increased competition for talent. Equity research jobs NYC are highly sought after, which can drive up compensation. Understanding these regional variations is essential when assessing potential earnings. You can also look into equity research compensation details for a better overview.

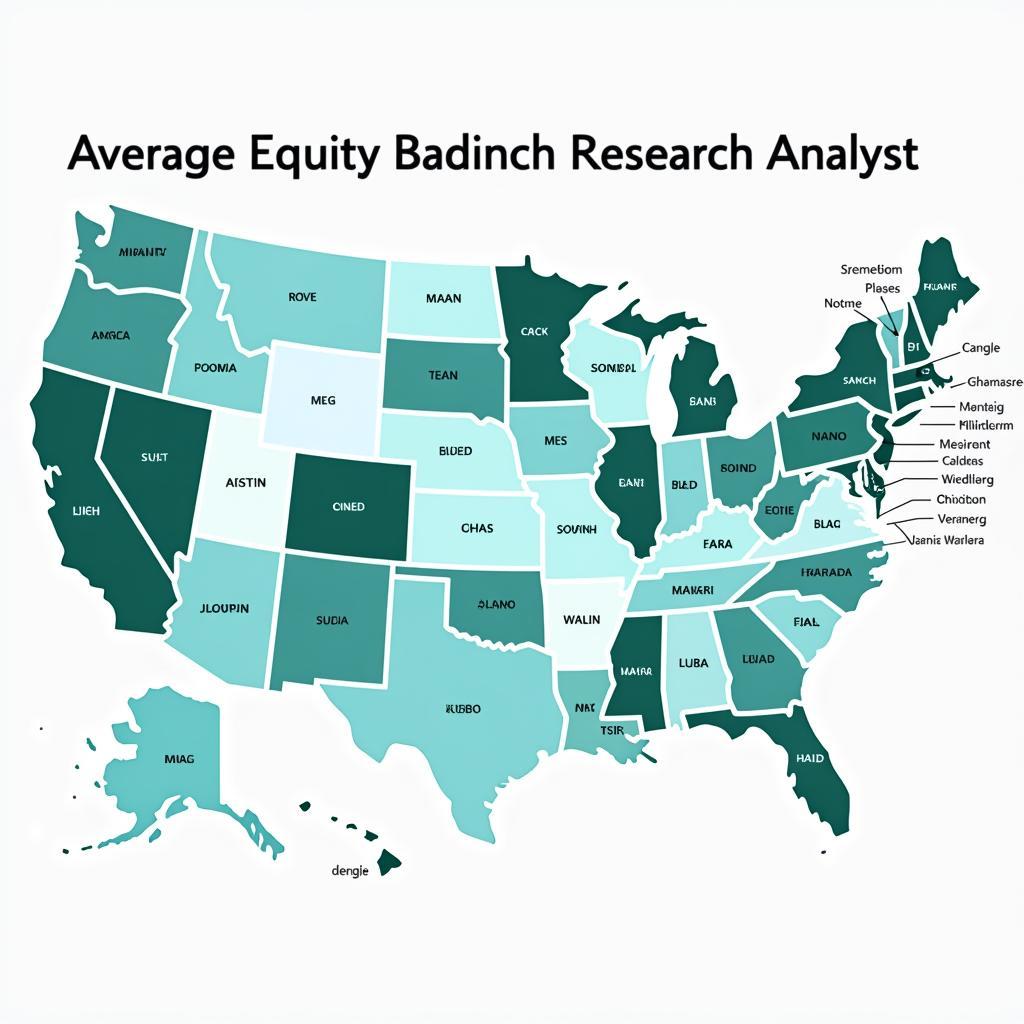

Equity Research Analyst Compensation by Location

Equity Research Analyst Compensation by Location

Firm Size and Type

The size and type of firm also influence compensation. Large, established investment banks typically offer higher salaries and bonus potential compared to smaller boutique firms. However, smaller firms might offer greater opportunities for professional growth and a more entrepreneurial environment. Hedge funds, known for their performance-driven culture, can offer exceptionally high compensation packages for top-performing analysts.

Negotiating Your Compensation

Don’t be afraid to negotiate your compensation package, especially when you have competing offers or a strong track record. Researching industry benchmarks and knowing your worth can empower you to secure the best possible deal. Be prepared to discuss your skills, experience, and contributions to justify your desired salary and bonus expectations.

What Does the Future Hold for Equity Research Compensation?

The financial landscape is constantly evolving, and so too is equity research analyst compensation. Factors like technological advancements, regulatory changes, and market conditions can all impact future earning potential. Staying informed about industry trends and adapting to new challenges is crucial for long-term career success in this field. Continuously developing your skills and expertise will enhance your value and earning potential in the years to come. If you’re curious about other career paths in research, exploring research analyst salary entry level positions can offer a broader perspective. It is also important to keep in mind the equity research hours when comparing this field with other career options.

Conclusion

Equity research analyst compensation is a multifaceted topic with various factors influencing earnings. By understanding these factors and staying informed about industry trends, aspiring and current analysts can navigate the compensation landscape effectively and position themselves for success in this dynamic and rewarding field. Don’t forget to research equity research compensation to get the most up-to-date information.

FAQ

- What is the average starting salary for an equity research analyst?

- How do bonuses impact overall compensation in equity research?

- What are the key skills needed to succeed as an equity research analyst?

- How does location affect equity research analyst salaries?

- What are the typical career progression paths for equity research analysts?

- What are the long-term job prospects in the equity research field?

- How can I negotiate a better compensation package as an equity research analyst?

Situations Often Encountered

- Candidates with advanced degrees (e.g., MBA, CFA) often command higher starting salaries.

- Strong analytical and communication skills are highly valued in this field.

- Networking and building relationships can open doors to new opportunities and potentially higher compensation.

Suggested Further Reading

You might find our articles on equity research jobs nyc and equity research to private equity helpful. For those new to the field, understanding typical equity research hours is crucial. Also, take a look at our comprehensive guide on equity research compensation for more in-depth information on this topic. Finally, for those just starting their careers, check out our article on research analyst salary entry level.

Need Help?

For assistance, please contact us at Phone Number: 0904826292, Email: research@gmail.com or visit our office at No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam. We have a 24/7 customer service team available.