Credit Analysis & Research Ltd (CARE) is a prominent player in the Indian credit rating industry. Investors and market participants often track the CARE share price to gauge market sentiment towards the company and its future prospects. This comprehensive guide delves into the factors influencing the CARE share price, providing valuable insights for potential investors.

Factors Influencing Credit Analysis & Research Ltd Share Price

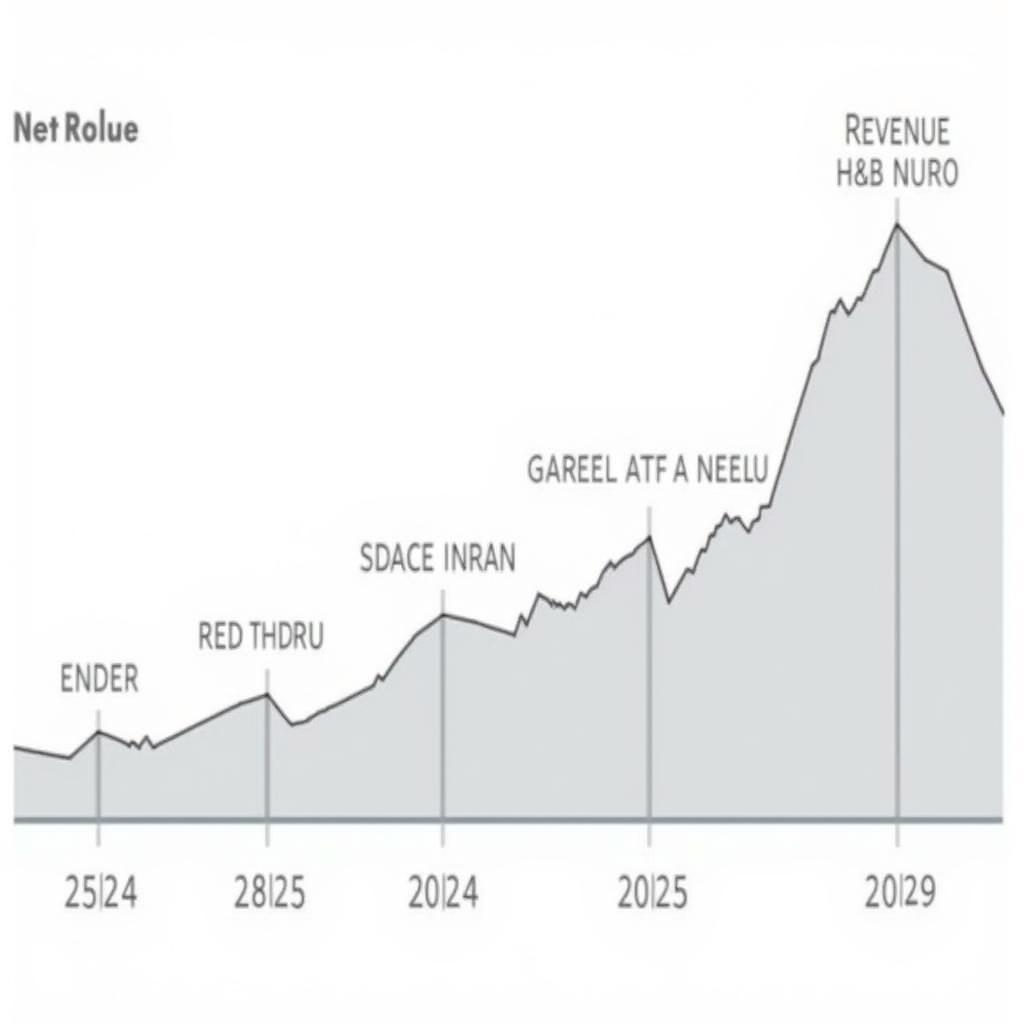

Financial Performance

CARE’s financial performance plays a pivotal role in shaping investor perception and subsequently, its share price. Key metrics such as revenue growth, profitability, and dividend payouts directly influence investor confidence. Strong financial results often translate into upward pressure on the share price.

Financial Performance Chart

Financial Performance Chart

Industry Outlook

As a credit rating agency, CARE’s fortunes are closely tied to the overall health of the Indian economy and credit markets. A robust economy typically leads to increased demand for credit ratings, benefiting companies like CARE. Conversely, economic downturns can negatively impact the demand for credit ratings, potentially impacting the share price.

Regulatory Environment

The credit rating industry is subject to stringent regulations. Any changes in regulations, such as those related to capital adequacy or rating methodologies, can impact CARE’s operations and influence investor sentiment.

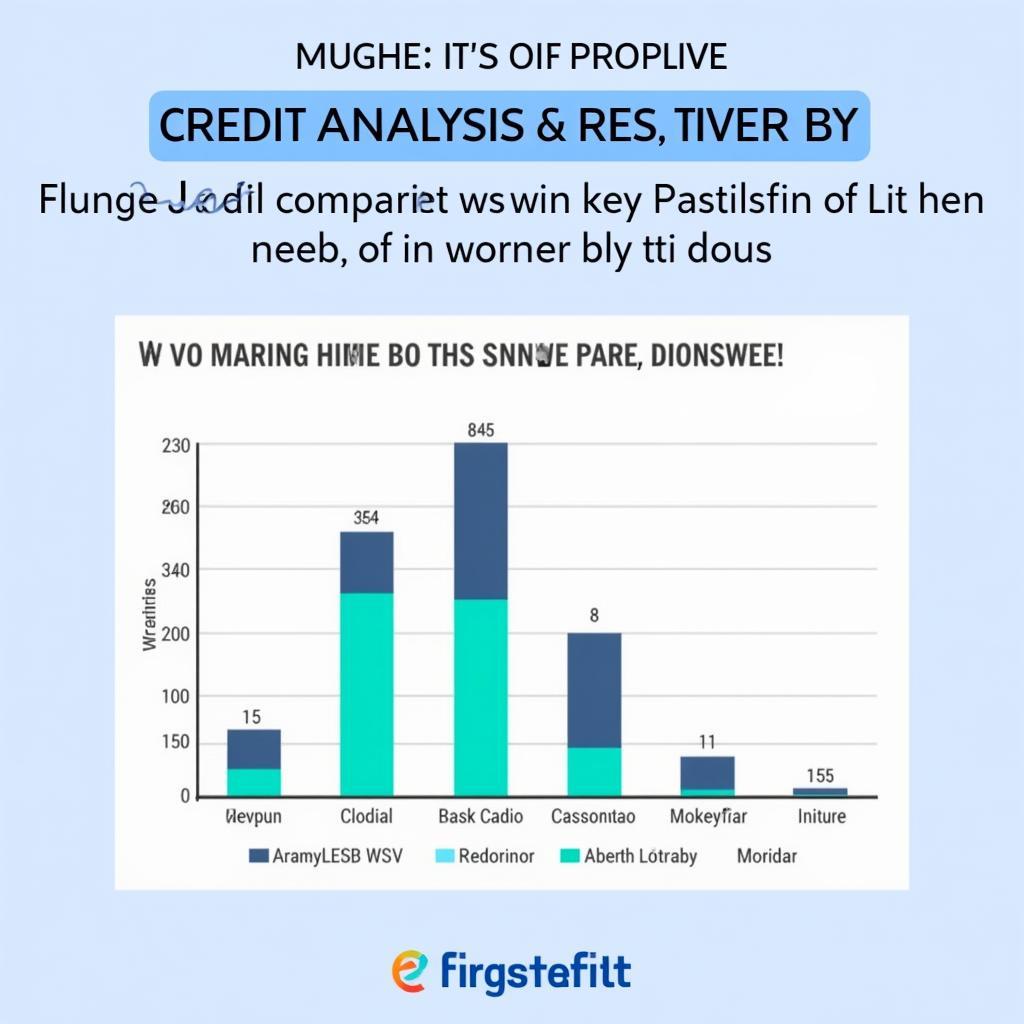

Competition

The credit rating industry in India is competitive, with several players vying for market share. Intense competition can put pressure on pricing and profitability, potentially affecting CARE’s share price.

Competitive Landscape

Competitive Landscape

Market Sentiment

Beyond fundamental factors, investor sentiment plays a significant role in shaping stock prices. Positive news flow, industry trends, and broader market sentiment can all contribute to upward or downward pressure on the CARE share price.

Understanding Credit Analysis & Research Ltd’s Business

Credit Analysis & Research Ltd is engaged in providing credit ratings for a wide range of debt instruments, including bonds, debentures, and bank loans. These ratings help investors assess the creditworthiness of borrowers and make informed investment decisions.

Expertise and Reputation

CARE is known for its expertise in credit analysis and its team of experienced professionals. The company’s reputation for providing independent and reliable credit ratings is a key asset.

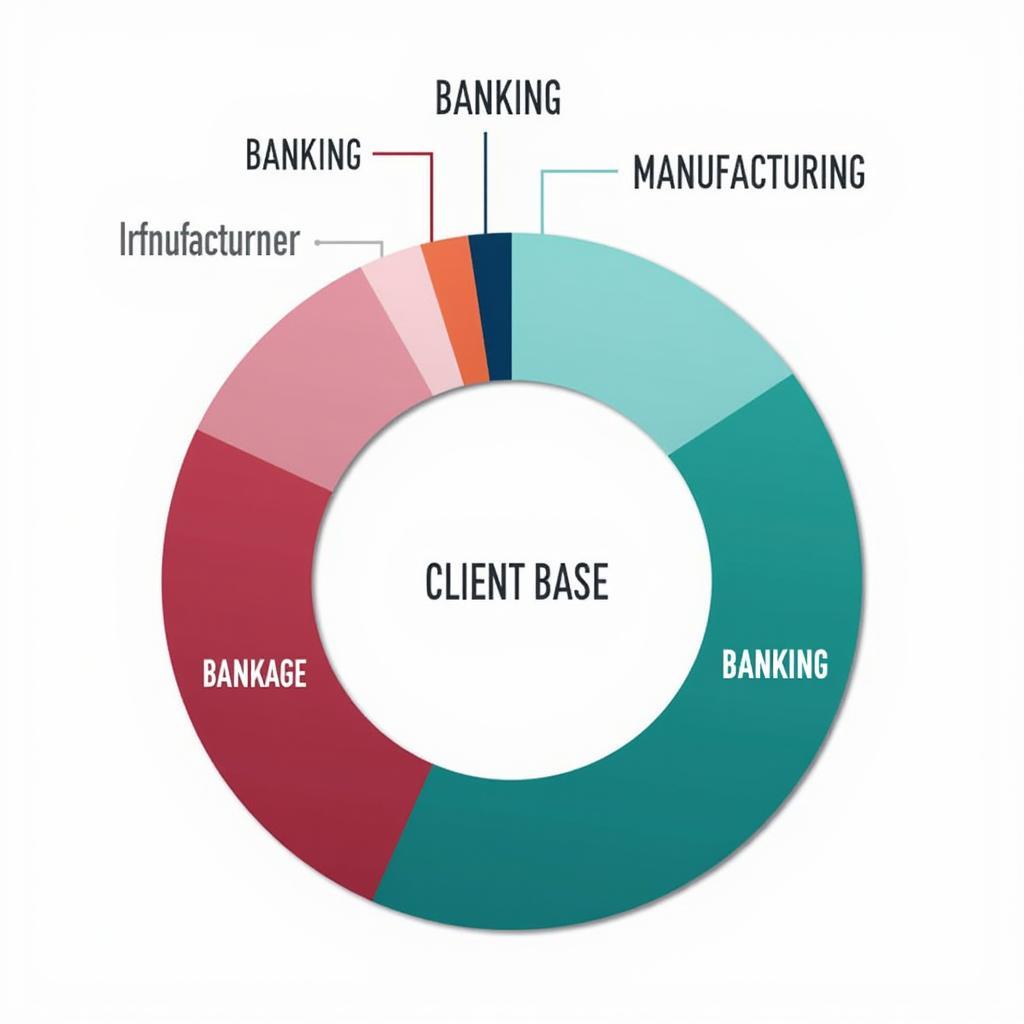

Diversified Client Base

CARE boasts a diversified client base spanning across various sectors of the Indian economy. This diversification helps mitigate risks associated with overdependence on a particular industry or client segment.

Client Portfolio Diversification

Client Portfolio Diversification

Conclusion

The Credit Analysis & Research Ltd share price is influenced by a complex interplay of factors. While financial performance, industry dynamics, and regulatory changes form the foundation, market sentiment and company-specific developments also play a crucial role. Investors should carefully evaluate these factors and conduct thorough research before making any investment decisions related to Credit Analysis & Research Ltd.