Corporate Governance Research plays a crucial role in understanding how organizations are directed and controlled. It examines the relationships between a company’s management, its board, its shareholders, and other stakeholders. This research contributes significantly to improving business practices, enhancing transparency, and fostering trust within the corporate world. Effective corporate governance is essential for long-term sustainability and success in today’s complex business environment.

What is Corporate Governance Research and Why Does it Matter?

Corporate governance research explores a wide range of topics, from board composition and executive compensation to risk management and ethical decision-making. It seeks to identify best practices and develop frameworks that promote effective governance. This research is vital for investors, regulators, and businesses alike, as it provides valuable insights into how companies can operate more efficiently, ethically, and sustainably. Strong corporate governance can lead to increased shareholder value, reduced risk, and improved overall corporate performance. Why? Because effective oversight and accountability are fundamental to building a successful and sustainable business.

Investing in strong corporate governance can also minimize potential legal and reputational risks. For example, by implementing robust ethical guidelines and compliance procedures, companies can protect themselves from costly lawsuits and reputational damage. Effective corporate governance is not just a matter of compliance; it’s a strategic imperative for organizations seeking long-term success.

Corporate Governance Research Framework

Corporate Governance Research Framework

Solid corporate governance principles can foster a culture of trust and transparency, which is particularly important in today’s interconnected world. When stakeholders have confidence in a company’s leadership and decision-making processes, they are more likely to invest in the company, support its growth, and recommend its products or services.

Key Areas of Corporate Governance Research

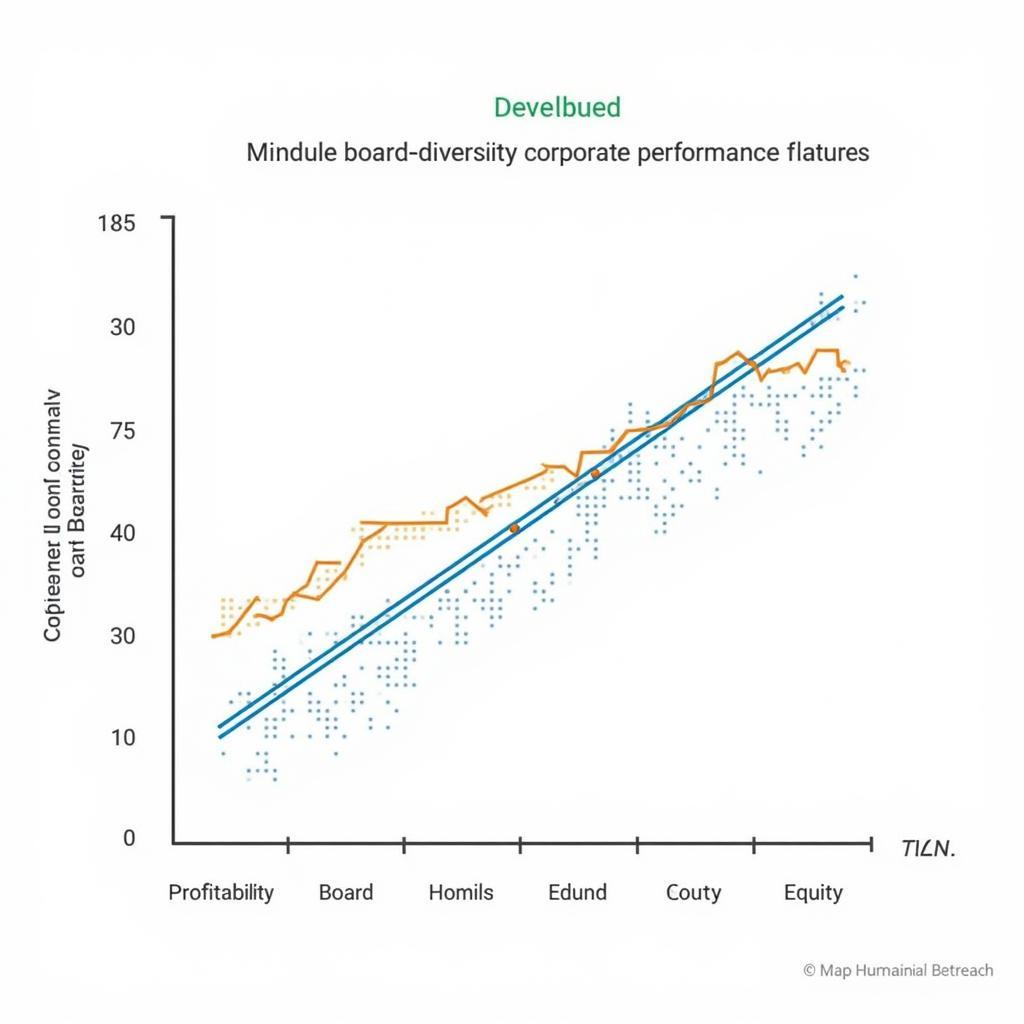

Several key areas within corporate governance research are currently attracting considerable attention. These include the impact of board diversity on firm performance, the effectiveness of various executive compensation structures, and the role of independent directors in ensuring accountability. Another important area of focus is the growing emphasis on environmental, social, and governance (ESG) factors in investment decisions. Researchers are exploring how companies can integrate ESG considerations into their governance frameworks and the impact of these factors on long-term value creation.

calvert research and management is known for its focus on responsible investing, including considerations of ESG factors.

How Does Board Structure Influence Decision-Making?

Board structure plays a significant role in corporate decision-making. The size and composition of the board, the balance of power between executive and non-executive directors, and the presence of independent directors all influence the quality and effectiveness of board decisions. Research suggests that diverse boards, with members from varied backgrounds and experiences, tend to make better decisions and are more likely to challenge management effectively.

Board Diversity and Corporate Performance

Board Diversity and Corporate Performance

Exploring the Role of Shareholder Activism

Shareholder activism has become an increasingly important force in corporate governance. Activist investors, often hedge funds or institutional investors, seek to influence corporate policy and strategy by acquiring significant stakes in companies and then using their voting power to push for changes. Research examining the impact of shareholder activism on corporate performance has yielded mixed results. While some studies suggest that activism can lead to improved corporate governance and increased shareholder value, others find that it can be disruptive and create uncertainty.

accounting and business research often explores these complex financial relationships and their impact on corporate governance.

The Future of Corporate Governance Research

The field of corporate governance research is constantly evolving, driven by changes in the global business environment, technological advancements, and emerging social and environmental concerns. Looking ahead, several key trends are expected to shape the future of corporate governance research. These include the growing importance of stakeholder engagement, the increasing use of data analytics to assess governance effectiveness, and the need for greater transparency and accountability in corporate decision-making.

responsibility research delves into the ethical dimensions of corporate decision-making and the increasing importance of stakeholder engagement.

One expert, Dr. Amelia Chen, a leading authority in corporate governance at the prestigious Institute for Business Ethics, notes, “The future of corporate governance lies in a more holistic approach that considers the interests of all stakeholders, not just shareholders. This requires greater transparency, accountability, and a commitment to ethical and sustainable business practices.”

Another expert, Mr. David Rodriguez, a seasoned corporate lawyer with extensive experience advising boards on governance matters, adds, “Data analytics and artificial intelligence are transforming the way we assess and manage corporate governance risks. These technologies offer powerful tools for enhancing transparency, identifying potential problems, and improving decision-making.”

In conclusion, corporate governance research is critical for understanding and improving how businesses operate in today’s complex and dynamic world. It provides valuable insights into how companies can create long-term value, manage risk effectively, and build trust with stakeholders. As the business landscape continues to evolve, ongoing research in this area will be essential for ensuring that corporate governance practices remain relevant, effective, and aligned with the needs of a changing world. By prioritizing effective corporate governance, organizations can build a strong foundation for sustainable growth and success.

craig hallum research often focuses on financial performance, which is directly impacted by the effectiveness of corporate governance.

business law research topics often overlap with corporate governance, especially regarding regulatory compliance and ethical considerations.

FAQ

- What is the main goal of corporate governance research?

- How does corporate governance research benefit investors?

- What are some key areas of focus in corporate governance research?

- How does board composition affect corporate performance?

- What role does shareholder activism play in corporate governance?

- What are some emerging trends in corporate governance research?

- How can companies improve their corporate governance practices?

For support, please contact us at Phone: 0904826292, Email: research@gmail.com or visit us at No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam. We have a 24/7 customer support team.