Citron Research Twitter has become a significant force in the financial world, often sparking intense debate and market volatility. This article explores the impact of Citron Research’s tweets, examining their strategies, controversies, and the implications for investors.

Understanding Citron Research’s Twitter Strategy

Citron Research, a prominent short-selling firm, utilizes Twitter as a primary platform for disseminating its investment thesis and research findings. Their tweets often target companies they believe are overvalued or engaged in fraudulent activities. This approach, while potentially lucrative, has also generated controversy and accusations of market manipulation.

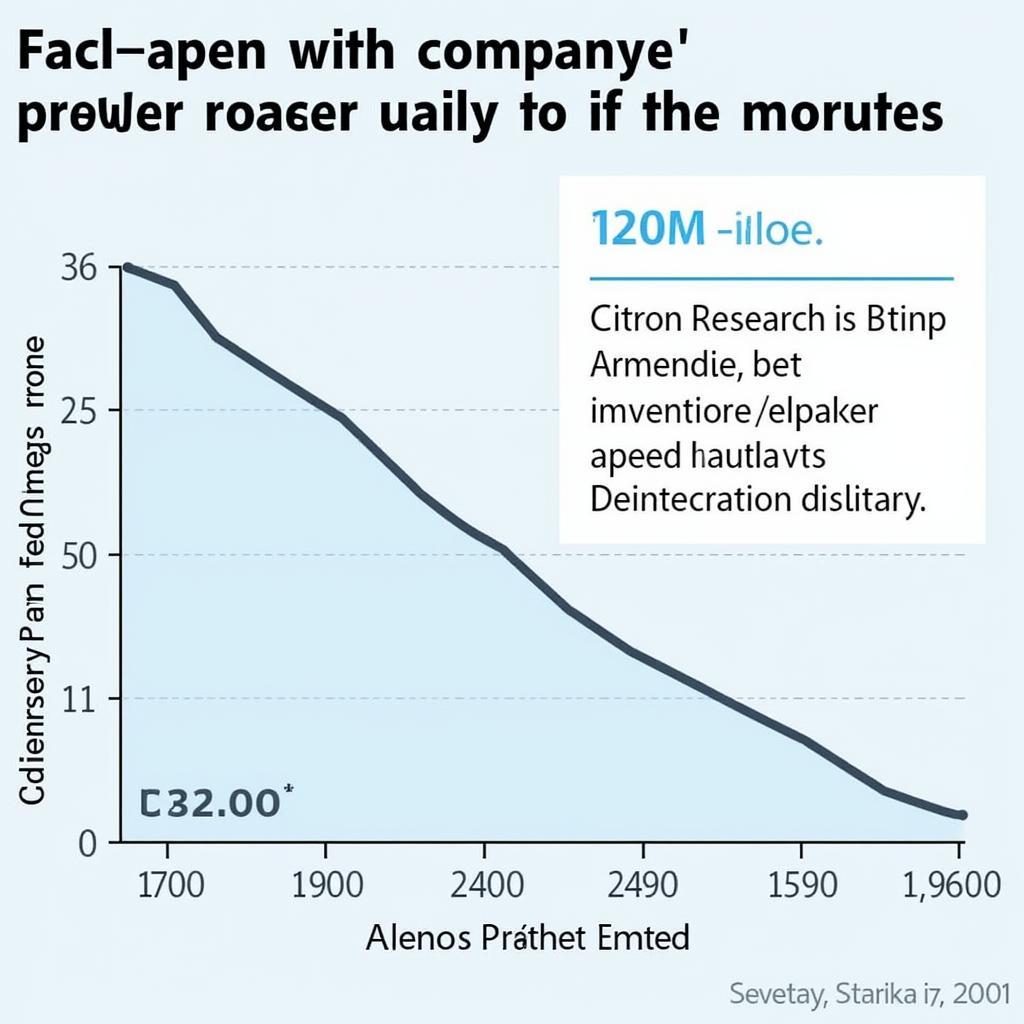

The Power of Short-Selling Tweets

Citron’s tweets can have a significant impact on stock prices, especially for smaller companies. A negative tweet can trigger a sell-off, leading to substantial losses for investors. This power stems from the immediacy and reach of Twitter, allowing information to spread rapidly.

Citron Research Tweet Impact

Citron Research Tweet Impact

Controversies and Criticisms

Citron Research’s tactics have drawn criticism from various quarters. Some accuse the firm of spreading misinformation and engaging in unethical practices to profit from declining stock prices. Others argue that Citron plays a vital role in exposing corporate malfeasance.

Analyzing Citron Research’s Target Companies

Citron typically focuses on companies with questionable business models, accounting irregularities, or inflated valuations. They conduct extensive research, often relying on publicly available information, and then publicize their findings via Twitter.

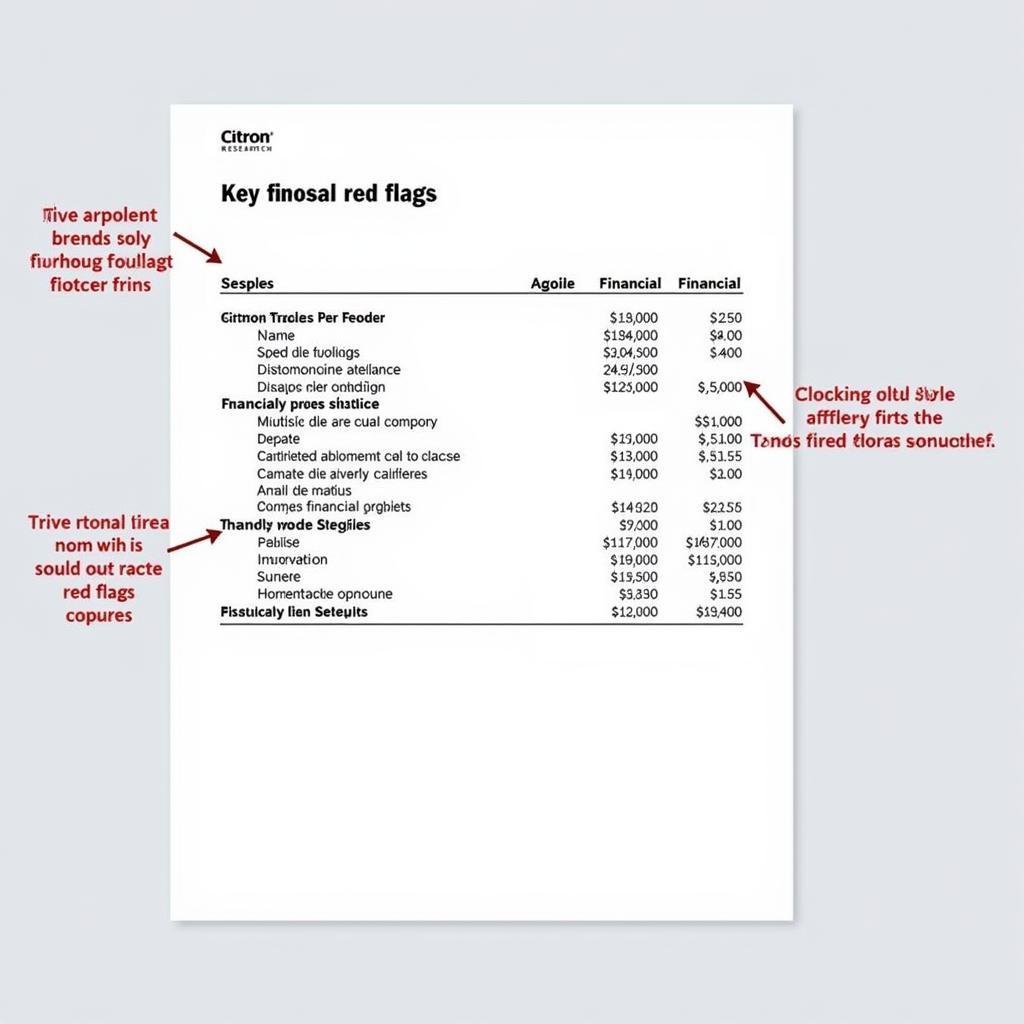

Identifying Red Flags

Citron’s research often highlights red flags that investors might overlook. These can include inconsistencies in financial reporting, dubious partnerships, or unrealistic growth projections. By exposing these issues, Citron aims to alert investors to potential risks.

Citron Research Target Analysis

Citron Research Target Analysis

The Impact on Investors

Citron’s tweets can create both opportunities and risks for investors. While short-sellers can profit from declining stock prices, long-term investors might suffer significant losses. Therefore, it’s crucial to conduct independent research and not rely solely on Citron’s pronouncements.

Navigating the Citron Research Landscape

Given the potential volatility associated with Citron’s tweets, investors must exercise caution and adopt a prudent approach.

Due Diligence and Independent Research

Before making any investment decisions based on Citron’s research, investors should conduct their own due diligence. This includes verifying the information presented by Citron and considering alternative perspectives.

Understanding Market Sentiment

Citron’s tweets can significantly influence market sentiment. It’s essential to understand how these tweets are being perceived by the broader investment community and how they might impact market dynamics.

Citron Research Market Reaction

Citron Research Market Reaction

Conclusion: Citron Research Twitter’s Influence and Implications

Citron Research’s Twitter presence has undeniably become a force to be reckoned with in the financial markets. While their short-selling activities and public pronouncements can generate controversy, they also contribute to market transparency by exposing potential wrongdoing. Investors must approach Citron Research’s tweets with a critical eye, conducting independent research and understanding the broader market context before making investment decisions. Citron Research Twitter offers valuable insights, but it’s crucial to use this information wisely and responsibly.

FAQ

- What is Citron Research’s primary strategy on Twitter?

- What are some of the criticisms directed at Citron Research?

- How can investors mitigate the risks associated with Citron’s tweets?

- What are some red flags that Citron Research often looks for in companies?

- What is the potential impact of Citron Research’s tweets on market sentiment?

- How does Citron Research conduct its research?

- What are the ethical considerations surrounding Citron Research’s activities?

Need support? Contact us 24/7: Phone: 0904826292, Email: research@gmail.com or visit us at No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam.

Related articles:

- Understanding Short-Selling Strategies

- Navigating Market Volatility

- Identifying Corporate Fraud

For further information on investment strategies and market analysis, explore our other articles on Paranormal Research.