Equity research plays a crucial role in investment decision-making. Understanding Best Practices For Equity Research is essential for anyone involved in the financial markets, whether you’re a seasoned professional or just starting out. This article explores these practices to equip you with the knowledge to conduct thorough and effective equity research.

Investing wisely requires diligent research, and understanding the best practices for equity research can significantly improve your investment outcomes. Let’s dive into the core principles that drive effective equity research. One key aspect is understanding the mifid ii research unbundling rules, which has reshaped the research landscape.

Understanding the Basics of Equity Research

Equity research involves analyzing publicly traded companies to determine their value and investment potential. This includes evaluating financial statements, industry trends, competitive landscape, and management quality. Solid equity research provides a foundation for informed investment decisions. A strong understanding of financial modeling and valuation techniques is crucial.

Key Components of Equity Research

- Financial Statement Analysis: Scrutinizing a company’s balance sheet, income statement, and cash flow statement to assess its financial health and performance.

- Industry Analysis: Examining the industry dynamics, growth prospects, and competitive forces that impact a company’s future.

- Competitive Analysis: Identifying and evaluating a company’s competitors to understand its market position and competitive advantages.

- Management Evaluation: Assessing the quality and experience of the management team to gauge their ability to execute the company’s strategy.

Developing an Effective Research Process

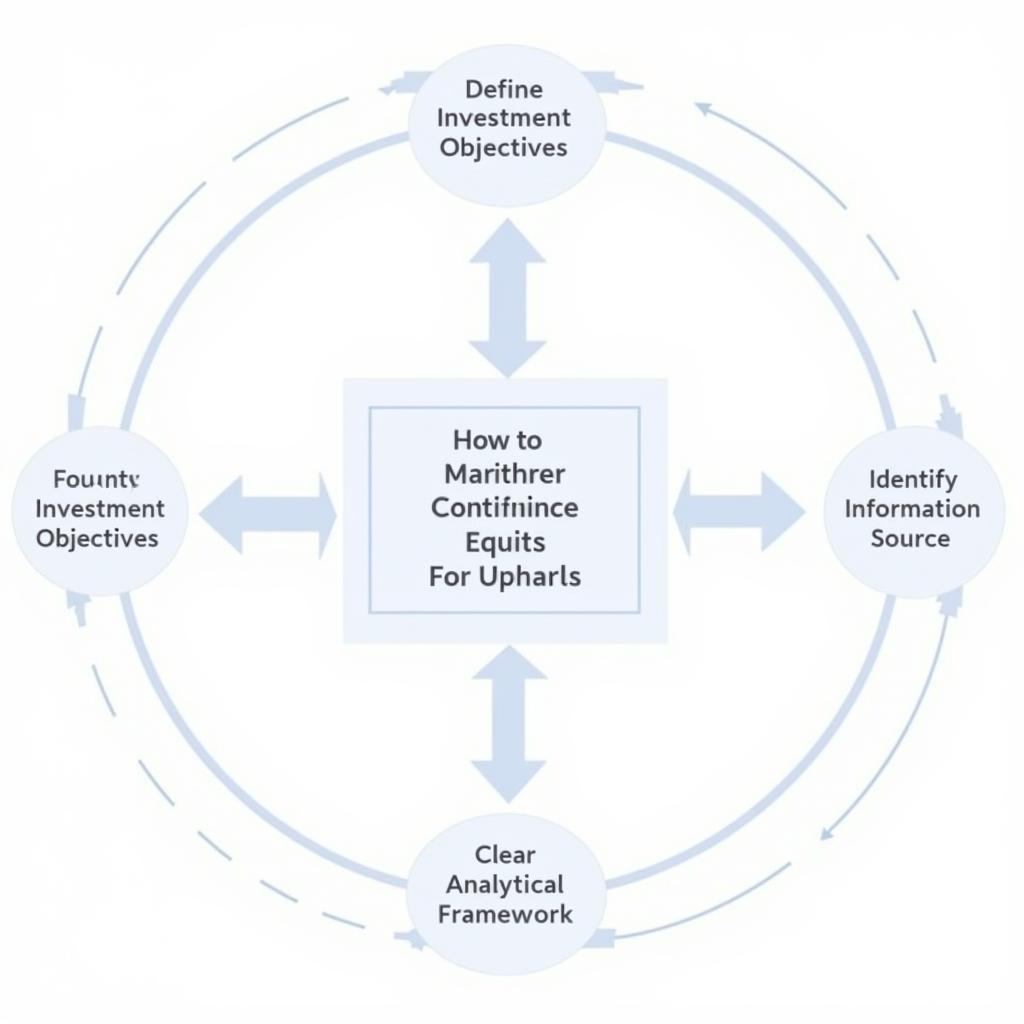

Developing a structured research process is critical for consistent and reliable results. This includes defining your investment objectives, identifying relevant information sources, and establishing a clear analytical framework.

Building a Robust Analytical Framework

A well-defined analytical framework guides your research and helps ensure you cover all critical aspects. This framework should incorporate both qualitative and quantitative factors. Consider incorporating elements like SWOT analysis and Porter’s Five Forces.

- Define Your Investment Objectives: Clearly articulate your investment goals and risk tolerance.

- Identify Information Sources: Utilize reliable sources such as company filings, industry reports, and reputable financial news outlets.

- Establish a Clear Analytical Framework: Develop a systematic approach to analyzing companies and industries.

Building a Robust Analytical Framework for Equity Research

Building a Robust Analytical Framework for Equity Research

Understanding the broader context of organizational research, as explored by resources like the Center for Organizational Research and Education, can also be beneficial.

Best Practices for Equity Research: Advanced Techniques

Beyond the basics, several advanced techniques can enhance your equity research. These include incorporating macroeconomic factors, understanding valuation models, and managing risk. Staying updated on industry trends is essential. Consider the implications of DEI research on company culture and performance.

Utilizing Valuation Models and Managing Risk

Valuation models, such as discounted cash flow analysis and relative valuation, provide a framework for estimating a company’s intrinsic value. Risk management involves identifying and mitigating potential investment risks. A thorough understanding of both is crucial.

- Incorporate Macroeconomic Factors: Consider the impact of macroeconomic trends on industry and company performance.

- Understand Valuation Models: Familiarize yourself with various valuation models and their applications.

- Manage Risk: Develop a risk management strategy to protect your investments.

If you’re seeking opportunities in this field, resources like equity research jobs remote can be invaluable. Additionally, understanding the Justice Research and Statistics Association can provide valuable insights.

Conclusion

By adhering to best practices for equity research, investors can make more informed decisions and improve their investment outcomes. Continuous learning and adaptation are crucial in the ever-evolving world of finance. Applying these best practices will enhance your ability to conduct effective equity research.

FAQ

- What is the purpose of equity research?

- What are the key components of equity research?

- How can I develop an effective research process?

- What are some advanced techniques for equity research?

- Why is risk management important in equity research?

- What are some reliable sources of information for equity research?

- How can I stay updated on industry trends?

Need support? Contact us 24/7: Phone: 0904826292, Email: research@gmail.com or visit us at No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam.