Alternative Investments Research is crucial for navigating the complex and often opaque world of non-traditional assets. These investments, ranging from private equity and hedge funds to real estate and commodities, require in-depth analysis due to their unique characteristics and illiquid nature. Understanding the nuances of these investments is paramount for informed decision-making.  Overview of Alternative Investments Research

Overview of Alternative Investments Research

Delving into Due Diligence: A Core Tenet of Alternative Investments Research

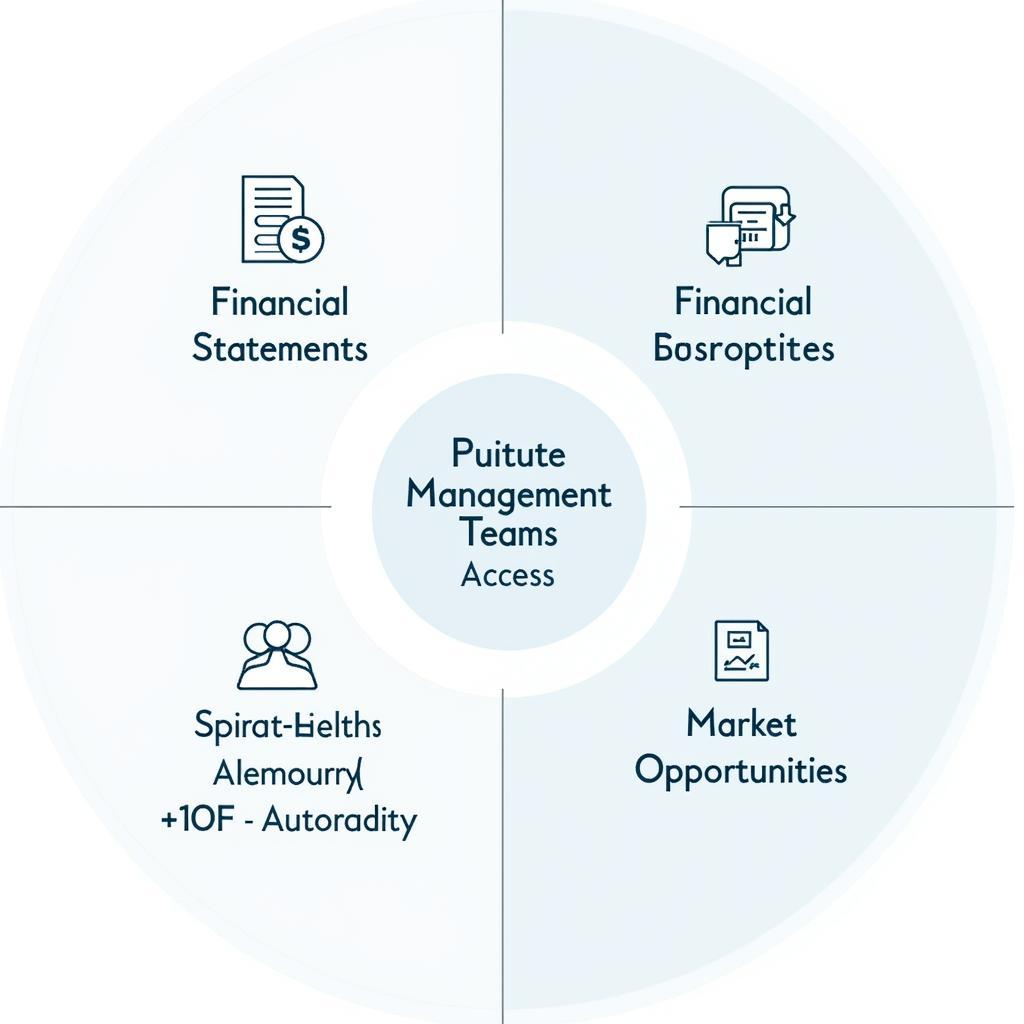

Due diligence forms the bedrock of successful alternative investments research. It involves a rigorous examination of the investment’s underlying assets, strategy, management team, and risk profile. This process helps investors identify potential red flags and make well-informed decisions. creative investment research explores the innovative approaches to researching these unique investments.

Key Aspects of Due Diligence in Alternative Investments

- Operational Due Diligence: This focuses on the investment manager’s operations, including compliance, risk management, and internal controls.

- Investment Due Diligence: This analyzes the investment strategy, portfolio construction, and historical performance.

- Legal Due Diligence: This involves reviewing legal documents, ensuring regulatory compliance, and assessing potential legal risks.

Unlocking the Potential of Private Equity Research

Private equity research demands a different approach compared to publicly traded securities.  Deep Dive into Private Equity Research Given the lack of readily available information, analysts must rely on private sources, industry contacts, and proprietary databases. Understanding the intricacies of deal structuring, valuation methodologies, and exit strategies is essential. trd research fortress investment group can provide valuable insights into the world of private equity.

Deep Dive into Private Equity Research Given the lack of readily available information, analysts must rely on private sources, industry contacts, and proprietary databases. Understanding the intricacies of deal structuring, valuation methodologies, and exit strategies is essential. trd research fortress investment group can provide valuable insights into the world of private equity.

Navigating the Hedge Fund Landscape: Hedge Fund Research

Hedge fund research presents a unique set of challenges. These funds often employ complex strategies and operate with limited transparency. Investors must carefully evaluate the fund manager’s track record, investment philosophy, and risk management practices. biotechnology equity research jobs provides a glimpse into the specialized research roles within the alternative investments sphere.

Real Estate Research: Beyond Bricks and Mortar

Real estate research goes beyond analyzing property values. Factors such as location, market trends, regulatory environment, and economic conditions play a crucial role. palm beach research group reviews offers an interesting perspective on real estate research.

Understanding Real Estate Investment Trusts (REITs)

REITs offer a liquid way to invest in real estate. Researching REITs involves analyzing their portfolio holdings, management team, and financial performance.

Commodity Research: Riding the Market Waves

Commodity research focuses on understanding supply and demand dynamics, geopolitical factors, and technological advancements. Investors must also consider the impact of weather patterns and environmental regulations. income research management discusses the importance of research in managing income generated from investments.

Conclusion: Mastering Alternative Investments Research for Optimal Returns

Alternative investments research is a critical component of portfolio diversification and achieving optimal risk-adjusted returns. By understanding the unique characteristics and research methodologies associated with each asset class, investors can navigate this complex landscape and unlock the potential of alternative investments.

FAQ

- What are the main categories of alternative investments?

- Why is due diligence so important in alternative investments research?

- What are the key challenges in hedge fund research?

- How does real estate research differ from traditional equity research?

- What factors influence commodity prices?

- What are some resources for conducting alternative investments research?

- How can I incorporate alternative investments into my portfolio?

Need assistance with your research? Contact us! Phone: 0904826292, Email: research@gmail.com or visit us at No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam. Our customer service team is available 24/7.