Commodity Research Bureau (CRB) charts are essential tools for traders and analysts to understand price movements in the commodities market. These charts track a basket of commodities, providing insights into overall market trends, volatility, and potential trading opportunities. Whether you’re an experienced trader or just starting, understanding CRB charts can equip you with valuable information to navigate the complex world of commodities trading.

What are Commodity Research Bureau Charts?

CRB charts visually represent the price performance of a diversified group of commodities over time. The CRB Index, the most well-known index tracked by these charts, covers a range of commodities, including:

- Energy (Crude oil, natural gas, heating oil)

- Agriculture (Corn, soybeans, wheat, sugar, coffee, cocoa)

- Metals (Gold, silver, copper)

- Livestock (Cattle, hogs)

The index assigns different weights to each commodity based on its economic significance, with energy typically holding the highest percentage. This weighting system allows the CRB Index to reflect the overall health of the commodities market and the global economy.

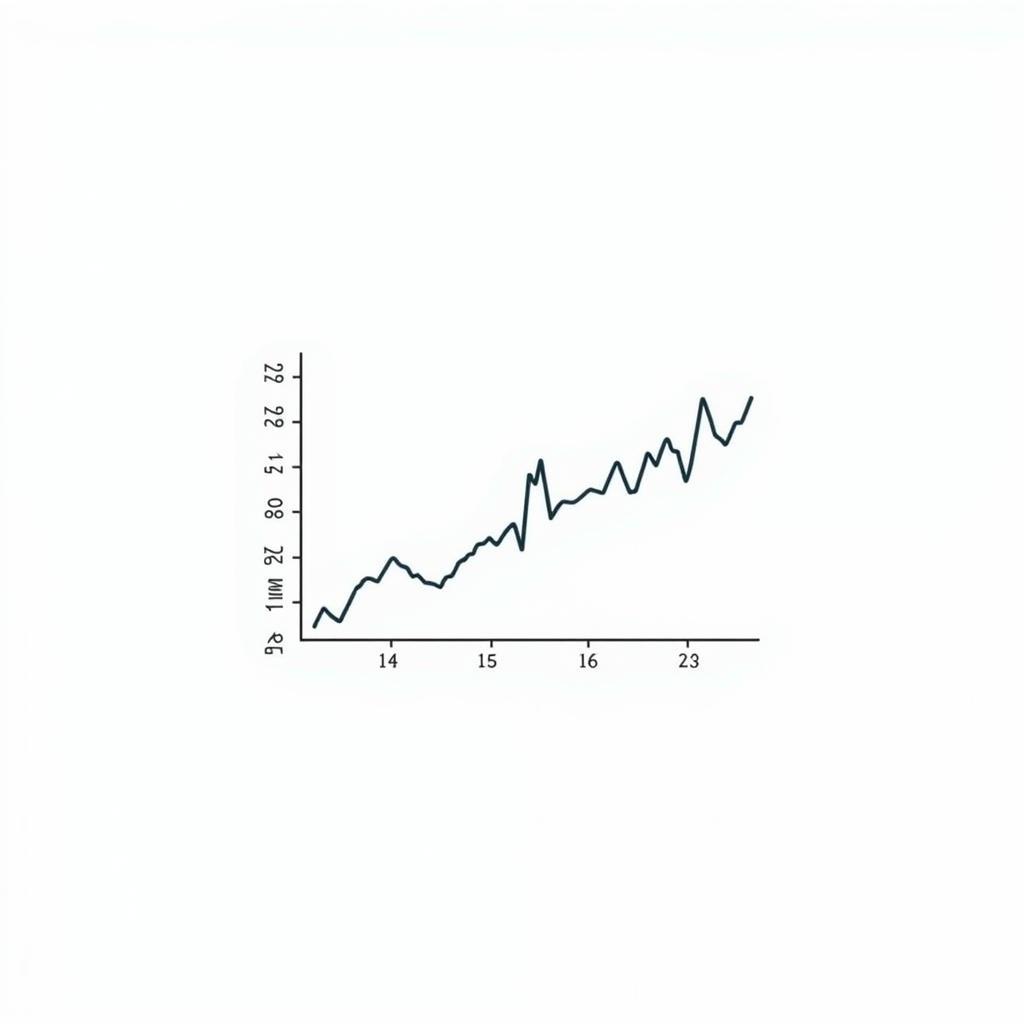

Example of a CRB Chart

Example of a CRB Chart

Why are CRB Charts Important?

CRB charts provide valuable insights for several reasons:

- Market Trend Identification: By tracking a basket of commodities, CRB charts can identify broad market trends, such as periods of inflation or deflation.

- Volatility Assessment: The charts can show the historical volatility of the commodities market, helping traders understand the potential risks and rewards.

- Diversification Opportunities: The diversity of commodities represented in CRB charts can highlight potential diversification opportunities for investors seeking to spread their risk.

- Economic Indicator: The CRB Index is often considered a leading indicator of inflation as commodity prices tend to react quickly to changes in economic conditions.

How to Read and Interpret CRB Charts

Understanding the basic elements of a CRB chart is essential for effective analysis:

- Timeframe: CRB charts can be viewed in various timeframes, from daily to yearly, allowing traders to analyze price movements over different periods.

- Price Scale: The vertical axis represents the price of the CRB Index or a specific commodity.

- Trendlines: Traders often draw trendlines on CRB charts to identify support and resistance levels, which can indicate potential buying or selling opportunities.

- Technical Indicators: Technical indicators, such as moving averages and oscillators, can be applied to CRB charts to confirm trends and generate trading signals.

Analyzing CRB Charts with Trendlines

Analyzing CRB Charts with Trendlines

Factors Influencing CRB Chart Movements

Numerous factors can influence price movements reflected in CRB charts, including:

- Global Supply and Demand: Changes in the supply and demand for specific commodities can significantly impact their prices and the overall CRB Index.

- Economic Growth: A strong global economy typically leads to higher demand for commodities, pushing prices upward.

- Geopolitical Events: Events like wars, natural disasters, or political instability can disrupt supply chains and influence commodity prices.

- Currency Fluctuations: The value of the US dollar, the currency in which most commodities are traded, can impact commodity prices. A weaker dollar can lead to higher commodity prices.

Limitations of CRB Charts

While valuable, CRB charts have limitations:

- Limited Scope: They only represent a selection of commodities and might not accurately reflect the performance of the entire market.

- Lagging Indicator: CRB charts are generally considered lagging indicators, meaning they reflect past price movements rather than predicting future ones.

Conclusion

Commodity Research Bureau Charts are powerful tools for understanding the dynamics of the commodities market. By tracking a diverse basket of commodities, these charts provide insights into market trends, volatility, and potential trading opportunities. While limitations exist, CRB charts remain an essential resource for traders and analysts seeking to navigate the ever-changing world of commodities.

Disclaimer: This information is for educational purposes only and should not be considered investment advice.