Tax Research. These two words can evoke a sense of dread in many, but for those delving into the financial and legal realms, they represent a critical process. Tax research is the systematic investigation of tax laws and regulations to answer specific questions or solve complex tax problems. Whether you’re an individual taxpayer, a business owner, or a seasoned tax professional, understanding the nuances of tax research is essential for navigating the ever-changing landscape of tax law.

What is Tax Research and Why is it Important?

Tax research involves examining various sources, including statutes, regulations, court cases, and administrative rulings, to determine the correct application of tax law to a particular situation. It’s more than just looking up a tax rate; it’s about understanding the context, the interpretations, and the potential implications of different tax strategies. Why is it so crucial? Effective tax research can help minimize tax liabilities, ensure compliance with tax laws, and support informed decision-making. For businesses, sound tax research can be the difference between profitability and financial strain. ibfd tax research provides global tax information.

Different Types of Tax Research

There are two primary types of tax research: substantive and procedural. Substantive research focuses on the actual tax laws and their interpretations, while procedural research deals with the processes and procedures involved in administering and enforcing tax laws. Both are critical for a comprehensive understanding of the tax system.

Essential tools and resources for tax research

Essential tools and resources for tax research

How to Conduct Effective Tax Research

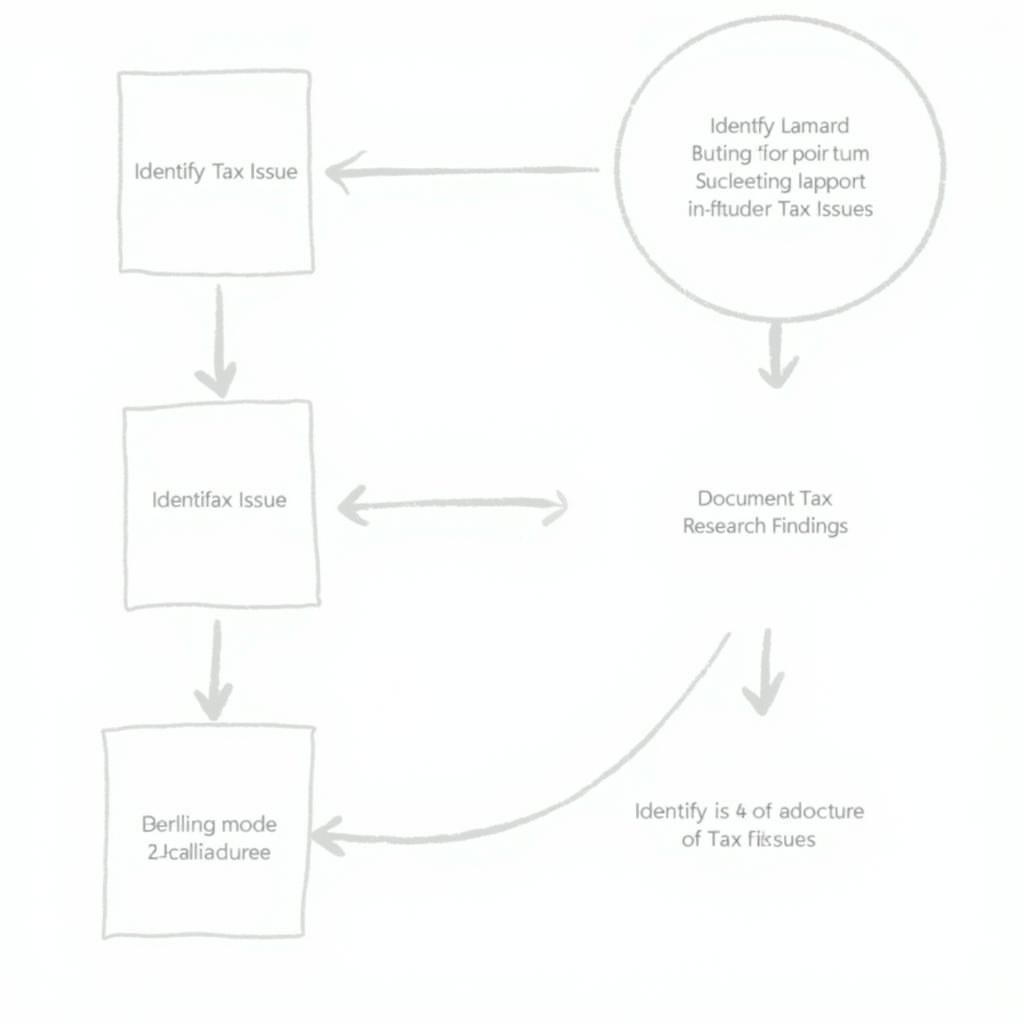

The key to effective tax research lies in a systematic approach. First, identify the specific tax issue or question. Then, gather relevant information from reliable sources, such as tax codes, regulations, and court cases. Analyze the information and develop a well-reasoned conclusion. Finally, document your research findings thoroughly, citing all sources used. federal tax research is a valuable resource.

Key Resources for Tax Research

- Tax Codes: These are the foundation of tax law, containing the specific rules and regulations governing taxation.

- Regulations: These provide further explanations and interpretations of the tax codes.

- Court Cases: Judicial decisions provide valuable insights into how tax laws are applied in real-world scenarios.

- Administrative Rulings: These are issued by tax authorities and offer guidance on specific tax issues.

- Tax Research Software: Software programs like cch tax research can streamline the research process by providing access to a vast database of tax information.

“Accurate tax research is paramount. It’s not just about finding answers; it’s about understanding the rationale behind those answers,” says renowned tax expert, Dr. Amelia Peterson, CPA.

Best practices for efficient tax research

Best practices for efficient tax research

Tax Research: Navigating the Complexities

Tax research can be complex and time-consuming, but it’s an indispensable tool for anyone dealing with tax matters. federal tax research 12th edition offers comprehensive guidance. By understanding the fundamentals of tax research and utilizing available resources, you can navigate the complexities of the tax system and make informed decisions that benefit your financial well-being. “Think of tax research as a detective investigation – you need to gather all the clues to solve the mystery,” adds Dr. Peterson.

In conclusion, tax research is an essential process for understanding and applying tax laws. Whether you’re dealing with personal or business taxes, thorough research can help minimize liabilities, ensure compliance, and support sound financial planning. federal tax research 12th edition pdf is also a useful tool. By embracing a systematic approach and utilizing available resources, you can navigate the intricacies of tax research and gain valuable insights into the world of taxation.

FAQ

- What is the purpose of tax research?

- What are the main sources of tax information?

- How can tax research software help with tax planning?

- What are the key steps involved in conducting effective tax research?

- What is the difference between substantive and procedural tax research?

- Why is it important to document tax research findings?

- Where can I find reliable resources for tax research?

Need further assistance with tax research? Contact us at Phone: 0904826292, Email: research@gmail.com Or visit us at: No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam. We have a 24/7 customer service team.