Equity research firms play a critical role in the financial world. They provide in-depth analysis and recommendations on publicly traded companies, helping investors make informed decisions. This article will explore the world of equity research, providing a comprehensive List Of Equity Research Firms and delving into what they do, how they operate, and the different types of research they produce.

Understanding Equity Research and Its Importance

Equity research analysts meticulously examine companies, their financials, and the industries they operate in. They then use this information to develop investment recommendations: buy, sell, or hold. This information is crucial for institutional investors, portfolio managers, and individual investors looking to navigate the complexities of the stock market. Equity research firms range from large, global investment banks to smaller, specialized boutiques. Each firm has its own approach and areas of expertise. Understanding these differences is key to selecting the right research for your investment needs. Want to know more about research analyst salaries? Check out this resource: research analyst salary.

Types of Equity Research Firms and Their Focus

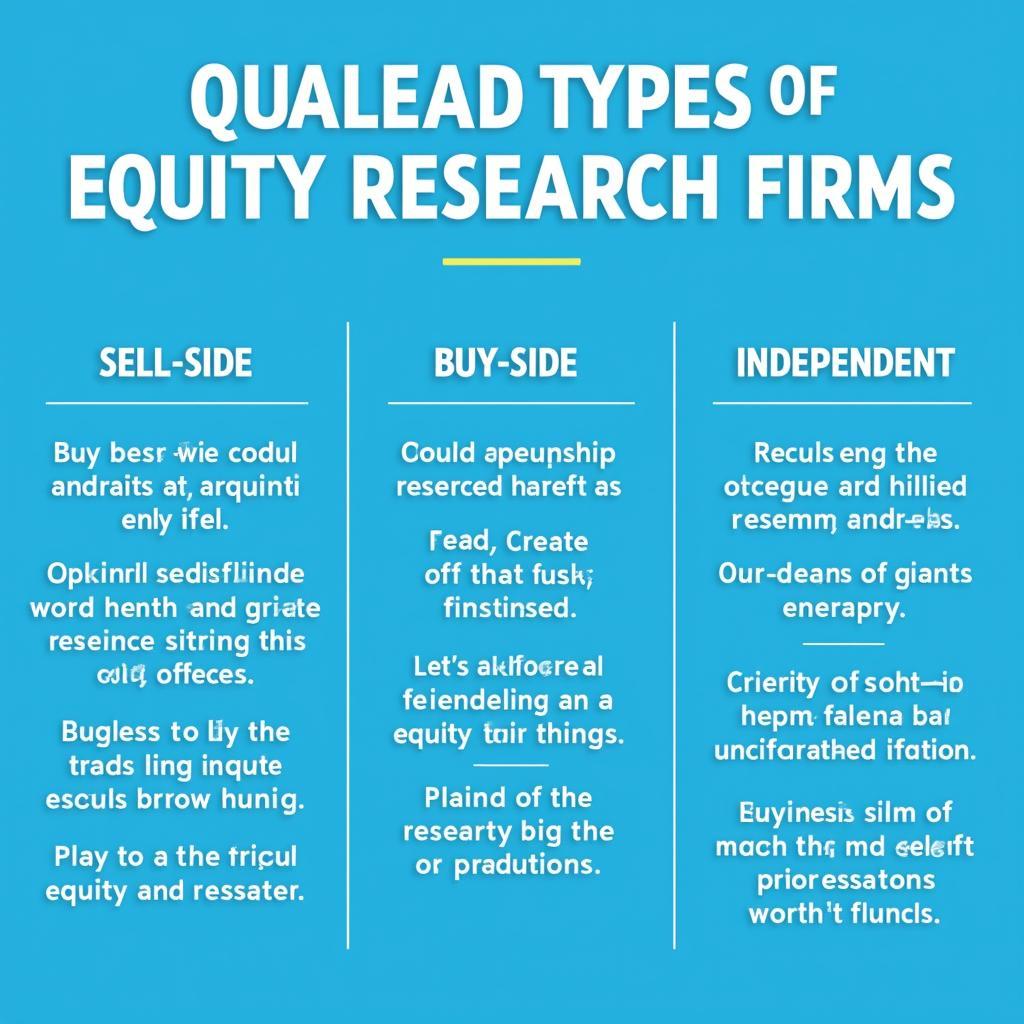

There are several types of equity research firms, each with a unique focus and methodology. Sell-side firms, typically housed within investment banks, produce research primarily for their clients, including institutional investors and high-net-worth individuals. Their recommendations often tie in with the bank’s underwriting and trading activities. Buy-side firms, like mutual funds and hedge funds, conduct research for internal use to guide their own investment decisions. Independent research firms offer unbiased research sold directly to subscribers, catering to a broader range of investors. Some firms specialize in particular sectors or industries, providing highly focused analysis. Knowing the type of firm and their focus is essential to understanding the potential biases and objectives behind their research.

Types of Equity Research Firms

Types of Equity Research Firms

Key Factors in Choosing an Equity Research Firm

Selecting the right equity research firm requires careful consideration of various factors. Reputation and track record are paramount. Look for firms with a history of accurate and insightful analysis. The expertise and experience of the analysts covering specific sectors are also crucial. A firm specializing in technology might not be the best choice for healthcare research, for example. Cost and accessibility of the research are practical considerations. Some firms offer subscription services, while others bundle research with other brokerage services. Finally, consider the firm’s investment philosophy and whether it aligns with your own. Do they favor growth stocks or value investing? Understanding these factors will help you choose a firm that meets your specific investment needs. For more insight on example reports, see: equity research report example.

What Does an Equity Research Report Contain?

Equity research reports typically include detailed financial analysis, industry overviews, company profiles, and valuation models. They often contain earnings forecasts, target prices, and investment recommendations. Some reports also provide qualitative assessments of management teams, competitive landscapes, and industry trends. Understanding how to interpret these reports is critical for making informed investment decisions.

Components of an Equity Research Report

Components of an Equity Research Report

What if you’re interested in a career in quantitative research? This article on Two Sigma salaries might be helpful: two sigma quantitative researcher salary.

Navigating the World of Equity Research: Tips and Strategies

Navigating the vast landscape of equity research can be daunting. One key strategy is to diversify your sources, using research from multiple firms to get a well-rounded perspective. Critically evaluate the research, considering the firm’s potential biases and track record. Don’t solely rely on research recommendations; conduct your own due diligence and analysis. Staying updated on market trends and news is essential for contextualizing the research.

Conclusion

Finding the right list of equity research firms is crucial for successful investing. By understanding the different types of firms, their methodologies, and how to evaluate their research, you can make more informed investment decisions. Remember to do your own research and consider your own investment goals when making decisions. Explore the world of equity research and equip yourself with the knowledge to navigate the complexities of the stock market. For those interested in market research jobs in Chicago, check out this link: market research jobs chicago.

Are you interested in the healthcare sector? Consider exploring healthcare market research companies: healthcare market research company in us.

Need assistance? Contact us at Phone: 0904826292, Email: research@gmail.com or visit us at No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam. We have a 24/7 customer support team.