Sell Side Equity Research plays a crucial role in the financial markets, providing valuable insights and analysis to investors. It helps inform investment decisions, shaping market sentiment and influencing stock valuations. This article will delve into the intricacies of sell side equity research, exploring its purpose, process, and impact on the financial landscape.  Overview of Sell Side Equity Research

Overview of Sell Side Equity Research

Understanding the Purpose of Sell Side Equity Research

What is the primary goal of sell-side equity research? Simply put, it’s to provide in-depth analysis of publicly traded companies, offering recommendations to investors on whether to buy, hold, or sell specific stocks. These recommendations are based on extensive research, financial modeling, and industry expertise. This research is then distributed to clients of the brokerage firm, assisting them in making informed investment choices.

One key aspect of sell side equity research is its focus on generating trading activity. By providing compelling investment ideas, analysts aim to stimulate buying and selling of securities, which ultimately benefits the brokerage firm through commissions and trading fees.

After conducting thorough due diligence, including financial statement analysis, industry research, and management interviews, analysts formulate their investment thesis and assign target prices for the stocks they cover. These reports often contain detailed financial models, industry forecasts, and valuation analysis.

The Sell Side Equity Research Process: A Deep Dive

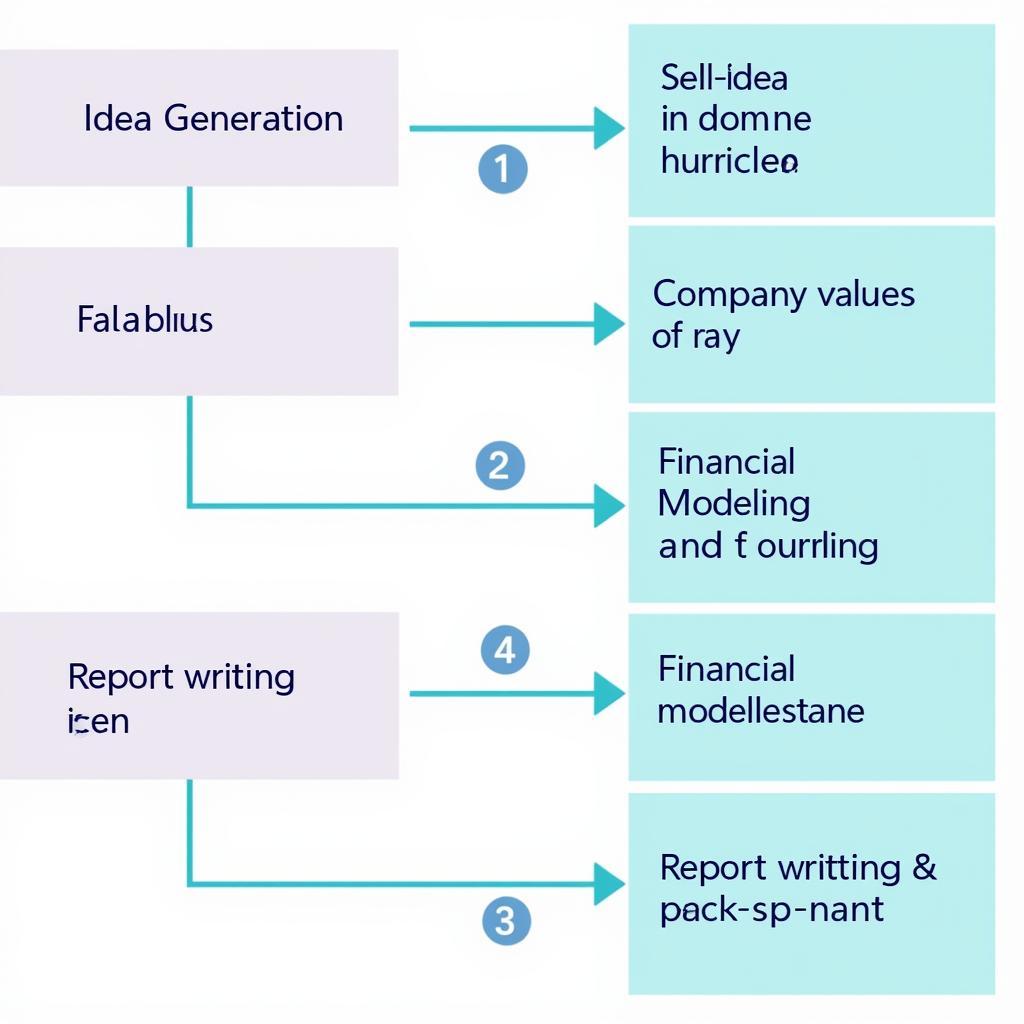

The sell side equity research process is a multi-faceted undertaking involving several key stages. First, analysts identify promising investment opportunities within their coverage universe. They then delve into detailed company analysis, evaluating financial performance, competitive positioning, and industry dynamics.  Steps in Equity Research Process

Steps in Equity Research Process

Key Steps in the Process

- Idea Generation: Identifying potential investment opportunities based on market trends, industry analysis, and company-specific factors.

- Financial Modeling: Building detailed financial models to project future earnings, cash flows, and other key financial metrics.

- Valuation: Determining the intrinsic value of a company’s stock using various valuation techniques, such as discounted cash flow analysis and relative valuation.

- Report Writing: Preparing comprehensive research reports that summarize the analyst’s findings, investment thesis, and recommendations.

Another essential part of the process involves frequent communication with company management, industry experts, and other stakeholders to gather insights and validate assumptions. This continuous dialogue ensures that the analyst’s understanding of the company and its prospects remains up-to-date.

research and development accounting can be a complex area for equity research analysts to analyze, requiring careful consideration of accounting treatment and its impact on future earnings. Similarly, understanding the research reports published by prominent firms like goldman equity research can provide valuable context and insights.

The Impact of Sell Side Equity Research on the Market

Sell side equity research plays a significant role in shaping market sentiment and influencing stock prices. Analysts’ recommendations can trigger buying or selling pressure, impacting trading volumes and market valuations.  Market Impact of Equity Research

Market Impact of Equity Research

Furthermore, sell-side research contributes to price discovery, helping the market to efficiently allocate capital to the most promising investment opportunities. By providing independent analysis and valuation assessments, analysts help investors to identify undervalued or overvalued stocks, promoting a more balanced and efficient market.

Specialized firms like kbw research focus on specific sectors, offering in-depth expertise and insights. Investors interested in accessing comprehensive research reports can often find them in PDF format, like those available on equity research report pdf. The janus henderson research fund class t provides another avenue for investors to access professionally managed portfolios based on in-depth research.

Conclusion

Sell side equity research is a vital component of the financial ecosystem. It empowers investors with valuable information, promotes efficient capital allocation, and influences market dynamics. By understanding the purpose, process, and impact of sell side equity research, investors can navigate the complexities of the financial markets and make more informed investment decisions.

FAQ

- What is the difference between sell-side and buy-side research?

- How do analysts determine target prices for stocks?

- What are the key skills required for a career in sell-side equity research?

- How has technology impacted the sell-side research industry?

- What are the ethical considerations in sell-side research?

- What is the role of regulatory bodies in overseeing sell-side research?

- How can investors effectively use sell-side research in their investment decisions?

For further support, contact us at Phone: 0904826292, Email: research@gmail.com or visit our office at No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam. We have a 24/7 customer support team.