Federal Tax Research 12th Edition is a crucial resource for anyone navigating the complex landscape of US tax law. Whether you’re a student, a tax professional, or simply trying to understand your own tax obligations, this edition provides valuable insights and updated information to help you make informed decisions. This article will delve into the key aspects of effectively utilizing this resource.

Understanding the Importance of Federal Tax Research

Staying abreast of the ever-changing tax code is essential for both individuals and businesses. Federal tax research 12th edition provides a framework for understanding and applying these complex regulations. It offers practical guidance on conducting effective research and interpreting tax laws, enabling you to minimize your tax liability and avoid potential penalties. Navigating the intricacies of tax law can be daunting, but resources like federal tax research can make the process more manageable.

Why the 12th Edition Matters

The 12th edition is vital due to its updated content reflecting recent legislative changes and court rulings. Tax laws are constantly evolving, and relying on outdated information can lead to costly mistakes. This edition ensures you have access to the most current information, allowing for accurate tax planning and compliance. For further research, consider exploring resources like cch tax research for a comprehensive understanding.

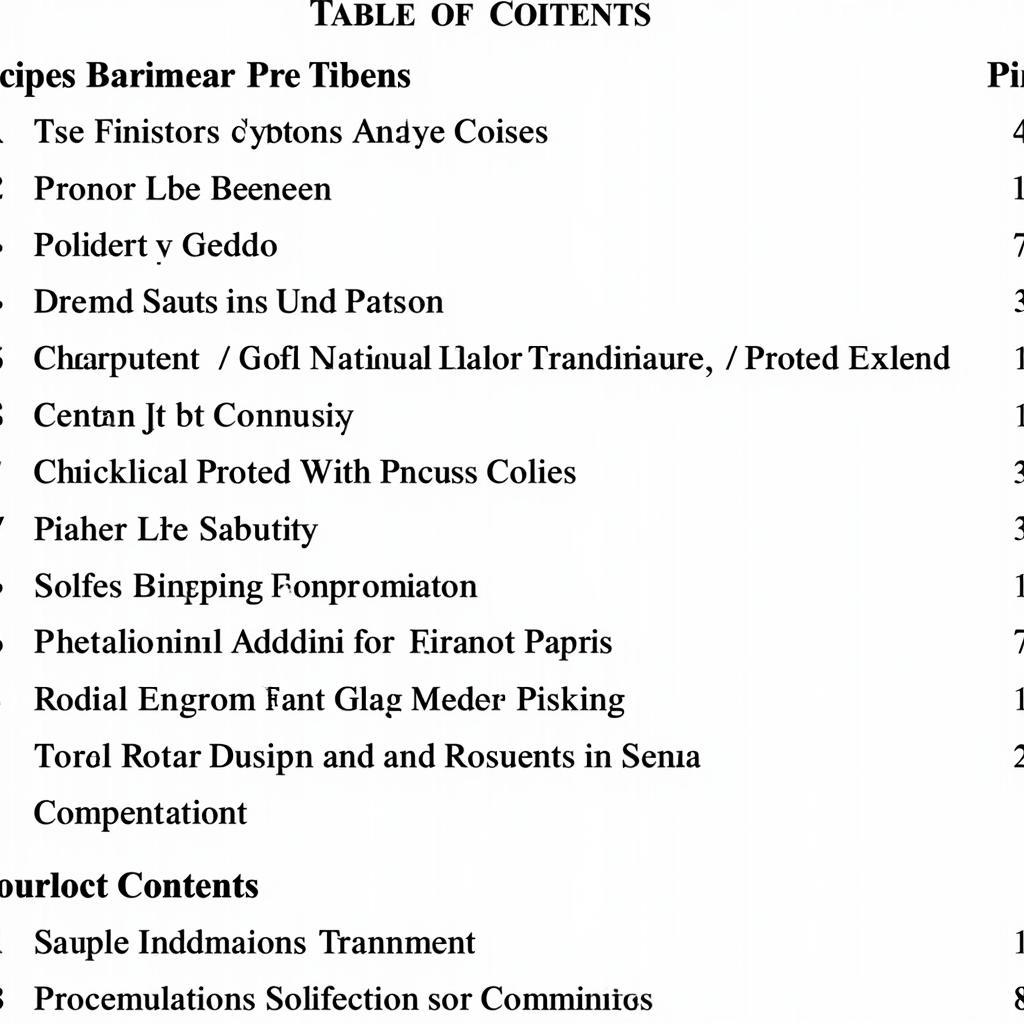

Table of Contents of Federal Tax Research 12th Edition

Table of Contents of Federal Tax Research 12th Edition

Key Features of Federal Tax Research 12th Edition

This edition includes several valuable features:

- Comprehensive Coverage: It covers a wide range of tax topics, from individual income tax to corporate tax and estate planning.

- Practical Examples: Real-world examples and case studies illustrate how tax laws apply in practice.

- Clear Explanations: Complex concepts are explained in a clear and concise manner, making the material accessible to a broader audience.

- Updated Information: The 12th edition incorporates the latest tax law changes, ensuring accuracy and relevance.

- Research Tools: It guides you on how to use various research tools, both online and offline, to find relevant tax information. If you’re interested in other research opportunities, check out sona research credits.

“Staying up-to-date with tax law is not just about compliance; it’s about empowering yourself to make informed financial decisions,” says Amelia Hernandez, a seasoned tax attorney.

Navigating the Text Effectively

To maximize your use of the 12th edition, consider these tips:

- Start with the index: Use the index to quickly locate specific topics or keywords.

- Review the table of contents: Familiarize yourself with the book’s structure and organization.

- Pay attention to examples and illustrations: These can help clarify complex concepts.

- Utilize the research tools: Learn how to use the resources mentioned in the book to conduct further research. For those considering academic paths in accounting, online accounting research programs may be of interest.

Conclusion

Federal tax research 12th edition is an indispensable resource for anyone seeking to understand and navigate the complexities of US tax law. By utilizing this valuable tool effectively, you can gain a comprehensive understanding of current tax regulations and make informed decisions to optimize your tax situation.

FAQ:

- What are the main changes in the 12th edition?

- How can I access the 12th edition?

- Is there a digital version available?

- Who should use this book?

- How often is the Federal Tax Research updated?

- What are some common tax research scenarios?

- Where can I find additional resources for tax research?

Need assistance with your tax research? Contact us 24/7 at Phone Number: 0904826292, Email: research@gmail.com, or visit our office at No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam. For those interested in obtaining a digital copy without cost, you may want to explore resources like federal tax research 12th edition pdf free.