Hedge Fund Research is a critical process for investors seeking to navigate the complex and often opaque world of hedge funds. These investment vehicles, known for their sophisticated strategies and potential for high returns, require a deep level of analysis to identify opportunities and manage risks effectively. This comprehensive guide delves into the intricacies of hedge fund research, providing valuable insights and actionable steps for investors looking to make informed decisions.

What is Hedge Fund Research?

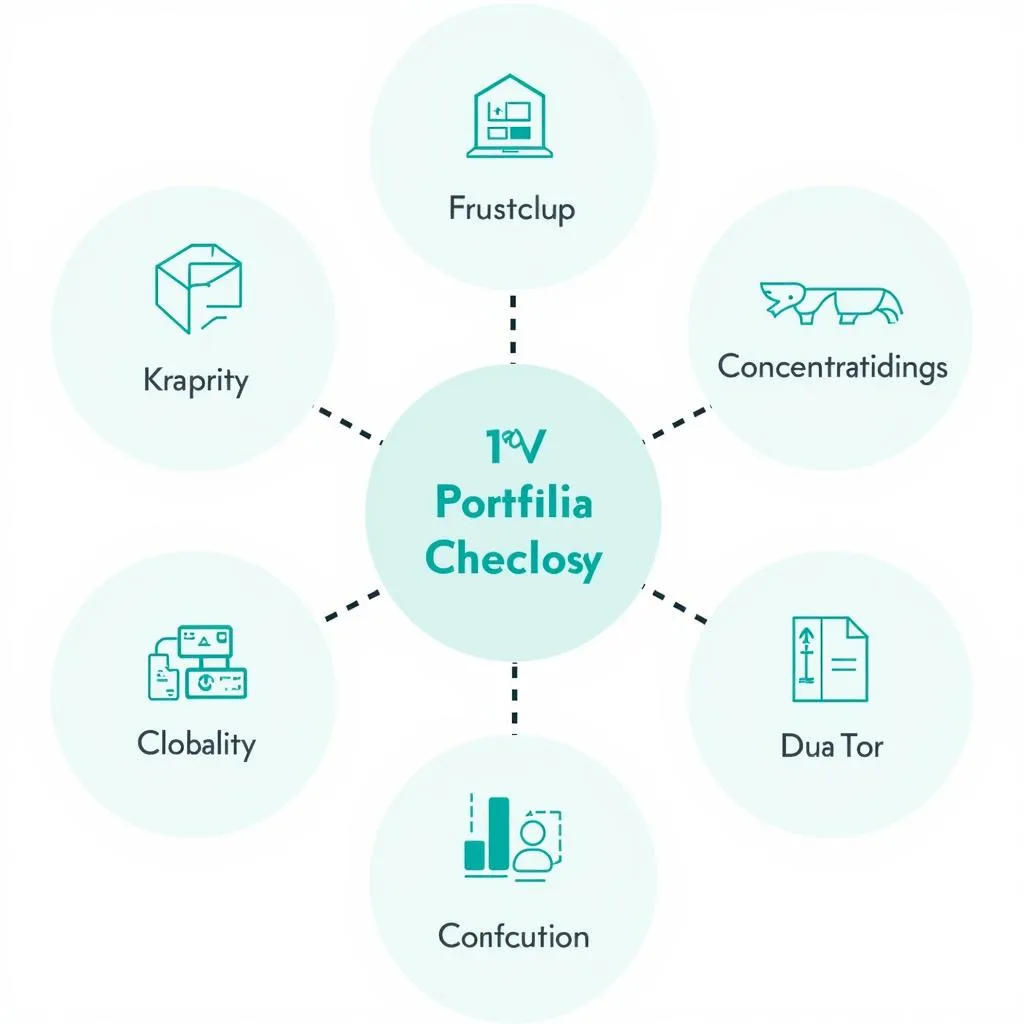

Hedge fund research encompasses a multifaceted approach to evaluating hedge funds, encompassing both quantitative and qualitative factors. It goes beyond simply analyzing historical performance data, digging deeper into the fund’s investment philosophy, portfolio construction, risk management practices, and the team behind it.

Key Aspects of Hedge Fund Research

Investment Strategy and Philosophy:

Understanding a hedge fund’s investment strategy is paramount. This involves examining the fund’s investment style (e.g., long/short equity, global macro, event-driven), target markets, and key investment themes. A clear articulation of the fund’s investment philosophy, outlining its core beliefs and approach to generating returns, is essential.

Portfolio Construction and Risk Management:

Analyzing a hedge fund’s portfolio construction provides insights into its investment process and risk tolerance. Factors to consider include:

- Diversification: Assessing the fund’s exposure across asset classes, geographies, and sectors.

- Concentration: Identifying any significant positions or biases that could impact performance.

- Leverage: Understanding the fund’s use of leverage and its potential impact on returns and volatility.

- Risk Management: Evaluating the fund’s risk management framework, including its approach to hedging, position limits, and stress testing.

Hedge Fund Portfolio Analysis

Hedge Fund Portfolio Analysis

Team and Track Record:

The experience, expertise, and integrity of the hedge fund’s management team are critical factors in its success. Investors should thoroughly research the team’s background, including:

- Track record: Examining the team’s historical performance at previous funds or investments.

- Experience: Assessing the team’s experience in relevant markets and strategies.

- Education and Expertise: Evaluating the team’s educational qualifications and industry certifications.

- Reputation and Integrity: Researching the team’s reputation within the industry and any past regulatory or legal issues.

Hedge Fund Manager Due Diligence

Hedge Fund Manager Due Diligence

Fees and Expenses:

Hedge funds typically charge a performance fee, often referred to as “2 and 20,” meaning a 2% management fee and 20% of any profits generated. Investors need to carefully analyze the fee structure to ensure it aligns with their investment goals and risk tolerance.

Due Diligence in Hedge Fund Research:

Conducting thorough due diligence is crucial when considering an investment in a hedge fund. This involves:

- Reviewing Fund Documents: Carefully examining the fund’s offering documents, including the private placement memorandum (PPM) and subscription agreement, to understand the fund’s terms, risks, and fees.

- Conducting Background Checks: Performing background checks on the fund’s managers, key personnel, and service providers to verify their credentials and identify potential red flags.

- Speaking with Current and Former Investors: Gathering insights from existing and previous investors about their experiences with the fund and its management team.

- Analyzing Fund Performance: Evaluating the fund’s historical performance, taking into consideration risk-adjusted returns, volatility, and drawdowns.

Importance of Independent Research:

Relying solely on information provided by the hedge fund itself can be risky. Investors should conduct their own independent research using reputable sources such as:

- Hedge fund databases: These databases provide access to comprehensive data on hedge funds, including performance, assets under management, and fee structures.

- Industry publications and research reports: Publications dedicated to the hedge fund industry offer valuable insights, analysis, and news.

- Consultants and advisors: Independent consultants and advisors can provide specialized expertise and due diligence services.

Hedge Fund Research Resources

Hedge Fund Research Resources

Conclusion:

Hedge fund research is a meticulous and ongoing process that demands a deep understanding of the industry, investment strategies, and due diligence practices. By adopting a comprehensive approach and leveraging the insights provided in this guide, investors can navigate the complexities of hedge fund research and make more informed decisions aligned with their investment objectives.

Remember, investing in hedge funds involves significant risks and requires careful consideration. Consult with a qualified financial advisor to determine if hedge funds are suitable for your specific investment needs.