A Securities Research Company plays a crucial role in the financial world, providing in-depth analysis and insights to help investors make informed decisions. Understanding the functions and benefits of these companies is essential for navigating the complexities of the market.  Securities research company analysts diligently working on market analysis and reports

Securities research company analysts diligently working on market analysis and reports

What Does a Securities Research Company Do?

Securities research companies employ teams of analysts who specialize in different sectors of the market. These analysts conduct extensive research, evaluating companies, industries, and economic trends to provide valuable insights to their clients. Their work often involves analyzing financial statements, conducting industry research, and meeting with company management. This rigorous process allows them to develop informed opinions on the potential performance of various securities, including stocks, bonds, and other investment instruments. The t. rowe price u.s. equity research fund is one example of how research helps inform investment strategies.

Key Functions of Securities Research

- Equity Research: Focusing on individual stocks, analysts evaluate company performance, industry trends, and competitive landscapes.

- Fixed Income Research: Analyzing bonds and other debt instruments to assess creditworthiness and interest rate risk.

- Macroeconomic Research: Examining broader economic factors, such as inflation, interest rates, and GDP growth, to understand their potential impact on financial markets.

- Quantitative Research: Using mathematical models and statistical analysis to identify investment opportunities and manage risk.

Why is Securities Research Important?

What are the benefits of using a securities research company? For individual investors, navigating the intricacies of the market can be overwhelming. A securities research company offers the expertise and resources necessary to make informed investment choices. Their analysis provides valuable context and helps investors understand the potential risks and rewards associated with specific investments. For institutional investors, access to high-quality research is crucial for developing effective investment strategies and managing large portfolios. It enables them to stay ahead of market trends, identify undervalued securities, and make timely investment decisions. janus henderson research fund d offers insightful research that can benefit both individuals and institutions.

Benefits of Utilizing Securities Research

- Informed Decision-Making: Providing in-depth analysis to support sound investment choices.

- Risk Management: Identifying potential risks associated with specific investments.

- Access to Expertise: Leveraging the knowledge and experience of seasoned analysts.

- Time Savings: Freeing up investors’ time to focus on other priorities.

“Thorough research is the cornerstone of successful investing,” says John Smith, CFA, Senior Analyst at Global Investment Strategies. “It empowers investors to make educated decisions and achieve their financial goals.” sec clinical research can also provide insights into the pharmaceutical and healthcare industries.

Choosing the Right Securities Research Company

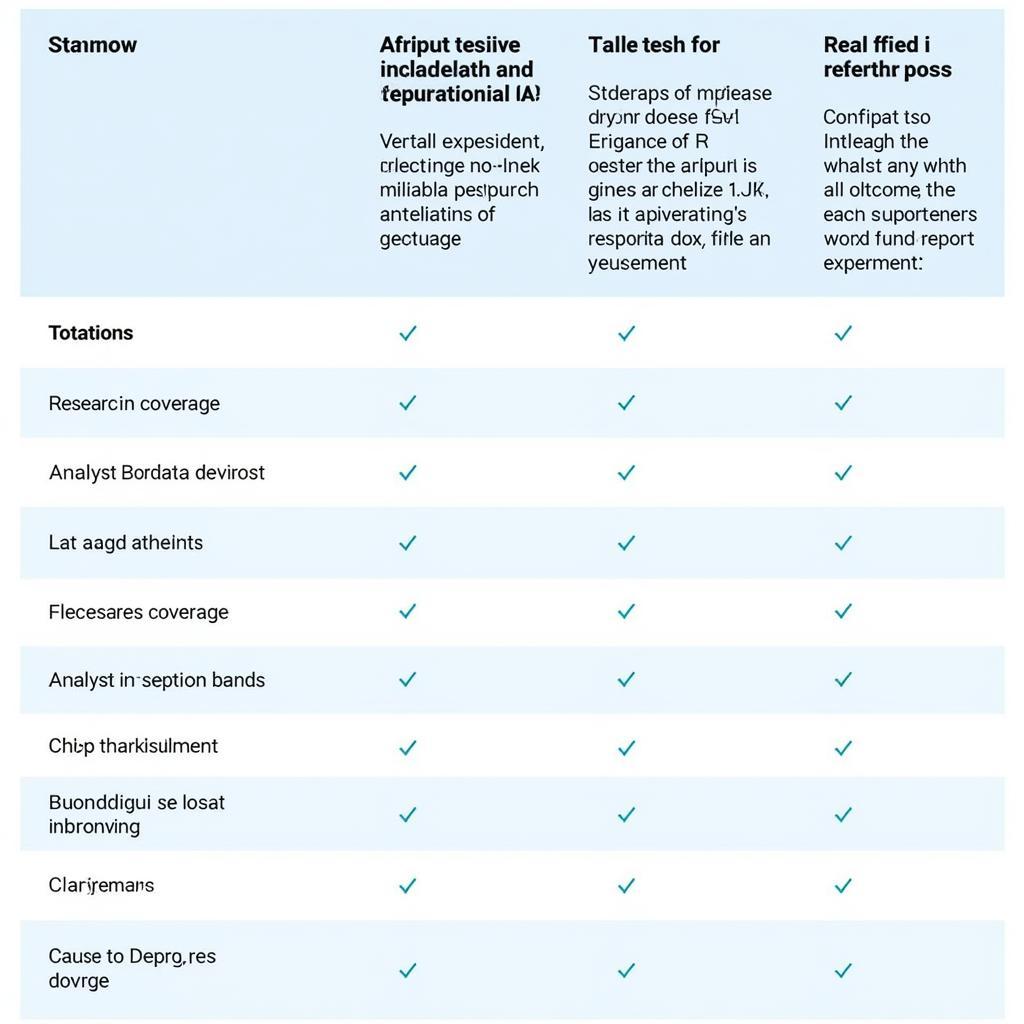

With a multitude of securities research companies available, selecting the right one requires careful consideration. Investors should evaluate factors such as the company’s reputation, the experience and expertise of its analysts, the depth and breadth of its research coverage, and the quality of its client service.  A table comparing different securities research companies based on key criteria.

A table comparing different securities research companies based on key criteria.

Key Considerations When Choosing a Firm

- Reputation and Track Record: Looking for a company with a proven history of providing accurate and reliable research.

- Analyst Expertise: Ensuring the company’s analysts have deep knowledge and experience in the relevant sectors.

- Research Coverage: Confirming the company covers the specific markets and asset classes that align with the investor’s interests.

- Client Service: Choosing a company that provides responsive and personalized support.

“Finding a reputable research firm is paramount,” adds Jane Doe, Portfolio Manager at Apex Capital Management. “A company’s track record and the expertise of its analysts are critical indicators of its value.” Consider firms like credit analysis & research ltd and conway investment research llc as part of your due diligence.

Conclusion

In conclusion, a securities research company plays a vital role in helping investors navigate the complexities of the financial markets. By providing in-depth analysis and insights, these companies empower investors to make informed decisions, manage risk effectively, and achieve their financial goals. Choosing the right securities research company is a critical step for any investor seeking to succeed in today’s dynamic market environment.

Need support? Contact us at Phone: 0904826292, Email: research@gmail.com or visit us at No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam. We have a 24/7 customer service team.