Options Research is crucial for navigating the complexities of the options market. Whether you’re a seasoned trader or just starting, understanding how to conduct effective options research can significantly impact your trading success. This article delves into the essential aspects of options research, providing you with the knowledge and tools you need to make informed decisions.

What is Options Research and Why is it Important?

Options research involves analyzing various factors that influence the price and behavior of options contracts. These factors include the underlying asset’s price, volatility, time to expiration, interest rates, and market sentiment. Thorough options research allows you to identify potentially profitable trading opportunities, manage risk effectively, and make informed decisions about your options investments. Without proper research, trading options can be like navigating a dark room filled with expensive furniture – you’re bound to bump into something and break it (or, in this case, your bank account). clinical research coordinator certification free

Understanding the Different Types of Options Research

There are several types of options research, each focusing on different aspects of the options market. These include:

- Fundamental Analysis: This involves analyzing the financial health and performance of the underlying asset.

- Technical Analysis: This focuses on chart patterns, technical indicators, and historical price movements to predict future price action.

- Volatility Analysis: This involves understanding and predicting the volatility of the underlying asset, which plays a crucial role in options pricing.

- Sentiment Analysis: This gauges the overall market sentiment towards the underlying asset, which can influence options prices.

Key Elements of Effective Options Research

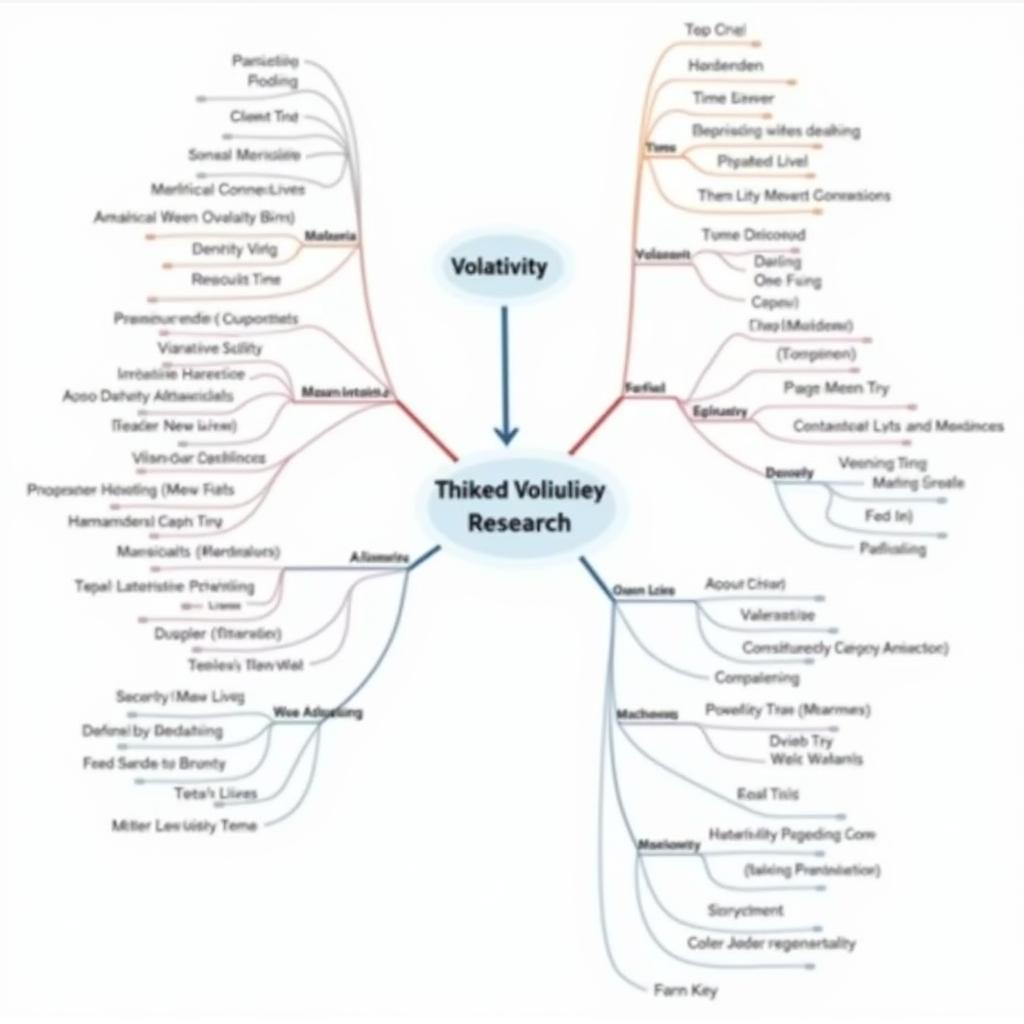

Key Elements of Options Research

Key Elements of Options Research

Effective options research involves a comprehensive analysis of several key elements:

- Implied Volatility: This represents the market’s expectation of future price volatility of the underlying asset. Understanding implied volatility is crucial for determining the fair value of options contracts.

- Time Decay (Theta): Options contracts have a limited lifespan, and their value erodes over time. This decay accelerates as the expiration date approaches. Understanding time decay is essential for managing your options positions.

- Open Interest: This measures the total number of outstanding options contracts for a particular underlying asset. Analyzing open interest can provide insights into market sentiment and potential future price movements. What are some good research topics for college students interested in finance? See our suggestions on good research topics for college.

- Liquidity: Options with higher trading volume and open interest tend to be more liquid, allowing for easier entry and exit from positions.

“Options research is like detective work,” says Dr. Eleanor Vance, a renowned financial analyst. “You need to gather all the available evidence and piece it together to form a clear picture of the market.”

Using Options Research Tools and Resources

Various tools and resources can assist you in conducting thorough options research:

- Options Chain Analyzers: These platforms provide real-time options data, including quotes, Greeks, and other essential metrics.

- Volatility Charts: These charts track historical and implied volatility, helping you assess potential price movements.

Options Research Tools

Options Research Tools

How to Conduct Options Research: A Step-by-Step Guide

- Identify Your Trading Objectives: Define your investment goals, risk tolerance, and time horizon.

- Select the Underlying Asset: Choose an underlying asset that aligns with your trading objectives.

- Analyze the Underlying Asset: Research the fundamental and technical aspects of the underlying asset. Consider checking out bunion pain research for unrelated research topics.

- Evaluate Options Contracts: Use options chain analyzers to identify suitable options contracts based on your analysis. options market research will provide valuable insights for your trading decisions.

- Develop a Trading Strategy: Formulate a clear and well-defined trading plan based on your research.

- Monitor and Adjust: Continuously monitor your options positions and adjust your strategy as needed.

“Successful options trading requires discipline and a commitment to ongoing research,” adds Dr. Vance. “The more you know, the better equipped you are to make profitable decisions.” You might be interested in finding out about free treatment options. More information can be found at st. jude children's research hospital tratamientos gratuitos.

Conclusion: Mastering Options Research for Success

Options research is a critical component of successful options trading. By understanding the key elements, utilizing appropriate tools, and following a structured research process, you can significantly enhance your trading performance and manage risk effectively. Remember, consistent and diligent options research is the key to unlocking the full potential of the options market.

FAQ

Need assistance? Contact us 24/7 at Phone Number: 0904826292, Email: research@gmail.com or visit us at No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam.