An Equity Research Report Example provides a valuable framework for understanding a company’s financial health and potential for future growth. These reports are crucial for investors looking to make informed decisions in the stock market. They offer detailed analysis, projections, and recommendations, serving as a guide for navigating the complexities of equity investments. Learning to dissect and interpret these reports is essential for any serious investor.

What Makes a Comprehensive Equity Research Report Example?

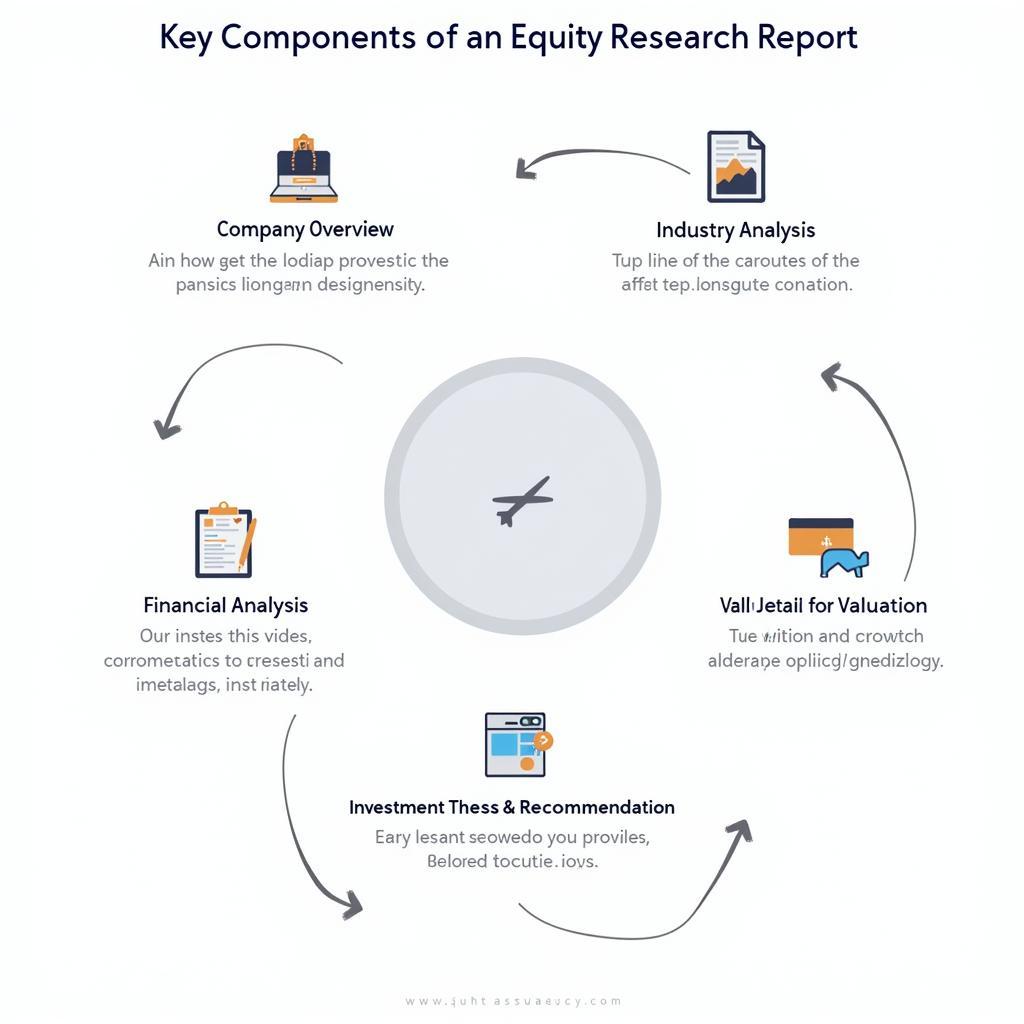

A robust equity research report example typically incorporates several key sections, each contributing to a holistic view of the company being analyzed. Let’s explore these components:

- Company Overview: This section provides a brief introduction to the company’s business model, operations, and key products or services. It sets the stage for a deeper dive into the financials and market position.

- Industry Analysis: Understanding the industry landscape is critical. This section examines market size, growth potential, competitive dynamics, and key trends that could impact the company’s performance.

- Financial Analysis: Here, the report delves into the company’s financial statements, including income statement, balance sheet, and cash flow statement. Key metrics like revenue growth, profitability, and debt levels are scrutinized.

- Valuation: This is where the analyst determines the intrinsic value of the company’s stock. Various valuation methods, such as discounted cash flow analysis and relative valuation, may be employed.

- Investment Thesis & Recommendation: This section summarizes the analyst’s findings and provides a clear recommendation, such as “Buy,” “Hold,” or “Sell.” The investment thesis outlines the rationale behind the recommendation.

Key Components of an Equity Research Report Example

Key Components of an Equity Research Report Example

How to Utilize an Equity Research Report Example?

Using an equity research report effectively involves more than just reading the recommendation. Investors should critically evaluate the analysis, considering the following:

- Understand the Assumptions: Every research report is based on certain assumptions about the future. It’s important to understand these assumptions and assess their validity.

- Consider the Analyst’s Track Record: Research the analyst’s past performance and expertise. Some analysts have a better track record than others.

- Conduct Your Own Research: Don’t solely rely on one report. Gather information from multiple sources and form your own independent opinion.

- Focus on the Long Term: Equity investments are typically long-term endeavors. Don’t be swayed by short-term market fluctuations.

Effective Use of Equity Research Report Examples

Effective Use of Equity Research Report Examples

Where Can You Find Reliable Equity Research Report Examples?

There are numerous sources for equity research reports. Some popular options include:

- Brokerage Firms: Most brokerage firms provide research reports to their clients.

- Independent Research Firms: Companies like market research firms nyc specialize in providing in-depth research.

- Financial News Websites: Many financial news websites offer access to research reports.

What are the Limitations of an Equity Research Report Example?

While valuable, equity research reports are not without their limitations:

- Bias: Analysts may have biases due to their firm’s relationships with the companies they cover. For example, see guggenheim equity research.

- Timeliness: Reports may become outdated quickly, especially in rapidly changing industries. Always check the publication date.

- Complexity: Some reports can be highly technical and difficult for novice investors to understand.

Looking to expand your knowledge base? Check out these valuable resources: research industries and courses on equity research. You can also benefit from professional web research: web research services.

Conclusion

An equity research report example offers a powerful tool for investors seeking to understand the complexities of the stock market. By carefully analyzing these reports and conducting their own independent research, investors can make more informed decisions and enhance their investment outcomes. Remember to always consider the limitations of these reports and utilize them as part of a broader investment strategy. Mastering the art of interpreting an equity research report example is essential for achieving success in the world of equity investing.

Need assistance? Contact us:

Phone: 0904826292

Email: research@gmail.com

Address: No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam.

Our customer support team is available 24/7.