The transition from Equity Research To Private Equity is a popular yet competitive career path. This article explores the key skills, experiences, and strategies needed to successfully navigate the move from equity research to private equity. We’ll delve into the nuances of both roles and provide actionable advice for aspiring private equity professionals.

Bridging the Gap: Equity Research to Private Equity

Many equity research analysts aspire to transition into private equity, attracted by the potential for higher compensation, greater deal involvement, and the opportunity to directly influence company performance. While both roles involve rigorous financial analysis, there are key differences that require careful consideration. After an initial period in equity research, analysts often seek new challenges and a more direct impact on the businesses they analyze. This is where a transition to research private equity can be particularly appealing.

Key Skills and Experience for the Transition

Several skills honed in equity research are highly transferable and valued in private equity. These include:

- Financial Modeling: A strong foundation in financial modeling is crucial in both fields. Private equity professionals need to be adept at building complex LBO models, projecting cash flows, and conducting valuation analyses.

- Industry Expertise: Deep knowledge of specific industries gained through equity research can be a significant asset in private equity. This expertise enables professionals to identify attractive investment opportunities and add value to portfolio companies.

- Deal Execution Experience: While equity research analysts don’t directly execute deals, they gain valuable experience by analyzing transactions and understanding the deal-making process. This understanding forms a solid base for a career in private equity.

Transitioning from Equity Research to Private Equity

Transitioning from Equity Research to Private Equity

Strategies for a Successful Transition

Making the leap from equity research to private equity requires a strategic approach. Consider the following:

- Networking: Building a strong network of contacts within the private equity industry is essential. Attend industry events, connect with recruiters specializing in private equity placements, and leverage your existing network for introductions.

- Highlighting Transferable Skills: Tailor your resume and cover letter to emphasize the skills and experience gained in equity research that are directly relevant to private equity, such as financial modeling, industry expertise, and deal analysis.

- Pursuing an MBA: While not always required, an MBA from a top-tier business school can significantly enhance your chances of securing a private equity role. It provides further networking opportunities and strengthens your business acumen.

Understanding the Differences: Equity Research vs. Private Equity

While both roles involve financial analysis, they differ significantly in their focus and day-to-day activities. Equity research analysts focus on publicly traded companies, providing investment recommendations to clients. Private equity professionals, on the other hand, invest in and manage privately held companies. This difference impacts the types of analyses performed, the level of involvement in company operations, and the overall career trajectory. Understanding these differences is critical for a successful transition. Penn State research studies might offer valuable insights on this career shift.

Navigating the Interview Process

The private equity interview process is notoriously rigorous. Be prepared for technical questions on financial modeling, valuation, and deal structuring. You will also be assessed on your industry knowledge, investment judgment, and ability to work in a team environment.

Long-Term Career Prospects

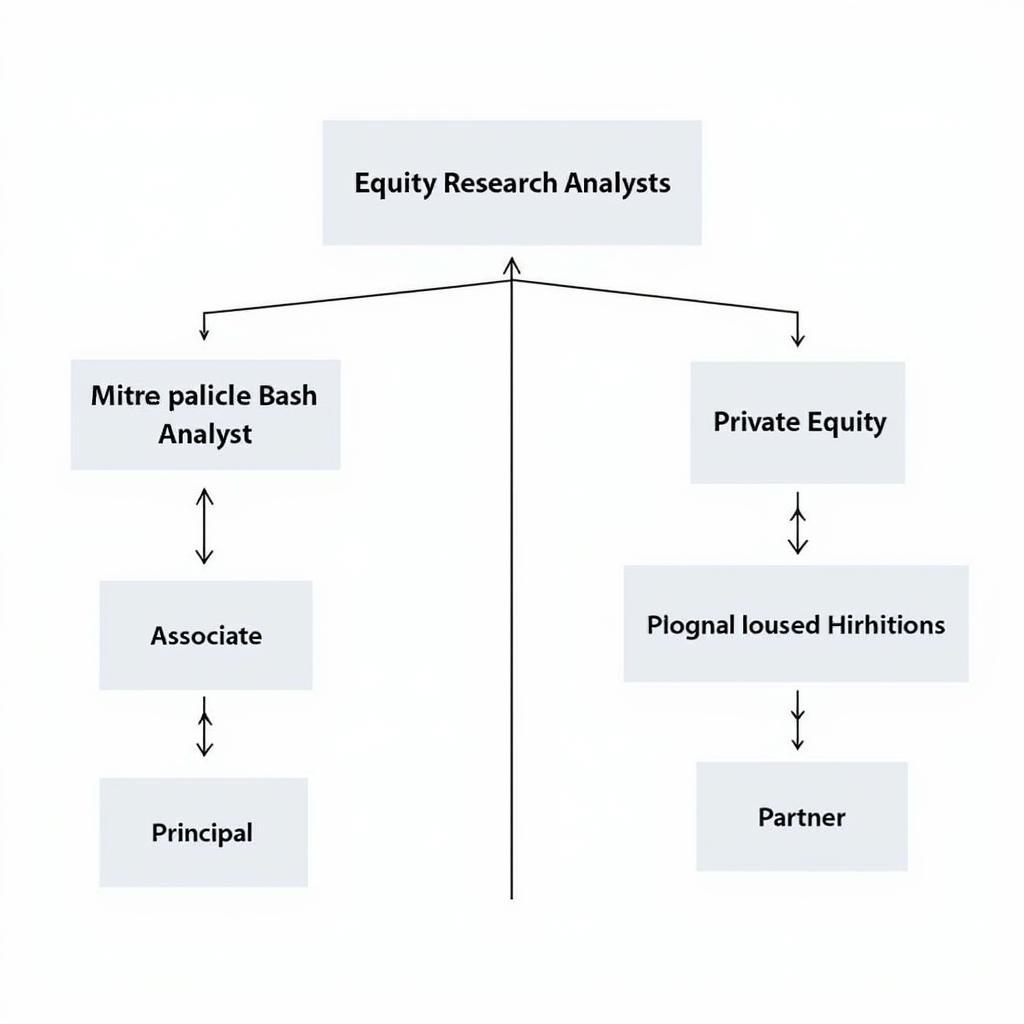

A successful transition to private equity can lead to a rewarding and lucrative career. The path often progresses from Associate to Principal and potentially to Partner, with increasing responsibility and compensation at each level. As Robert Smith, a prominent figure in private equity, once said, “Success in private equity requires not only financial acumen but also the ability to build strong relationships and create value for portfolio companies.” This rings true and highlights the importance of developing both hard and soft skills. Explore resources like acquisition research symposium for more information.

Conclusion

The transition from equity research to private equity can be challenging but highly rewarding. By focusing on developing transferable skills, networking strategically, and understanding the nuances of the private equity industry, you can significantly increase your chances of success. Remember that this transition requires dedication, preparation, and a clear understanding of the equity research to private equity landscape. For further insights, consider researching public affairs research council of louisiana.

Career Path of an Equity Research Analyst Transitioning to Private Equity

Career Path of an Equity Research Analyst Transitioning to Private Equity

FAQ

- What is the typical salary increase when moving from equity research to private equity?

- How important is networking for breaking into private equity?

- What are the key differences in the day-to-day responsibilities of an equity research analyst vs. a private equity associate?

- Is an MBA necessary for transitioning to private equity from equity research?

- What are the most common interview questions for private equity roles?

- How can I demonstrate my industry expertise during the interview process?

- What are the long-term career prospects within private equity?

Need more support? Contact us 24/7 at Phone: 0904826292, Email: research@gmail.com or visit us at No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam.

Consider reading more about occupational therapy research jobs on our website.