Vanguard 529 Research is crucial for anyone considering investing in a 529 plan for education savings. Understanding the benefits, drawbacks, and various plan options available through Vanguard is essential for making informed decisions about your child’s future. This guide provides a deep dive into Vanguard 529 plans, equipping you with the knowledge to navigate the world of education savings effectively.

Understanding Vanguard 529 Plans

Vanguard offers a range of 529 plans designed to help families save for qualified education expenses, from kindergarten through graduate school. These plans offer tax-advantaged growth, meaning your investments grow tax-deferred, and withdrawals are tax-free when used for qualified expenses like tuition, fees, books, and even room and board in some cases. Vanguard 529 plans are managed by experienced professionals, providing a sense of security and confidence in your investment.

Benefits of Choosing a Vanguard 529 Plan

Opting for a Vanguard 529 plan offers several advantages:

- Low Costs: Vanguard is known for its low-expense ratios, which can significantly impact your investment growth over time.

- Investment Options: Vanguard 529 plans offer a variety of investment portfolios, allowing you to choose an option that aligns with your risk tolerance and investment goals.

- Flexibility: You can typically change your investment options twice per year and even change the beneficiary of the plan if needed.

Potential Drawbacks to Consider

While Vanguard 529 plans offer numerous advantages, it’s important to be aware of potential drawbacks:

- Limited Investment Choices: Compared to some brokerage accounts, the investment options within a 529 plan might be more limited.

- Penalties for Non-Qualified Withdrawals: If you withdraw funds for non-qualified expenses, you’ll face a 10% penalty, plus you’ll owe income tax on the earnings.

Navigating the Vanguard 529 Research Process

Conducting thorough vanguard 529 research involves understanding your individual needs and financial goals. Consider factors such as your child’s age, estimated future education costs, and your risk tolerance.

How to Choose the Right Vanguard 529 Plan

Selecting the right plan requires careful consideration of your investment objectives and time horizon. Are you looking for a hands-off approach with age-based portfolios, or do you prefer a more active role in managing your investments? Understanding your investment style is crucial.

Choosing the Right Vanguard 529 Plan

Choosing the Right Vanguard 529 Plan

Key Questions to Ask During Your Research

- What are the fees associated with the plan?

- What investment options are available?

- What is the plan’s historical performance?

- Can I change the beneficiary if needed?

Maximizing Your Vanguard 529 Investment

Once you’ve chosen a Vanguard 529 plan, consider these strategies to maximize your investment:

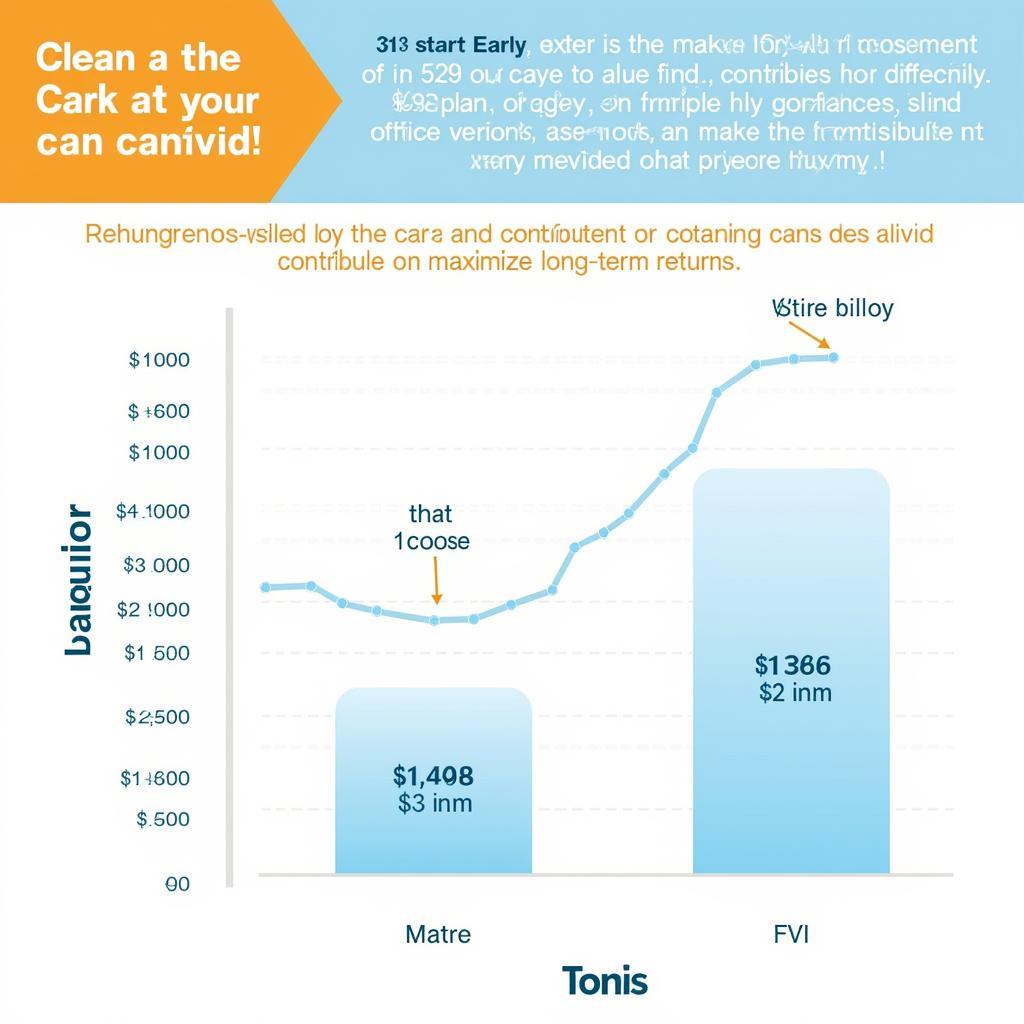

- Regular Contributions: Even small, regular contributions can add up significantly over time thanks to the power of compounding.

- Automatic Investments: Setting up automatic investments can help you stay disciplined and reach your savings goals.

- Review Your Investments: Periodically review your investment allocations to ensure they still align with your goals and risk tolerance.

“A well-researched 529 plan is a powerful tool for securing your child’s future,” advises financial expert, Dr. Amelia Hernandez, CFA. “Don’t underestimate the importance of understanding the nuances of each plan.”

Maximizing Vanguard 529 Investment

Maximizing Vanguard 529 Investment

Conclusion

Vanguard 529 research is an investment in your child’s education and future. By understanding the benefits, drawbacks, and available options, you can make informed decisions and confidently navigate the complexities of saving for college. Don’t wait, start your vanguard 529 research today.

FAQ

- What is a 529 plan?

- How do I open a Vanguard 529 plan?

- What are qualified education expenses?

- Can I use a 529 plan for expenses other than college?

- What happens if my child doesn’t go to college?

- Can I contribute to a 529 plan if I don’t live in the state that sponsors it?

- How can I learn more about Vanguard 529 plans?

“Consistent contributions to a 529 plan, coupled with a well-defined investment strategy, can significantly ease the financial burden of higher education,” adds Ms. Sarah Chen, CFP, a renowned financial planner.

Need more support? Contact us at Phone Number: 0904826292, Email: research@gmail.com, or visit us at No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam. Our customer service team is available 24/7.