Equity research analysts play a crucial role in the financial world, providing valuable insights into companies and industries to guide investment decisions. So, How Much Do Equity Research Analysts Make? The answer, like many things in finance, isn’t straightforward. Compensation depends on a variety of factors, including experience, location, employer, and performance. Let’s delve into the intricacies of equity research analyst salaries.

After completing your due diligence using helpful resources like the best investment research firms, you’ll be well-equipped to understand the salary landscape. You can also explore specific niches, such as opportunities for an equity research analyst healthcare.

Decoding the Equity Research Analyst Salary

The salary range for equity research analysts can vary significantly. Entry-level analysts can expect a starting salary in the $60,000 to $80,000 range, while senior analysts with extensive experience can earn well over $200,000 annually. Bonuses, often tied to individual and firm performance, can significantly add to total compensation, sometimes reaching six figures.

Experience Matters: From Junior to Senior Analyst

As with most professions, experience plays a critical role in determining an equity research analyst’s salary. Junior analysts, typically those with less than three years of experience, will earn less than their more seasoned counterparts. Mid-level analysts, with three to five years of experience, can expect a noticeable jump in salary. Senior analysts, often with more than five years of experience and proven success, command the highest salaries and bonus potential.

Location, Location, Location: The Impact of Geography

Geographic location also influences equity research analyst salaries. Major financial hubs like New York, London, and Hong Kong tend to offer higher salaries due to the high cost of living and increased competition for talent. While salaries may be lower in other cities, the cost of living is also often lower, resulting in a different overall financial picture.

Employer Type and Size: Boutique Firms vs. Bulge Bracket Banks

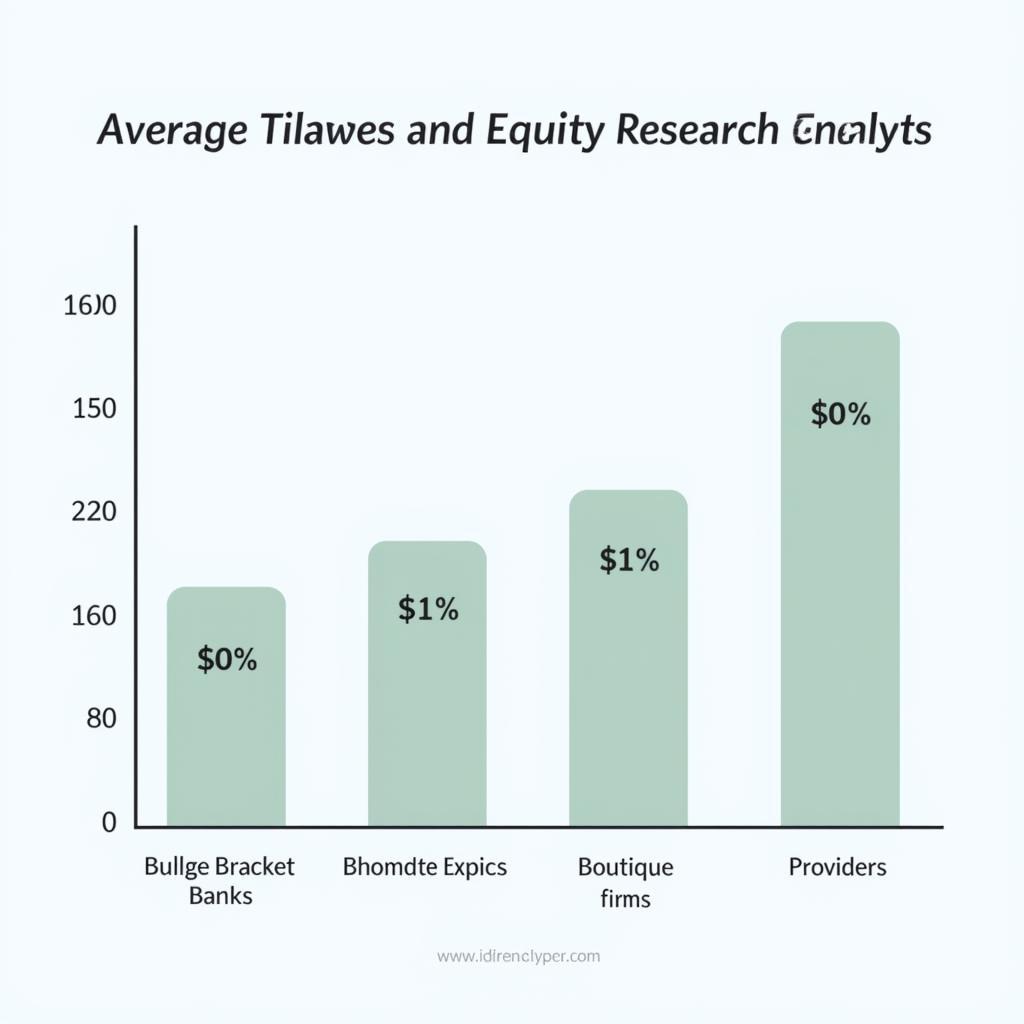

The type and size of the employer can significantly impact an equity research analyst’s earnings. Large investment banks, often referred to as “bulge bracket” firms, typically offer higher base salaries and larger bonus potential compared to smaller, boutique firms. However, boutique firms may offer greater opportunities for professional development and more direct involvement in investment decisions. Global Equities Research LLC exemplifies this type of smaller firm.

Equity Research Analyst Salary Comparison by Firm Type

Equity Research Analyst Salary Comparison by Firm Type

The Perks and Benefits: Beyond the Base Salary

In addition to base salary and bonuses, equity research analysts often receive a comprehensive benefits package. This can include health insurance, retirement plans, paid time off, and other perks, such as access to Craig Hallum research or specialized equity research software. These benefits can add significant value to the overall compensation package.

What Influences Salary Growth? Key Factors to Consider

Several factors can influence salary growth for equity research analysts. Strong analytical skills, excellent communication abilities, and a deep understanding of financial markets are essential. Furthermore, obtaining professional certifications, such as the Chartered Financial Analyst (CFA) designation, can enhance career prospects and earning potential.

Factors Influencing Equity Research Analyst Salary Growth

Factors Influencing Equity Research Analyst Salary Growth

Conclusion: Navigating the Equity Research Salary Landscape

While the question “how much do equity research analysts make?” doesn’t have a single answer, understanding the various factors influencing compensation can provide valuable insights. By considering experience, location, employer, and individual performance, aspiring and current equity research analysts can better navigate the salary landscape and make informed career decisions. Keep in mind that continuous learning and professional development are crucial for maximizing earning potential in this dynamic field.

FAQ

- What is the average starting salary for an equity research analyst? The average starting salary typically ranges from $60,000 to $80,000.

- Do equity research analysts receive bonuses? Yes, bonuses are common and often tied to performance.

- Which cities offer the highest salaries for equity research analysts? Major financial hubs like New York, London, and Hong Kong generally offer higher salaries.

- How can I increase my earning potential as an equity research analyst? Gaining experience, obtaining certifications, and developing strong analytical and communication skills can boost earning potential.

- What is the difference in salary between bulge bracket banks and boutique firms? Bulge bracket banks generally offer higher base salaries, while boutique firms may offer other advantages.

- What are some common benefits offered to equity research analysts? Benefits typically include health insurance, retirement plans, and paid time off.

- How does the CFA designation impact an equity research analyst’s salary? The CFA designation can enhance career prospects and lead to higher earning potential.

For further exploration, you can research specialized areas like equity research analyst healthcare roles or delve into the world of equity research software.

Need support? Contact us at Phone: 0904826292, Email: research@gmail.com or visit us at No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam. We have a 24/7 customer support team.