Value Research, at its core, is about uncovering hidden gems. It’s a meticulous process of analyzing businesses, their financials, and future prospects to determine their intrinsic worth. This in-depth examination goes beyond the surface numbers, aiming to identify companies trading below their true value, often overlooked or misunderstood by the market.

Unearthing Hidden Value: The Essence of Value Research

Value investors, often considered the Sherlock Holmes of the financial world, employ a disciplined and rigorous approach. They meticulously scrutinize financial statements, assess management quality, and delve deep into industry dynamics. Their goal? To separate the market noise from true value, seeking investment opportunities with the potential for long-term, sustainable growth.

Key Pillars of Value Research: Where Insights Take Shape

Several key elements underpin the value research process:

- Financial Statement Analysis: Scrutinizing a company’s balance sheet, income statement, and cash flow statement to assess its financial health, profitability, and cash generation capabilities.

- Valuation Metrics: Utilizing key ratios like price-to-earnings (P/E), price-to-book (P/B), and dividend yield to gauge a company’s attractiveness relative to its peers and historical performance.

- Competitive Advantage: Identifying factors that give a company an edge in the marketplace, such as strong brand recognition, cost leadership, or unique intellectual property.

- Management Quality: Evaluating the experience, integrity, and track record of a company’s leadership team to assess their ability to navigate challenges and drive future growth.

Navigating the Value Investing Landscape: Strategies and Approaches

Value investing encompasses various strategies tailored to different risk appetites and investment horizons:

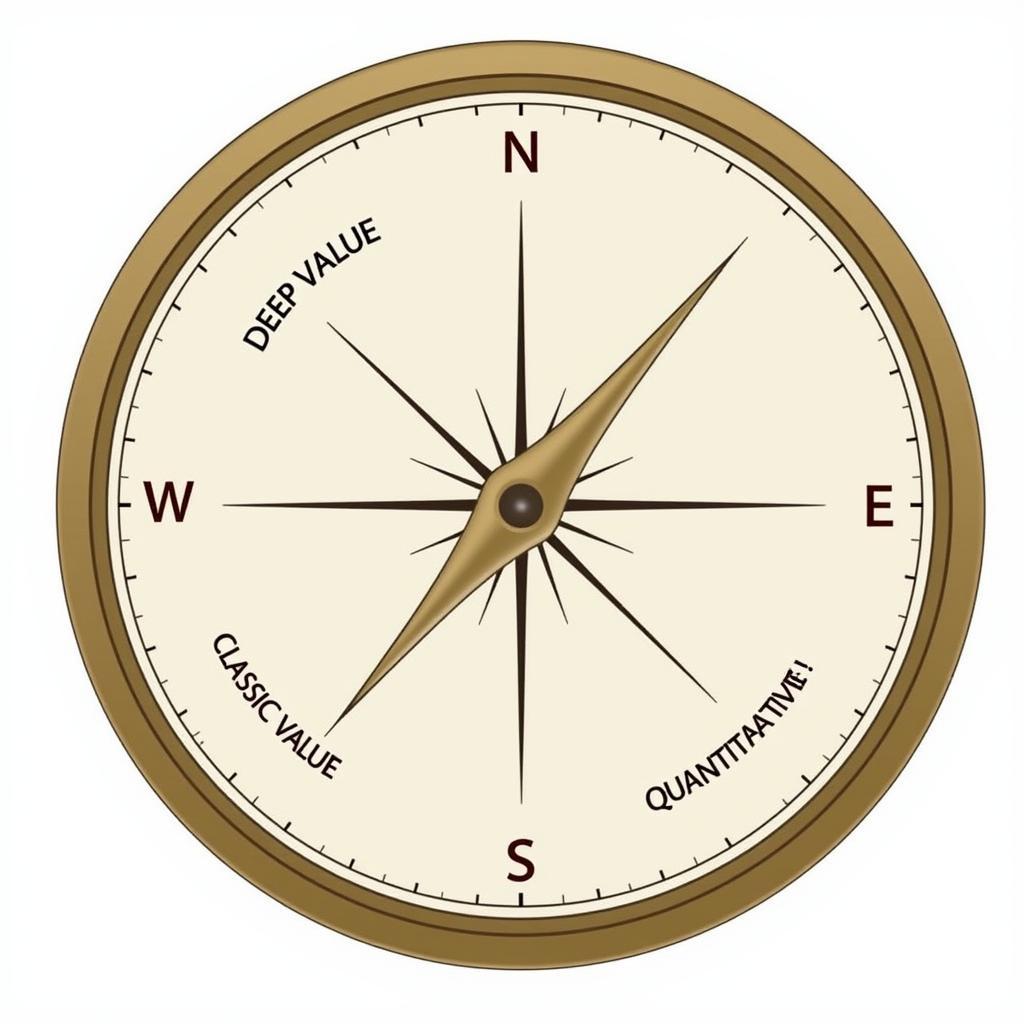

- Deep Value Investing: Focusing on severely undervalued companies with the potential for significant turnaround, often involving higher risk and longer investment timelines.

- Classic Value Investing: Targeting fundamentally sound companies trading at a discount to their intrinsic value, emphasizing a margin of safety and long-term growth potential.

- Quantitative Value Investing: Utilizing statistical models and algorithms to identify undervalued stocks based on historical data and financial ratios.

Different paths on a compass representing various value investing approaches

Different paths on a compass representing various value investing approaches

The Allure of Value Research: Potential Rewards and Challenges

Value research offers the potential for attractive returns by identifying mispriced assets. However, it demands patience, discipline, and a long-term perspective. Market sentiment can impact stock prices in the short term, and realizing the true value of an investment may take time.

“Successful value investing requires the ability to think independently and remain rational amidst market fluctuations,” notes renowned value investor [Name of a fictional expert], portfolio manager at [Name of a fictional firm]. “It’s about understanding the true worth of a business and capitalizing on opportunities when the market undervalues its potential.”

Value Research in Action: Real-World Applications

Value research extends beyond individual stock picking; it’s applied across various financial disciplines:

- Equity Research: Analysts delve into company financials, industry trends, and competitive landscapes to provide investment recommendations to clients.

- Fund Management: Portfolio managers utilize value research to construct portfolios of undervalued stocks, aiming to outperform market benchmarks over the long term.

- Mergers and Acquisitions: Value research helps determine the fair value of target companies in acquisition deals.

Conclusion: Unlocking Long-Term Value Through Research

Value research remains a compelling approach for investors seeking to navigate market complexities and unearth hidden gems. By embracing a disciplined process, focusing on intrinsic value, and exercising patience, investors can position themselves to potentially benefit from the power of value investing.

Remember, informed investment decisions begin with thorough research. If you’re looking to explore the world of value investing, resources like ms in market research and value edge research services can provide valuable insights.

Ready to unlock the potential of value research? Contact us today at 0904826292 or research@gmail.com to embark on your journey towards informed investing. Our team at No. 31, Alley 142/7, P. Phú Viên, Bồ Đề, Long Biên, Hà Nội, Việt Nam is available 24/7 to assist you.