Research Affiliates Asset Allocation (RAAA) strategies have gained significant traction among investors seeking a disciplined and evidence-based approach to portfolio construction. These strategies, developed by the renowned investment research firm Research Affiliates, challenge conventional market-cap-weighted indexing by emphasizing factors like value, momentum, and low volatility. This approach aims to enhance long-term returns by systematically exploiting market inefficiencies and capitalizing on the tendency for undervalued assets to outperform over time.

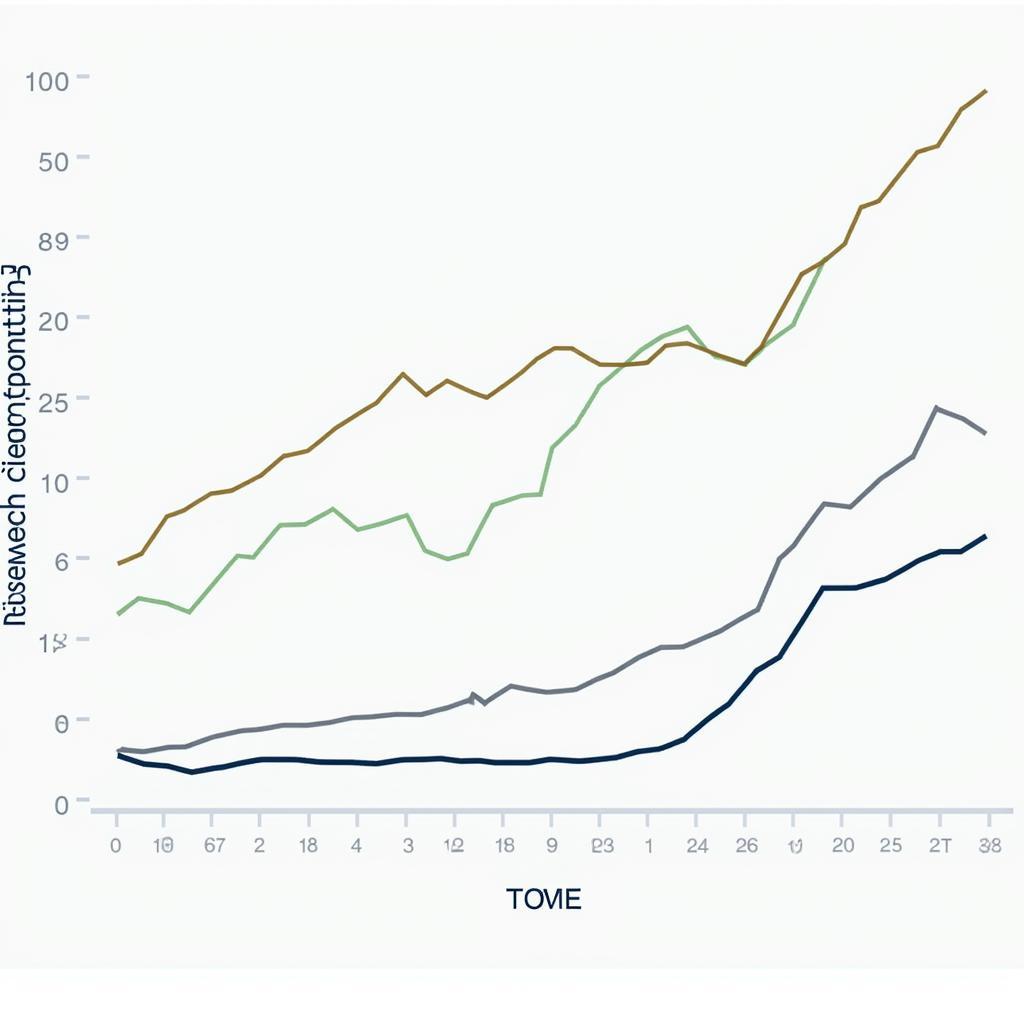

Research Affiliates Asset Allocation Chart

Research Affiliates Asset Allocation Chart

Understanding the Principles of RAAA

At the core of RAAA lies the belief that traditional market capitalization-weighted indices are inherently flawed. These indices allocate more weight to larger companies, regardless of their underlying fundamentals or valuations. This approach, RAAA argues, can lead to overexposure to overvalued assets and underrepresentation of potentially undervalued opportunities.

RAAA strategies address this by employing a fundamentally weighted methodology. This approach assigns portfolio weights based on economic factors such as sales, cash flow, dividends, and book value. By focusing on these fundamental metrics, RAAA seeks to identify undervalued assets and capitalize on their potential for growth.

Key Features of Research Affiliates Asset Allocation

RAAA strategies are characterized by several distinctive features:

- Value Investing: RAAA emphasizes investing in undervalued assets, seeking to buy low and sell high.

- Momentum Investing: By incorporating momentum factors, RAAA aims to capture trends in asset prices and participate in market uptrends.

- Low Volatility: RAAA recognizes the importance of managing risk and seeks to construct portfolios with lower volatility compared to traditional benchmarks.

- Global Diversification: RAAA strategies typically invest across a wide range of asset classes and geographies, reducing overall portfolio risk through diversification.

Benefits and Risks of RAAA

Benefits:

- Potential for Enhanced Returns: RAAA’s focus on undervalued assets and systematic approach to exploiting market inefficiencies has the potential to generate higher long-term returns compared to conventional strategies.

- Disciplined and Rules-Based: RAAA removes emotional biases from investment decisions by adhering to a predefined set of rules and a systematic approach.

- Risk Management: Incorporating factors like low volatility and global diversification can help mitigate overall portfolio risk.

Risks:

- Tracking Error: RAAA portfolios can deviate significantly from traditional benchmarks, potentially leading to periods of underperformance.

- Model Risk: As with any quantitative strategy, there’s a risk that the underlying models might not accurately predict future market behavior.

- Implementation Challenges: Implementing RAAA strategies can be complex and may require specialized expertise and resources.

Is RAAA Right for You?

Determining the suitability of RAAA depends on an investor’s individual circumstances, risk tolerance, and investment goals. Investors with a long-term investment horizon and a willingness to tolerate potential short-term volatility may find RAAA strategies appealing. However, it’s essential to consult with a qualified financial advisor to determine if RAAA aligns with your specific investment objectives and risk profile.

Conclusion

Research Affiliates Asset Allocation offers a compelling alternative to traditional market-cap-weighted indexing. By focusing on fundamental factors, RAAA aims to deliver superior risk-adjusted returns over the long term. While RAAA strategies present both potential benefits and risks, they provide investors with a disciplined and evidence-based framework for constructing diversified investment portfolios.